February Insider

Investment Market Begins to Thaw: A Conversation with Berkadia’s Tim Cobb

The pandemic put property sales transaction activity on ice. But as the vaccine rolls out and spring approaches, deals are starting to heat up. In fact, Berkadia’s Tim Cobb predicts a phenomenal uptick in property sales starting in the second quarter.

The pandemic put property sales transaction activity on ice. But as the vaccine rolls out and spring approaches, deals are starting to heat up. In fact, Berkadia’s Tim Cobb predicts a phenomenal uptick in property sales starting in the second quarter.

Well-known for its multifamily expertise, Berkadia offers a full-service suite of financial services for the seniors housing and care sector. Clients have access to the capital markets, in-depth research, investment sales, and advisory services.

NIC Chief Economist Beth Mace recently discussed the warming investment climate with Berkadia’s Cobb, senior housing & healthcare-investment sales lead. Here is a recap of their conversation.

Mace: Can you tell us about yourself and your role at Berkadia?

Cobb: Berkadia is a full-service integrated commercial real estate company offering investment sales, mortgage banking, and loan servicing. We are a dominant player in the multifamily market with an additional focus on specialty real estate disciplines including seniors housing and healthcare, hospitality, affordable housing, student housing, and institutional advisory services. I joined Berkadia a little over three years ago to start up the seniors housing investment sales and advisory group. I manage a team of four dedicated seniors housing professionals. I also am responsible for the integration of the seniors housing mortgage banking products.

Berkadia has nearly 2,000 employees. Our seniors housing team has access to many resources including an analytics group in India. Our research team in Arizona also works with our seniors housing group. Our ability to access debt products from our mortgage banking division, paired with our rich data and analytics platform, gives us the ability to optimize investment sales. We act as true advisors rather than bankers or brokers.

Mace: What types of product or services does Berkadia offer that are specific to the seniors housing and skilled nursing sectors?

Cobb: Berkadia provides debt solutions through Fannie Mae, Freddie Mac, and HUD. We are one of the top seniors housing HUD lenders. We also offer bridge loans to those products.

Mace: Berkadia is a privately held organization that is a joint venture between Berkshire Hathaway and Jefferies Financial Group. How does this structure help you provide services to the seniors housing and skilled nursing sectors?

Cobb: We have access to more capital than a typical lender. Additionally, the affiliation with Jefferies allows us to advise on transactions with solutions that include public market executions.

Mace: Berkadia recently announced the acquisition of Moran and Company, a multifamily advisory firm known for institutional transactions. Will this impact the senior housing platform?

Cobb: We’re excited about that announcement. Moran is a multifamily investment sales and advisory group that brings institutional investor knowledge to our sales and debt platform. Moran will open opportunities for our clients to bring in new capital partners.

Mace: What impact has the pandemic had on your activity and business?

Cobb: The primary impact has been the uncertainty which has led to lower transaction volume. However, due to continually low interest rates we still saw significant volume of over $1 billion in transactions primarily driven through our FHA business. During the first few months of the pandemic, non-recourse bridge lenders pulled back. It was difficult to get people into buildings to conduct physical inspections. We are seeing more activity now that the vaccine is rolling out and the market is beginning to thaw. Overall, we believe business in the second and third quarters will be robust.

Mace: Have lending terms changed?

Cobb: We will consider balance sheet and bridge financing selectively depending on asset quality and the quality of client. Interest rates are steady. We match leverage levels to that of the take-out loan products. Right now, there are more bridge loan opportunities for skilled nursing than for assisted living. Fannie Mae and Freddie Mac have tightened their lending requirements. At first, they wanted 24-month debt repayment reserves. But now they require reserves of 6 to 12 months. Our view is that over the next six months these requirements will be loosened, and bridge lending will pick up.

Mace: Any new trends?

Cobb: We are doing more HUD business with private pay assisted living. Many owners wouldn’t touch HUD loans in the past because it was hard to compete with Fannie Mae and Freddie Mac. But now those owners are interested.

Mace: Don’t HUD loans take a long time to secure?

Cobb: It’s not taking that long. There are more processes involved to get a HUD loan. But it really depends on whether the client has the right information available. We can get HUD loans done relatively quickly. Certain rules have been changed, and there has been significant improvement on timing. We typically provide a bridge loan for an acquisition and close the HUD loan simultaneously.

Mace: Is the long term of HUD loans a problem?

Cobb: That’s a bit of a misconception. More structuring can be done around HUD loans than most people know. There are ways to buy down pre-penalties and create slightly more flexible debt repayments.

Mace: What about sales activity? Are you seeing distressed deals?

Cobb: We are seeing distressed deals. But sellers have a lot of different motivations. The market is still uncertain. Some sellers are recycling capital, looking for higher returns.

Mace: Has the pandemic affected Berkadia’s interest in seniors housing in the near and long term?

Cobb: Yes, but not the way you might think. We think the pandemic will accelerate the push for a government reimbursed component for private pay seniors housing. That is something the industry has talked about for years, though it could bring more government oversight. Also, adult children who have had to help their aging parents get through the pandemic are realizing that they need some help. We service $8 billion of seniors housing loans, and from that data, we’re already seeing early indications of an uptick in occupancies at well-located properties with good operators. We’re very bullish on seniors housing and will continue to be.

Mace: How do you underwrite deals in a period of uncertainty?

Cobb: Uncertainty is another market variable. We underwrite everything to investor yield requirements, while being more cognizant of returns from other real estate classes.

Mace: What is your view of the current state of the capital markets?

Cobb: We believe interest rates will likely continue to stay low driven by the impact of pandemic and the global outlook. Most lenders think the debt markets will have recovered by the third quarter. It’s still a good time to borrow. On the equity side, there are funds with millions of dollars that have a large appetite to invest in the space.

Mace: How does the integration of health care into seniors housing affect your underwriting? Are deals more complicated?

Cobb: I don’t think it has changed our view on seniors housing. These are complicated operating businesses. We expect to see more innovation as operators look to improve margins.

Mace: In your crystal ball, what are you optimistic about and pessimistic about?

Cobb: Once we are over the pandemic, legislators will have a better understanding of the importance of giving operators the tools they need to provide a safe level of care. But the industry needs to increase penetration to boost demand. It’s important to rebuild confidence in the industry among residents and their families.

Mace: Anything else you would like our readers to know?

Cobb: We have a full-service group. We offer capital markets transactions on both the debt and equity side, as well as mortgage banking, a servicing platform and investment sales. We have significant resources that give our clients actionable insights into their objectives and a range of options based on current market data.

“Strap on Your Seatbelts.” Policy Outlook Kicks Off 2021 NIC Leadership Huddles

NIC Leadership Huddles are back. The popular live webinar series, which NIC initially launched as part of its response to the COVID-19 pandemic last year, launched anew on January 27, with a very timely focus on policy, just a week after the swearing in of President Biden. The new series, which offers a complimentary new Leadership Huddle twice each month into July, seeks to retain the same level of relevance, and quality of discussion, which drew thousands of industry decision-makers to the Leadership Huddles in 2020.

The new series comes with a few tweaks. Upon registration, attendees can sign up not only for the webinar, held via GoToWebinar, but can opt to attend a facilitated peer-to-peer group discussion within Zoom, immediately afterwards. Attendees are also encouraged to pose a question or two during registration for prospective discussion during the webinar sessions. Access to the peer-to-peer group discussions is offered on a first-come, first-served basis, to ensure an appropriate number of participants for the collective discussions.

While COVID-19 will likely feature prominently in many Leadership Huddle Webinars and associated discussions, the series will cast a broader net, to include all of the major issues impacting the sector today. Titled, “Policy Outlook: A New Administration & A New Congress,” this series’ first Leadership Huddle focused, appropriately, on the key policy issues impacting the seniors housing and skilled nursing sectors; what actions the new administration and new Congress are likely to take; and the funding decisions that are critical for advancing integrated care and services for America’s seniors.

The fast-paced webinar covered a great deal of ground concerning policy impacts on the industry, leaving attendees hungry to delve into more detail in the peer-to-peer discussion session, which was moderated by Juniper Communities Founder and CEO, Lynne Katzmann. But first, NIC Co-Founder and Strategic Advisor, and President, Nexus Insights, Bob Kramer, moderated the webinar. He kicked it off by observing that the new administration and new Congress have hit the ground running, saying, “It seems like every few hours there’s a release, a report, an announcement, dealing with the topics we want to talk about today.”

Vaccinations

Focusing in on perhaps the most obvious and important administration effort, regarding seniors housing and care, Kramer began by asking the panel whether the Biden administration would meet its goals on vaccination.

Expert panelist Dan Mendelson, Founder and former CEO of Avalere Health, was bullish, but not without some qualifications. Saying, “This is an administration that cares deeply about healthcare,” he explained that investors and operators in the space “should strap on their seatbelts because there’s going to be a lot of activity coming out.” Taking the position that Biden was elected because of his position on COVID-19, Mendelson pointed out that the new administration has secured an additional 200 million doses of vaccine and is likely to acquire more as the Johnson & Johnson product comes to market, “likely, in the next couple of weeks.”

Mendelson went on to say, “There will be enough vaccine, likely, to vaccinate everyone in this country by the end of the summer.” He sees the possibility that, if everything aligns, the U.S. could achieve herd immunity by the Fall. However, he indicated it will take a coordinated effort to ensure vaccines are properly distributed and administered in the field. Pressed by Kramer on whether we’ll meet the administration’s 100-day goal on vaccinations, Mendelson said, “I think we’ll exceed it, if the people on this call get into gear and really facilitate the change. This is not something that’s just going to happen because someone else does it.” He explained that owners and operators play an important role in ensuring that their residents and staff get vaccinated.

Co-panelist Anne Tumlinson, Founder, ATI Advisory, added that “If you do the math, there’s a big difference in terms of the timeline it takes to get to herd immunity between one million and two million doses a day. If we can do two million a day, we can get to herd immunity in about three months, which would make a really big difference in terms of getting ahead of these variants.” She said she expects that the Biden administration is aiming for two million a day in order to exceed expectations.

$1.9 Trillion Stimulus Package

Another major policy movement is Biden’s proposed $1.9 trillion stimulus package, designed to revive the economy, protect businesses, and combat the pandemic. Kramer asked how much, if any, of those funds would flow into the skilled nursing and seniors housing sectors. Tumlinson pointed out that the package is designed to put money directly into the hands of individuals, as opposed to prior bills aimed at funding businesses more directly. The package, according to Tumlinson, does provide for many pandemic-related activities, such as testing, treatment, vaccines, and supplies, much of which will reach the sector indirectly.

While agreeing with Tumlinson, Mendelson added that the package will go through changes as it passes through Congress. “I will bet on some of it (reaching the sector) as opposed to none of it,” he concluded, adding, “the reality is that the sector is going to need resources to get this vaccination done.” Also, this may not be the only package that gets passed. According to Tumlinson, the White House is already working on a second package, as part of a ‘build back better’ legislative agenda, which will also directly impact the sector.

Mendelson added that, “The administration has said COVID-19 is our number one priority, coverage is our number two priority, disparities is our number three priority, or maybe they’ve said all of them are our number one priority, really…if the sector wants funds to flow in, it needs to align with those priorities.”

Expansion of Medicaid and Medicare Coverage

On that expansion of coverage priority, Kramer asked how far the new administration would get. “This is going to start soon, and by soon, I mean tomorrow,” said Mendelson. He explained that the administration is expected to announce a series of executive orders around coverage. “The goal is going to be to expand coverage through existing programs; and by that, of course, we mean the exchanges and Medicaid.” He also mentioned the possibility that Medicaid would be expanded down to the age of 60, and that the idea is to, “cover as many as people as possible through the existing channels.” He concluded that we will see significant expansion of coverage through the exchanges and Medicaid – but that Medicare expansion may remain an aspiration in the face of a resistant Congress.

In an ensuing discussion on the likelihood of the Supreme Court striking down all or part of the ACA, Mendelson indicated we are unlikely to see the law completely struck down, but that the administration is planning for contingencies, whatever the court decides. The likelihood is that access to coverage will expand under this administration.

Kramer, observing that under both Obama and Trump, managed care plans saw a significant expansion through both Medicare and Medicaid, asked whether the trend would continue. The answer is yes. Tumlinson explained that many minorities and lower income patients get a lot of value through their Medicare Advantage plans, and that these programs have allowed the Federal government to expand coverage, without going to Congress. She said, “I think you’ll see some tussling around the edges of the program, but I think we’ll continue to see a lot of rapid enrollment growth and a lot of value-driven consumers.” As for Medicaid expansion, despite heavy resistance in some states from the nursing care industry, Tumlinson sees continued expansion as very likely.

Katzmann asked how this expansion would play out for senior living providers. “Senior living is a recipient of a lot of those Medicaid home and community-based dollars,” said Tumlinson, “Ultimately, it’s a positive, I think, for the sector. I know there’s a lot of concern about those rates…it’s a complicated set of issues, but…in the mind of Medicaid, assisted living is squarely within the home and community-based bucket in terms of funding right now.”

On the growth rate of Medicare Advantage plans, Mendelson noted that a lot of Medicare Advantage growth occurred under the same Obama administrators that are now managing the transition for Biden, including Jonathan Blum, who, he said, is being considered as Centers for Medicare & Medicaid Services (CMS) Administrator. In short, Mendelson said, “I think that it is quite likely that we will see this kind of growth going forward in the future.” He warned, however, that, “This administration will not allow a blank check to Medicare Advantage plans,” saying he expects greater demands on the plans’ patient experiences, value, and around their marketing practices. But, even with greater regulatory scrutiny, Mendelson said Medicare Advantage plans will be the norm for assisted living and skilled nursing five years from now.

That will mean investors and operators will need to be able to present good data and develop strong relationships with capitated risk providers. Also, Mendelson said, “If you want to shape the future of Medicare Advantage policy, you have to have a positive vision for what that means in your buildings.” In agreement, Kramer added, “What that means is that, if there’s an overall move to put more into home and community-based services, assisted living better be ready to say that, within that framework, it can work to achieve those goals of the administration.” Tumlinson, too, sees a need for assisted living to communicate its value, saying, “This industry, especially assisted living, has to be so clear, and so strategic, in articulating its value to Federal policy makers.”

Tumlinson, responding to a question on further Medicaid expansion, said, “This sector has not even remotely started to wrap its brain around what it means to be able to actually charge some of these services to a Medicare Advantage plan and what that could mean for them.” Opportunities are plentiful, but sector leaders must learn how to leverage them, according to Kramer, who said, “What you’re saying is there are great opportunities for the assisted living sector, with regard to how it can show it can deliver, using these programs. But, at the same time, it better be ready because others are going to be eager to take those dollars, if assisted living isn’t.”

Mendelson said that these “flexibilities,” such as food delivery, transportation services, pest control, and others, are here to stay: “They’re not going to get rolled back, they’re not going to be reversed. They have become an essential public health lifeline for many seniors in this country.” As for assisted living and skilled nursing leaders, he said, “Nothing could be more important than figuring out how you fit within these benefits.” But operators will need to produce data to prove the value they are providing.

Summarizing her thoughts on Medicaid expansion, Tumlinson said, “This is a huge opportunity, unless you don’t do anything about it, in which case, it’s a huge threat…these are absolutely, without question, pathways to new sources of revenue, new sources of volume, better occupancy, better value overall, or they’re going to erode the value of senior living and skilled nursing facilities.”

In his own summary, Mendelson said, “I think the sector needs to anticipate major changes in referral sources, because referrals are not going to be coming from all the old channels. They’re going to start to leak over to some of the entities that we’ve discussed before.” Asked by Katzmann for examples, Mendelson said, “if an at-risk primary care company is in your neighborhood, and they are taking full-cap risk for Medicare Advantage plans, they are a great target for referrals. If you’re not getting referrals from them, somebody else is.” He also pointed to the need for companies to have data. He said, “All of the companies that I see making progress in the space are taking this very, very seriously. They have data. They are looking at what is happening to their patients, they’re understanding it, and they’re progressing that.”

Minimum Wage

Switching to a discussion on minimum wages, Mendelson said, “I see the minimum wage going up modestly. I don’t think it’s realistic to think that there’s going to be a $15 minimum wage in the near future. But I think that it could go up a little bit.” He suggested the sector could work with policy makers to help them understand the implications of wage changes, and help them build a “road map,” rather than expecting that everyone can suddenly begin to pay $15 an hour.

“Lightning Round” Topics

In the last few minutes, before the end of the webinar and the beginning of the discussion period of the event, Kramer launched into a “lightning round” blitz of questions for his panelists. He asked Mendelson if he thought the public health emergency would be extended through all of 2021. “Yes, no question” was the response. On the three-day hospital stay rule, Tumlinson said, “I think it will be totally reversed.” Also, telehealth is here to stay, in a modified form, according to Mendelson. On licensure rules, many of which were waived in 2020, Mendelson stated that, “I think a lot of them will stay. Our Surgeon General is a nurse, which I think is amazing; and you will see increased flexibility and a little bit of a shift of the pendulum away from protectionism.”

Asked whether the sector should look out for any surprises from policy makers, Tumlinson warned that a lot of Medicare money is going into the assisted living sector, and that, “there’s a hook.” Assisted living should expect some more scrutiny on how those dollars are spent. Kramer summarized, “The sector should be aware of the fact that, now that they’ve been discovered, now they’re seen as part of the healthcare continuum, further scrutiny, which could include not only hearings, but pushes for differing degrees of Federal regulation could be very real in the near term.”

You can register to attend upcoming NIC Leadership Huddles, including both the live webinars and the optional, first come, first served peer-to-peer discussions, within the Events tab on www.nic.org. Registrants are provided with a recording of the event, compliments of NIC, and our generous sponsors and partners.

Executive Survey Insights Wave 20: January 11 to January 24, 2021

By Lana Peck, Senior Principal, NIC

“A compelling departure from recent surveys, significantly fewer respondents in the Wave 20 survey cited resident or family member concerns as a reason for slower pace of move-ins and/or faster pace of move-outs the past 30-days—and notably fewer survey respondents cited a slowdown in leads conversions/sales.

“A compelling departure from recent surveys, significantly fewer respondents in the Wave 20 survey cited resident or family member concerns as a reason for slower pace of move-ins and/or faster pace of move-outs the past 30-days—and notably fewer survey respondents cited a slowdown in leads conversions/sales.

The CDC reports that more than 2.7 million doses of the COVID-19 vaccine had been administered as of January 26, to residents in nursing care, assisted living communities, and other senior living settings. According to Wave 20 survey respondents, four out of five organizations have conducted their first clinic. On average, two-thirds of residents (66%) and nearly one-half of staff (47%) have received the first dose of the vaccine, and nine out of ten respondents anticipate that all residents willing to take the vaccine will be vaccinated within two months. More consumers having access to the vaccine in an environment where infection control is the highest priority may encourage prospective residents to move in and improve future occupancy rates.”

—Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions continue to change. Wave 20 survey includes responses collected January 11 to January 24, 2021 from owners and executives of 92 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 20 Summary of Insights and Findings

- Long anticipated as a game-changer with regard to improving occupancy, seniors housing and care operators are currently holding vaccination clinics for their residents and staff. In December, the CDC prioritized skilled nursing and assisted living residents and staff members in phase 1a of the COVID-19 vaccine distribution. According to Wave 20 survey respondents, four out of five have organizations have received the first dose of the vaccine. On average, two-thirds of residents (66%) and nearly one-half of staff (47%) have had their first dose, and nine out of ten respondents anticipate that all residents willing to take the vaccine will be vaccinated within two months.

- Four of the five respondents indicated that educating and motivating staff to take the vaccine was a challenge in distributing the vaccine. To mitigate these challenges, operators are implementing a variety of strategies to encourage and improve vaccine acceptance.

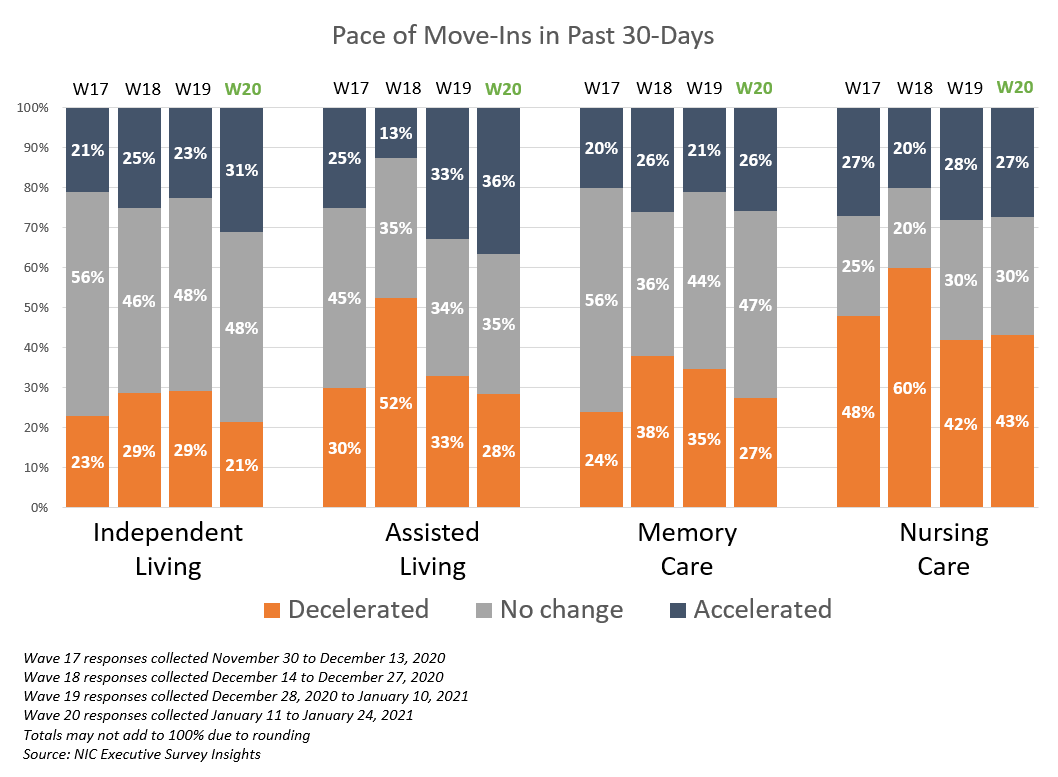

- In the Wave 20 survey, there was some improvement in the pace of move-ins for each of the care segments except the nursing care segment. The shares of organizations reporting an acceleration in the pace of move-ins in the past 30-days is higher than the portion of organizations reporting decelerations for independent living and assisted living (an improvement for these two care segments since the Wave 14 and 15 surveys conducted in October, reflecting operator experiences in early Fall), but equal for memory care. More organizations with nursing care beds have reported decelerations than accelerations in move-ins for the past seven waves of the survey.

- The share of organizations citing increased resident demand as a reason for acceleration in the pace of move-ins remained high (77%) in the Wave 20 survey but down from a recent high of 86% in the Wave 16 survey, conducted in mid-November. Presumably for various reasons, such as anecdotal reports of more hospital discharges of patients to home health and elective surgeries on hold in some locales hard hit by the coronavirus, hospital placement cited as a reason for acceleration in the pace of move-ins (26%) continued to lag the survey time series high of 41% reached in Wave 10, conducted in late July. Other reasons for faster pace of move-ins mentioned by respondents included admissions restrictions being lifted and COVID-19 vaccination clinics having been started.

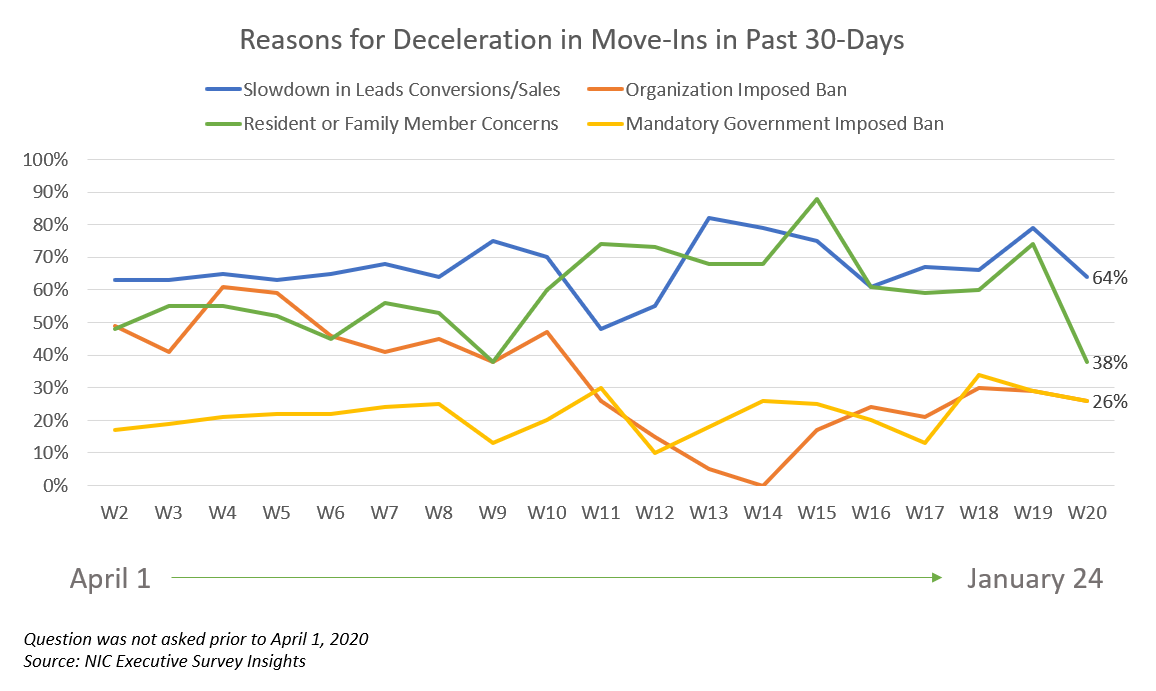

- Significantly fewer respondents in the Wave 20 survey cited resident or family member concerns than in the Wave 19 survey (38% vs. 74%), and notably fewer cited a slowdown in leads conversions/sales (64% vs. 79%) as reasons for deceleration in move-ins in the past 30-days.

- Between 50% to 60% of survey respondents have consistently reported offering rent concessions to attract new residents since the Wave 13 survey conducted in late-September to early-October. Among organizations with multiple properties that were offering rent concessions in the Wave 20 survey, one in three (32%) were offering rent concessions in more than one-half of their properties, and one in four (26%) were offering rent concessions in all of their properties.

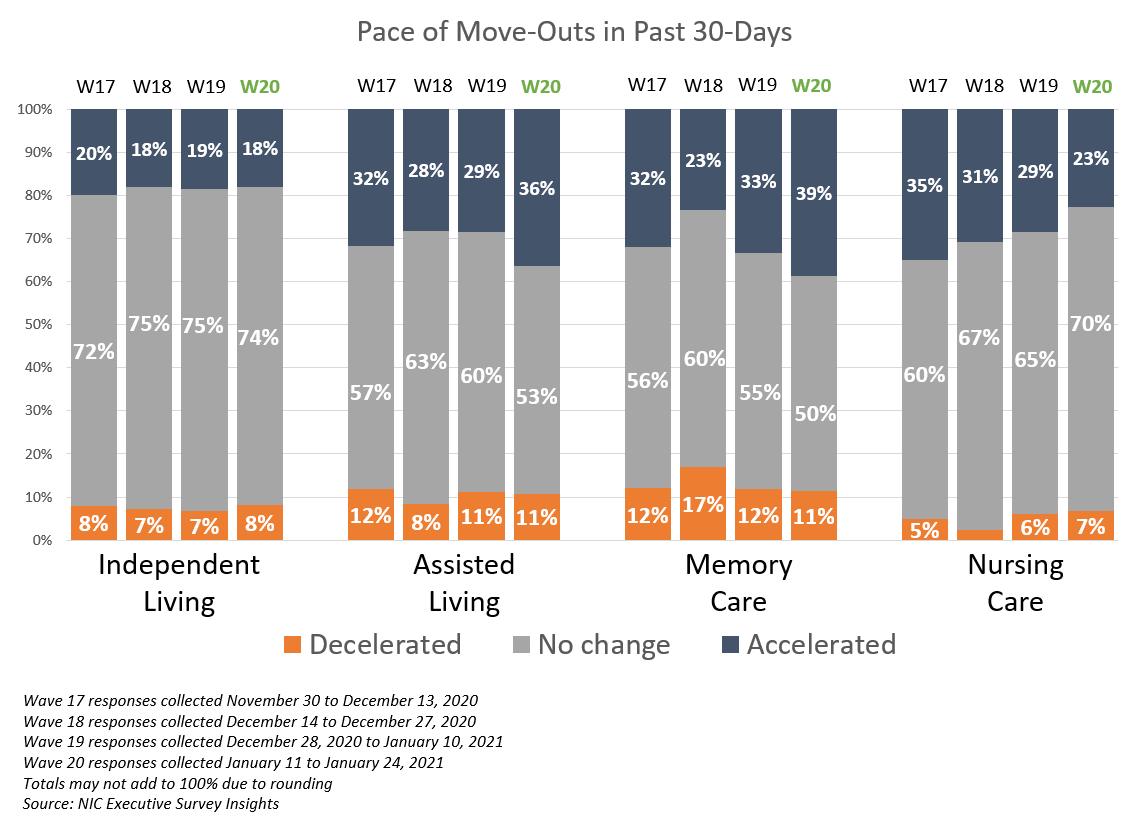

- As shown in the chart below, more organizations with assisted living and/or memory care units in the Wave 20 survey than at any other time in the survey time series reported accelerations in the pace of move-outs in the past 30-days. That said, fewer organizations with nursing care beds noted acceleration in the pace of move-outs than in the past five waves of the survey dating back to Wave 15 conducted late-October to early November. Presumably in part due to operator innovations in infection mitigation and creative visitation protocols which have gained acceptance from many residents and their families, respondents citing resident or family member concerns as a reason for acceleration in move-outs is at the lowest level in the survey time series (23%).

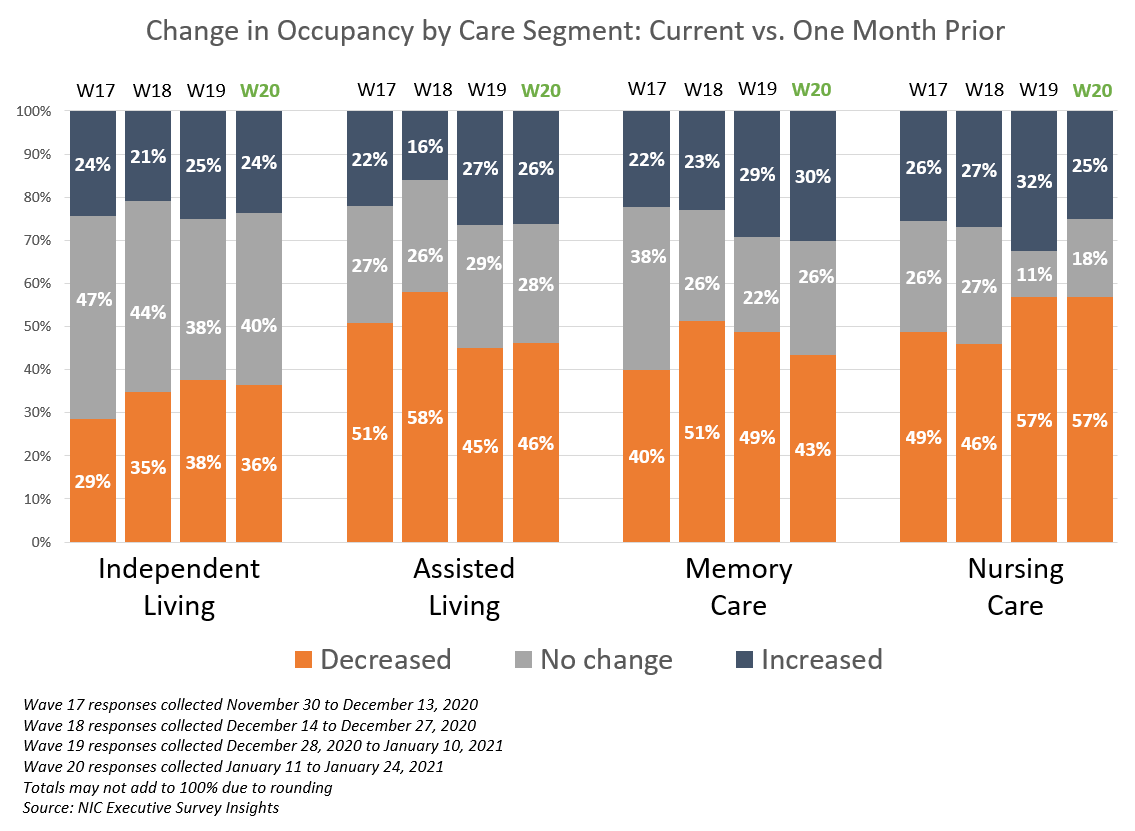

- For each of the care segments, the shares of organizations reporting occupancy declines continued to outpace those reporting occupancy increases. Considering recent survey data, this trend began in the Wave 16 survey conducted in mid-November (reflecting experiences that occurred during the beginning of the Fall surge in coronavirus cases in October). Essentially unchanged from the Wave 19 survey, between 46% and 57% of organizations with assisted living units, memory care units and/or nursing care beds, and 36% with independent living units, reported declines in occupancy in the past 30-days.

Wave 20 Survey Demographics

- Responses were collected between January 11 and January 24, 2021 from owners and executives of 92 seniors housing and skilled nursing operators from across the nation. Just over half of respondents are exclusively for-profit providers (56%), one-third are nonprofit providers (32%), and 12% operate both for-profit and nonprofit seniors housing and care properties.

- Owner/operators with 1 to 10 properties comprise just over half of the sample (58%). Operators with 11 to 25 properties make up about one-quarter of the sample (22%), while operators with 26 properties or more make up 20% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 65% of the organizations operate seniors housing properties (IL, AL, MC), 31% operate nursing care properties, and 36% operate CCRCs (aka Life Plan Communities).

If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link or send a message to insight@nic.org to be added to the email distribution list.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are continuing to change.

Skilled Nursing: Where Are We, and What Are the Opportunities?

By Bill Kauffman, Senior Principal, Research & Analytics, NIC

The skilled nursing sector is arguably facing the most challenging times in its history. COVID-19 has compounded pre-pandemic struggles for many operators in terms of patient census, staffing shortages, and cash flow; the latter despite recent pandemic-related federal government support. The latest surge of COVID-19 cases has been discouraging and has made it feel like the crisis may never end. Indeed, the pandemic has created challenges that most sector veterans never could have imagined in their lifetime. However, with vaccines starting to be distributed and prioritized for both patients and staff in nursing care properties, there is much hope that we will soon hear positive stories with some semblance of normalcy by this fall or sooner.

The skilled nursing sector is arguably facing the most challenging times in its history. COVID-19 has compounded pre-pandemic struggles for many operators in terms of patient census, staffing shortages, and cash flow; the latter despite recent pandemic-related federal government support. The latest surge of COVID-19 cases has been discouraging and has made it feel like the crisis may never end. Indeed, the pandemic has created challenges that most sector veterans never could have imagined in their lifetime. However, with vaccines starting to be distributed and prioritized for both patients and staff in nursing care properties, there is much hope that we will soon hear positive stories with some semblance of normalcy by this fall or sooner.

As many in the skilled nursing sector know, a crisis presents opportunity, and the pandemic and its resulting impacts is no exception for virtually all sectors in the economy to learn from this historical event. Indeed, skilled nursing operators and investors have an opportunity to reflect on what they have learned and what they can improve upon now and in the future. It is important to note, however, that the pandemic has likely widened the gap between strong operators and those who already were struggling prior to COVID-19.

The Importance of Strong Operators

Strong operators are key to long-term success in skilled nursing, both operationally and financially. This could be a positive for those that are, or have interest in, strong operators as market share will likely grow for the winners, especially as skilled nursing properties continue to treat higher acuity patients. Medicare and Medicare Advantage will likely continue to reduce overall healthcare spending by cutting down on hospital admissions and length of stay at skilled nursing properties.

Operators with strong clinical operations and a managed care strategy in place before the pandemic may have an easier path forward to the future. The year 2020 highlighted the importance of having an infrastructure in place to care for the most vulnerable population, but it also accelerated the evolution of many skilled nursing operators that were already on this course before the pandemic. Operators may not survive if they fail to respond to these evolving pressures that include managed care, higher acuity, enhanced technology communication platforms, and other consumer demands.

There has been much discussion about how some operators may elect to sell or leave the business given the challenges of the pandemic, in addition to rapid changes taking place before the pandemic. These include the growth in managed care, a new reimbursement system, pressure on length of stay, and competition from home health. On the other hand, there will be operators that emerge stronger for having gone through the pandemic in terms of their operating ability and clinical programs. For example, some operators have completely changed how they think about infection control and now implement stricter safety protocols which will aid in the overall quality of care for patients.

Capital Is Also a Key

Having access to capital is another key to success, and the operators who have continued to prepare for the future and managed to operate with reasonable debt levels certainly have an advantage. Despite the current difficulty in operations, investor appetite for high-quality skilled nursing properties with good operators remains a key investment thesis in the capital markets.

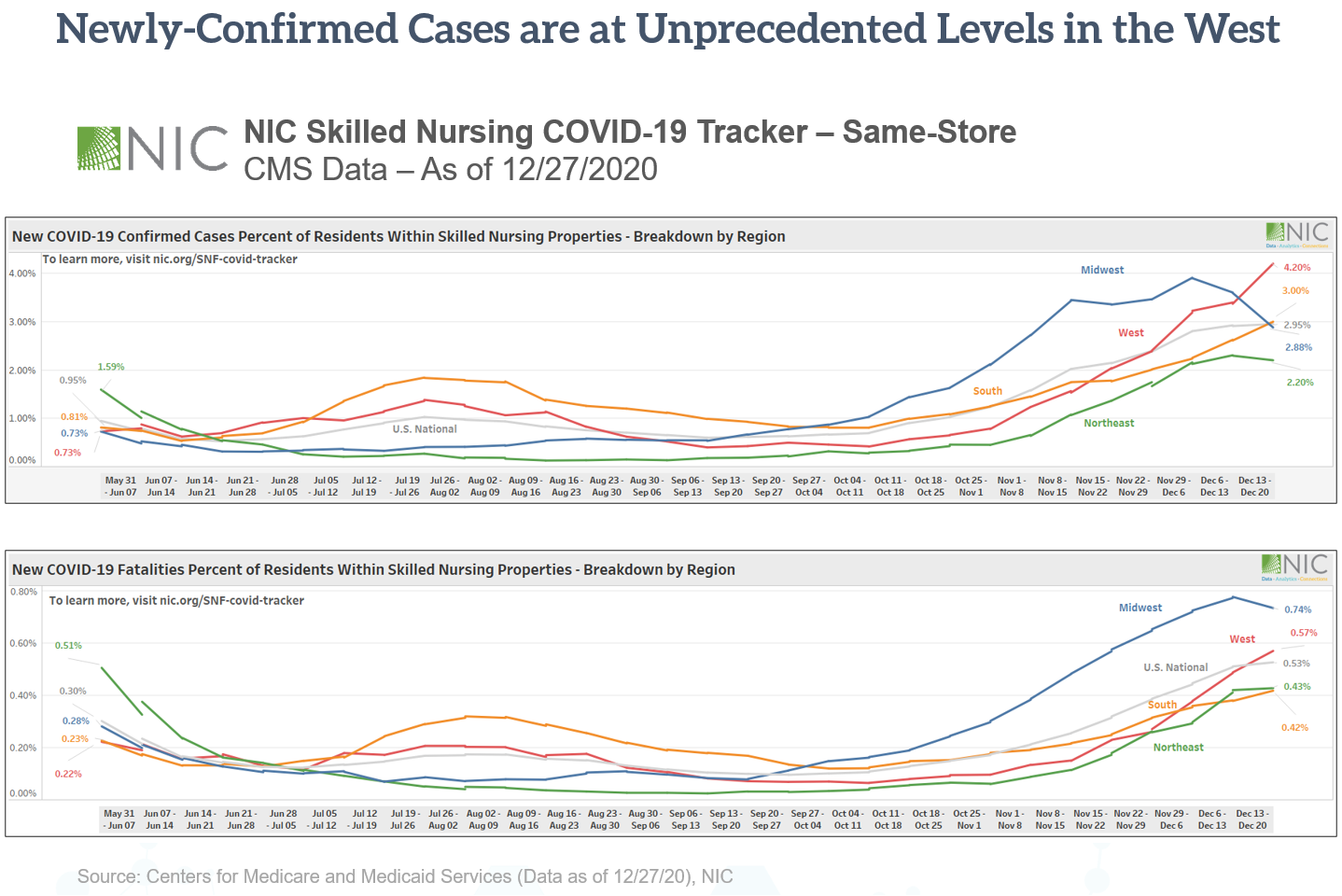

Indeed, the challenges in operations continue. Nearly a year into the pandemic, the COVID-19 case counts continue to mount, and the challenges remain. Unfortunately, as we entered the winter months (see graph below), data shows that cases were the highest they’ve been, especially in the West Region of the United States. The NIC Skilled Nursing COVID-19 Tracker exhibit below shows new COVID-19 confirmed cases as a percent of residents within skilled nursing properties were 4.2% in the West during the week ended December 20, 2020. This data also shows that, during that same week, new COVID-19 fatalities as a percent of residents within skilled nursing properties were the highest they have been in the Midwest at 0.74%.

Another significant challenge is operator occupancy. Skilled nursing occupancy was at 74.7% as of October 2020 based on data from the NIC Skilled Nursing Data Initiative, representing a 10.5 percentage point drop from February 2020. In addition, managed Medicare reimbursement is likely to continue the downward pressure. Data shows managed Medicare revenue per patient day declined 15.9% between January 2012 and October 2020.

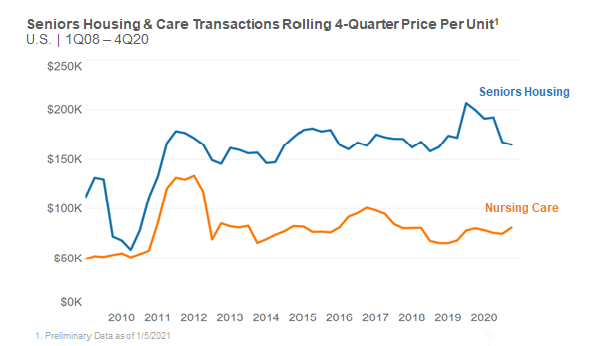

Despite these challenges, skilled nursing (nursing care) property price per bed has held firm according to price per bed data; see graph below for details and sources. This pricing trend depicted in the graph below is a national rolling four-quarter measure, and it is not same-store data; the mix of properties could impact the results. However, it does reflect what is trading in the market albeit with relatively lower transactions closed in 2020 due to the pandemic.

So, what does this data say as the price per bed holds firm? For one, the properties trading could be higher quality with good operators. Second, there is still a very attractive expected spread in terms of the interest rates on debt and the expected long-term cash flow of a high-quality property, which may be supporting price levels. And lastly, there are some small private investors, owners, and/or operators looking to expand regionally and have optimistic long-term views about the sector.

What Are the Opportunities for Operational Improvement?

Most of the headlines in the news related to skilled nursing have been negative throughout the pandemic. However, for operators that are committed to the long-term success of their operations, the pandemic has reinforced an environment where they are constantly thinking about improving and figuring out how they can best serve their patients. In addition, the retention of staff as well as creating and maintaining a positive culture have become top priorities.

Source: NIC MAP® Data Service, Real Capital Analytics

One opportunity for improvement is to integrate active and dedicated physicians into the clinical and financial operations at the property level. This would likely to lead to better clinical outcomes, improved census management, and additional success in value-based initiatives—a focus for many operators as they look toward the future.

Another example of a pandemic-related acceleration of an earlier trend is the importance of having 21st century health care technology. Operators have tremendous opportunity to improve their technology infrastructure. This includes upgrading existing technology regarding electronic medical records and communication platforms, in addition to adding new technology like telehealth capabilities. Operators who do not upgrade their technology are playing at a significant disadvantage, especially in times of the pandemic and certainly after the pandemic.

An area often warranting attention is the needs of staff and the care providers at a property. Without a well-functioning positive culture at a property and within the broader corporate structure, the long-term success of the organization, including the quality of care for patients, is at high risk of being jeopardized. This includes tending to the mental health of the care providers through opportunities such as meditation programs, one-on-one appointment with stress management counselors, and adherence to vacation and time-off policies. Operators who are successful on these fronts will have a significant advantage, especially when it comes to delivering quality care to patients.

Given the market challenges and fast-paced changes that are likely to continue, a new way of operating for many – a “decentralized” management strategy – could create significant efficiencies by giving more decision-making authority to the property administrator instead of having all major decisions being approved at the corporate office. This requires specific talent, and providers need to think outside the box and outside the sector to find that talent. Once found, that talent pool of newly hired should be incentivized to be successful. This may include not just a simple salary and bonus, but an ownership percentage and/or more direct earnings structures aligned with the success of the property.

Ultimately, whatever path an operator chooses to move forward upon, the status quo is likely a recipe for failure especially for a segment within the United States’ healthcare sector, such as skilled nursing, where budget pressures will continue as far as the eye can see.

To get more trends from the latest data you can download the Skilled Nursing Monthly Report. There is no charge for this report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators in order to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form on the NIC Skilled Nursing Data Initiative page. NIC maintains strict confidentiality of all data it receives.

Vaccination Clinics: What to Expect and Overall Turnout

With the pandemic still impacting our everyday lives, and particularly impacting the senior living sector for close to a year, the release of an approved COVID-19 vaccine has started the path to ending this pandemic. Despite the prioritization of senior living communities to receive the vaccine across the country, many operators still have questions about the vaccination timing and process. Samantha Medred, Future Leaders Council (FLC) member and Director, HealthTrust, discussed this with the Executive Director (ED) from HarborChase of Wellington. Here is one community’s experience with the vaccination clinic, as well as observations made from the corporate level:

With the pandemic still impacting our everyday lives, and particularly impacting the senior living sector for close to a year, the release of an approved COVID-19 vaccine has started the path to ending this pandemic. Despite the prioritization of senior living communities to receive the vaccine across the country, many operators still have questions about the vaccination timing and process. Samantha Medred, Future Leaders Council (FLC) member and Director, HealthTrust, discussed this with the Executive Director (ED) from HarborChase of Wellington. Here is one community’s experience with the vaccination clinic, as well as observations made from the corporate level:

Medred: What market are you located in, what care levels do you offer, and what is your set-up capacity?

ED: HarborChase of Wellington is in Palm Beach County, Florida; it offers assisted living with an extended congregate care license and memory care. Set-up capacity is 76 assisted living beds and 58 memory care beds.

Medred: When did you apply for your community to receive the COVID-19 vaccine? How long did it take to receive approval and a vaccination date?

ED: HarborChase of Wellington registered on October 19, 2020, to receive the vaccine and, on January 11, 2021, received its first dose.

Medred: What challenges did you encounter?

ED: We did encounter the challenge of actually getting the vaccine, as the community is an assisted living, and the state had not released vaccines immediately to them.

Medred: When did your community receive its vaccinations?

ED: The community has or will receive them in 2021 on January 11, February 1, and February 21.

Medred: How did you determine the order in which communities received the vaccine? Was that decision made internally at HCR or was that determined by the state or county where the property is located?

Corporate: We, as a company, decided that all communities would participate and were at the mercy of the state/local provider as to when each community would receive the vaccine.

Medred: Did you have an option with which vaccine you received?

ED: There was no option given.

Medred: Could you explain how the process went? For example, were all vaccinations administered in one day? Who administered the vaccines?

ED: Walgreens administered the first dose of the Pfizer vaccine to 106 residents and 66 staff and essential caregivers in one day. The community divided the staff in half to receive the vaccine in case of adverse effects on staff.

Medred: What percentage of residents chose to take the vaccine? What percentage of staff received the vaccine?

ED: We had 97 percent of residents choosing to receive the vaccine and 40 percent of associates in the first round. Another 30 to 40 percent of associates will receive their first doses when the first group of associates receives their second doses.

Medred: For all HCR communities that have been vaccinated, what percentage of residents have chosen to take the vaccine? What percentage of staff?

Corporate: Residents are at 95 to 100 percent, and staff members range from 50 to 60 percent.

Medred: If a resident or staff member chose not to take the vaccine, when the second dose is administered, is there an option for them to receive it then?

ED: Yes.

Medred: What about new residents, how do they receive vaccines going forward? Will you require new staff to be vaccinated going forward? Will there be follow-up clinics?

ED: We are working with Walgreens and our local Publix to see how we can manage this in the future. We also are looking to apply to become a vaccination site to ensure that we can keep all new staff, families, and residents vaccinated.

Medred: At the corporate level, has there been any discussion about offering incentives to employees to take the vaccine? Have incentives been offered at any of HCR’s communities?

Corporate: No.

Medred: Did it cost the facility anything? Was insurance information taken from residents/staff to bill individual insurance companies, or did the state pay for it?

ED: There was no cost to the community. Walgreens did take residents and staff insurance information, but if they did not have insurance, a driver’s license number was recorded for the state to pay for it.

Medred: Now that the community has received vaccinations, is there any change expected in the near-term on admissions/COVID-19 protocols? Do staff/residents now seem more at ease?

ED: There is no change at the moment; however, a frequent comment that has been made by the staff is “a small weight has been removed from their shoulders.”

Medred: Have you seen any change in leads since the vaccine was prioritized for assisted living facilities, and has that translated into move-ins yet?

ED: We have not seen any change at this time.

Since the initial rounds of vaccinations, Florida ended its partnership with Walgreens and hired a third-party contractor who will take over clinics going forward. The new company will no longer be providing scheduled appointments; they are notifying communities the day they will be at the property. This will inherently cause issues with staff who are not scheduled to work the day the vaccinations are administered.

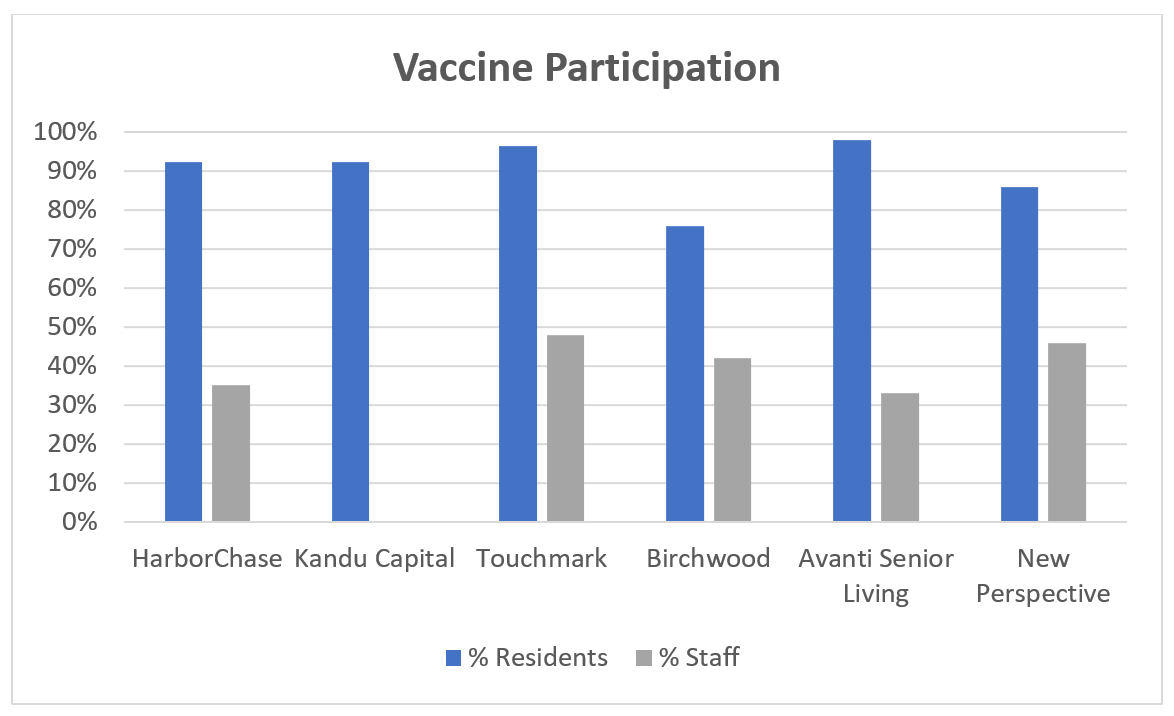

In addition to the HCR interview above, I also had the opportunity to catch up with Brad Dubin from Kandu Capital, Jay Leo from Touchmark, Andrew Sfreddo from Birchwood Healthcare Partners, Lori Alford from Avanti Senior Living, and Alex Massopust from New Perspective regarding the initial response they have experienced during their vaccination clinics.

- Kandu Capital noted six out of nine of their communities have received their initial dose, with 90 to 95 percent of residents choosing to take the vaccine.

- Touchmark noted that 11 of 13 of their communities received some sort of vaccination effort to date, but that some have had full independent living, assisted living and memory care resident and employee vaccinations, while some of their communities just had skilled nursing vaccinated and the seniors housing side is still pending vaccinations. Touchmark’s resident participation was 97 percent, noting that less than 100 percent participation was mostly due to residents not in-house at the time of vaccination clinics (hospice/hospital stay). Staff participation was noted to be 48 percent.

- Birchwood noted 18 of the 31 communities had received vaccinations, with 76 percent of residents choosing to take the vaccine and 42 percent of staff. However, approximately 10 percent of staff who did not originally choose to take the vaccine have signed up for vaccination during the communities’ second clinic.

- Avanti Senior Living noted that all seven of their communities had received initial vaccinations, and approximately 98 percent of residents and 33 percent of staff chose to be vaccinated.

- New Perspectives’ experience was within the range of the others, with 86 percent of residents choosing vaccinations and 46 percent of staff.

At this point, no one with whom we spoke was requiring vaccination for employment; however, several noted that they are considering it. Birchwood did note that if an employee does not take the vaccine, they are requiring staff to get tested once more per week than the county requirement. Birchwood also noted that they are giving away several raffles for incentive purposes. No one else noted to be offering incentives at this time.

One thing we have learned from the last year is that COVID-19 is a constantly evolving event, with experiences varying from community to community. While these are initial indications, as more people become vaccinated, hopefully staff members at seniors living communities will increase participation and CDC guidelines will begin to loosen allowing activities and experiences at senior living communities to return to a level of normalcy.

Interviews in this article have been edited for clarity and length.