February 1st 2024

Accessing Capital in 2024 – NIC Webinar

Accessing capital is top of mind for the senior housing and care sector. When will the Fed begin interest rate cuts? Will bank debt be more available than it was during 2023? What do the capital markets hold for borrowers? Is private equity investment still on the table? A panel of industry experts will tackle these questions and more at the next NIC complimentary webinar on February 13, 2024, at 1:00pm ET. Register today.

NIC Analytics Active Adult Case Study: Treplus Communities

The latest NIC case study features Treplus Communities’ active adult rental strategy. Treplus focuses on understanding the consumer, differentiating active adult from traditional senior housing and multifamily housing, and implementing and maintaining a strong brand. Learn strategies Treplus Communities executes to build, lease up, and grow the organization’s thriving active adult portfolio by downloading the case study here.

The latest NIC case study features Treplus Communities’ active adult rental strategy. Treplus focuses on understanding the consumer, differentiating active adult from traditional senior housing and multifamily housing, and implementing and maintaining a strong brand. Learn strategies Treplus Communities executes to build, lease up, and grow the organization’s thriving active adult portfolio by downloading the case study here.

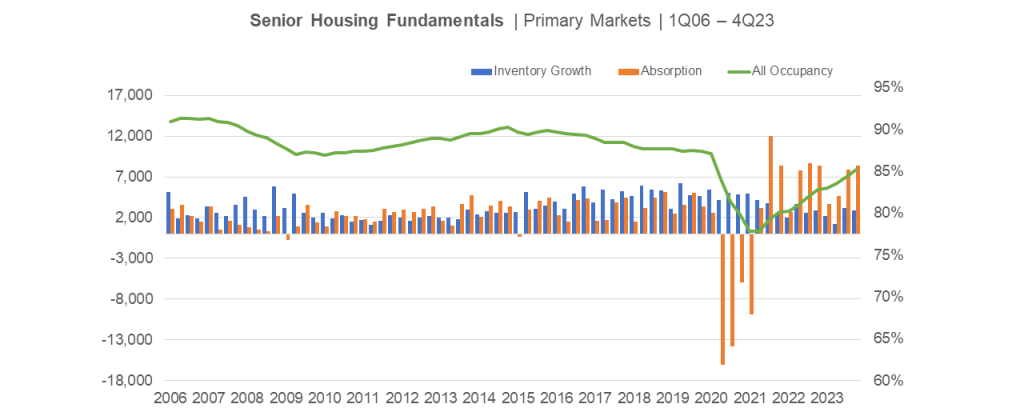

NIC MAP Vision Fourth Quarter 2023 Key Takeaways: Senior Housing Occupancy Rate Increases for Tenth Consecutive Quarter

The NIC Analytics Team presented findings during a webinar with NIC MAP Vision clients on January 18, to review key senior housing data trends during the fourth quarter of 2023. Key takeaways included the following:

- Market fundamentals for 31 Primary Markets on track for pre-pandemic occupancy recovery in the second half of 2024.

- Occupancy rate in 68 Secondary Markets reached pre-pandemic levels.

- Occupied units continued to climb to new record highs.

- Inventory growth remained relatively moderate.

- Construction activity still slow in most markets.

NIC INSIGHTer: Bank Regulation on CRE Loans

Do you see increased pressure coming from regulators this year requiring commercial banks to recognize losses on loans for commercial real estate properties?

“Bank regulators have increased their scrutiny on CRE loans due to continued uncertainty in the economy and higher interest rates. Regulators have focused more on loans with the following characteristics: maturities within 12-18 months; repricing/refinancing risk; potential declining valuations and guarantor dependency to meet contractual payment obligations.”

“Bank regulators have increased their scrutiny on CRE loans due to continued uncertainty in the economy and higher interest rates. Regulators have focused more on loans with the following characteristics: maturities within 12-18 months; repricing/refinancing risk; potential declining valuations and guarantor dependency to meet contractual payment obligations.”

Sarah Duggan

Executive Director, Wholesale Banking, Seniors Housing and Healthcare Lending, Synovus Bank

“Key has been proactive in preparing for the pending regulatory changes, specifically around proposed increases to capital requirements. Every bank has a different set of variables, but I am excited about our ability to contribute to the sector in 2024.”

“Key has been proactive in preparing for the pending regulatory changes, specifically around proposed increases to capital requirements. Every bank has a different set of variables, but I am excited about our ability to contribute to the sector in 2024.”

Morgin Morris

Senior Mortgage Banker, KeyBank Real Estate Capital

Exploring the Potential of Multigenerational Living and Learning: NIC Talks with Anne Doyle

What does it mean to bring an explorer’s mindset to the redesign of senior housing? Anne Doyle, CEO of Spark Living and Learning, shares exciting new ideas on how to develop a learning culture to attract the next generation of residents. Partnerships with local colleges or universities can provide unexpected benefits such as employee sourcing, expense management, educational enrichment, and engagement with the wider community. Learn more here.

What does it mean to bring an explorer’s mindset to the redesign of senior housing? Anne Doyle, CEO of Spark Living and Learning, shares exciting new ideas on how to develop a learning culture to attract the next generation of residents. Partnerships with local colleges or universities can provide unexpected benefits such as employee sourcing, expense management, educational enrichment, and engagement with the wider community. Learn more here.