Preliminary Q4 2015 Data Shows Active Sales but Slowing Dollar Volume

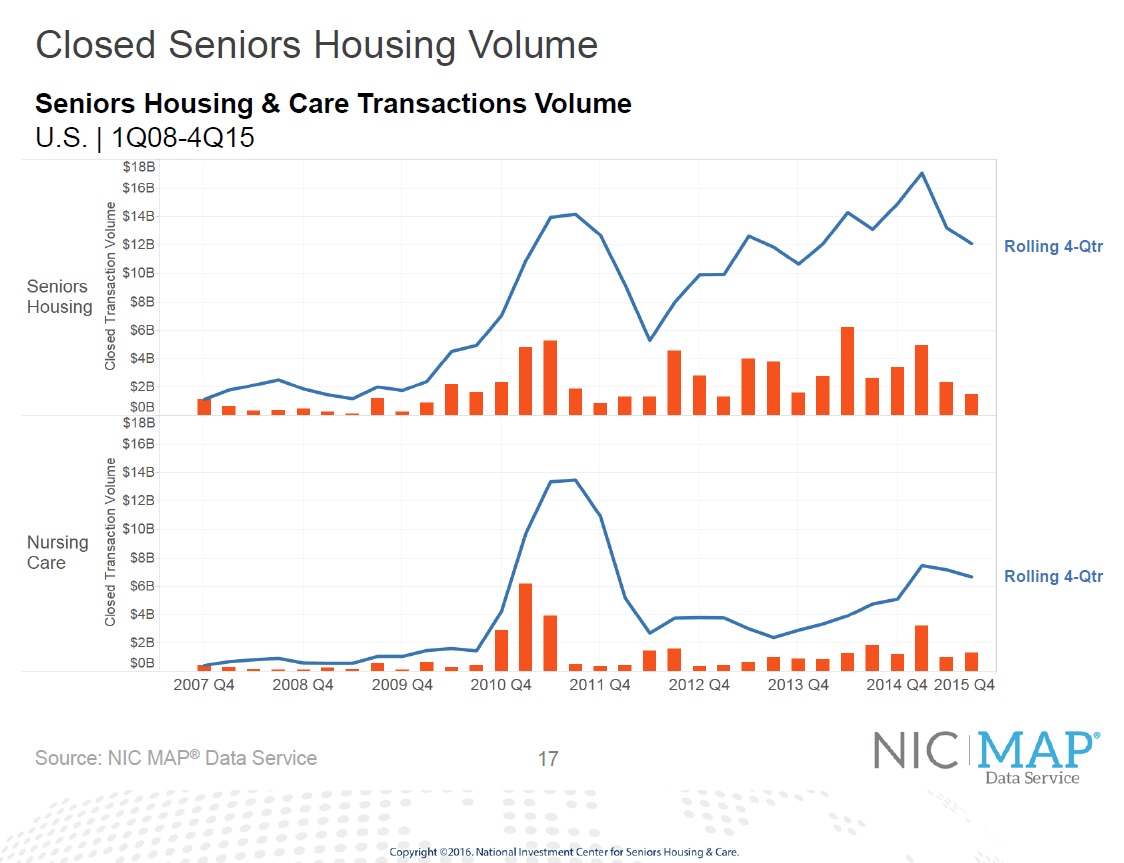

The U.S. seniors housing and care property sales market continued to remain active in the fourth quarter of 2015, although preliminary data shows dollar volume slowed significantly during the second half of the year. During the fourth quarter of 2015, $2.8 billion in seniors housing and care properties sales closed, down from $3.3 billion in the third quarter and $4.4 billion in the fourth quarter of 2014. Combined third- and fourth-quarter volume totaled $6.1 billion, which was down significantly from $12.7 billion in the first half of the year. The rolling four-quarter total fell to $18.7 billion from its $20.4 billion in the third quarter, but was up from $17.8 billion in late 2014.

Transactions volume for seniors housing properties totaled $1.5 billion during the fourth quarter, down 37% from the prior quarter and down 43% from a year ago. On a rolling four-quarter basis, seniors housing volume was $12.1 billion, the lowest four-quarter total since the second quarter of 2014 and down 8% from year-earlier levels.

Nursing care volume totaled $1.3 billion during the quarter, up 36% from the prior quarter and down 28% from a year ago. On a rolling four-quarter basis, nursing care volume totaled $6.6 billion, which was up 40% from $4.7 billion in the fourth quarter of 2014. The jump in nursing care transactions volumes may reflect the changing landscape in the sector, in which some owners are selling properties to strategic buyers who are working to capitalize on current market dynamics and opportunities.

The year 2015 marked the second consecutive year during which more than 500 seniors housing and care deals closed, with 514 closed transactions. This compares to 554 closed transactions in 2014. Of those 2015 transactions, there were only two that exceeded $1 billion. As the year evolved, fewer large deals over $500 million occurred.

Of the 514 transactions that closed in 2015, 403 were single-property sales, down from 452 in 2014. The remaining 111 transactions that closed in 2015 were portfolio sales, up from 102 in 2014. The dollar size of the portfolio sales fell in 2015; the data show that there were more portfolio deals in the smaller $10 to $50 million range in 2015.

A few larger deals to note for 2015 include:

- Ventas/American Realty Capital transaction for $1.2 billion. For purposes of clarification, the dollar value of this sale represents the seniors housing and care real estate assets traded (the total transaction in itself was $2.6 billion, which included a large amount of medical office building assets). The seniors housing and care portion of the sale traded at a price per unit of $311,000, which included 46 seniors housing and care properties housing 3,800 units.

- Omega/Aviv merger for $1.7 billion, which included 332 properties and 32,073 units at a price per bed of $53,000.

- Northstar Realty Finance acquisition from Fortress for $875 million, which included 32 properties and 3,912 units at a price per unit of $223,600.

- New Senior Investment Group (SNR) acquisition from Fortress (Holiday) for $640 million, which included 28 properties and 3,243 units at a price per unit of $197,000.

- Extendicare sale to a group of investors led by Formation Capital for $870 million.

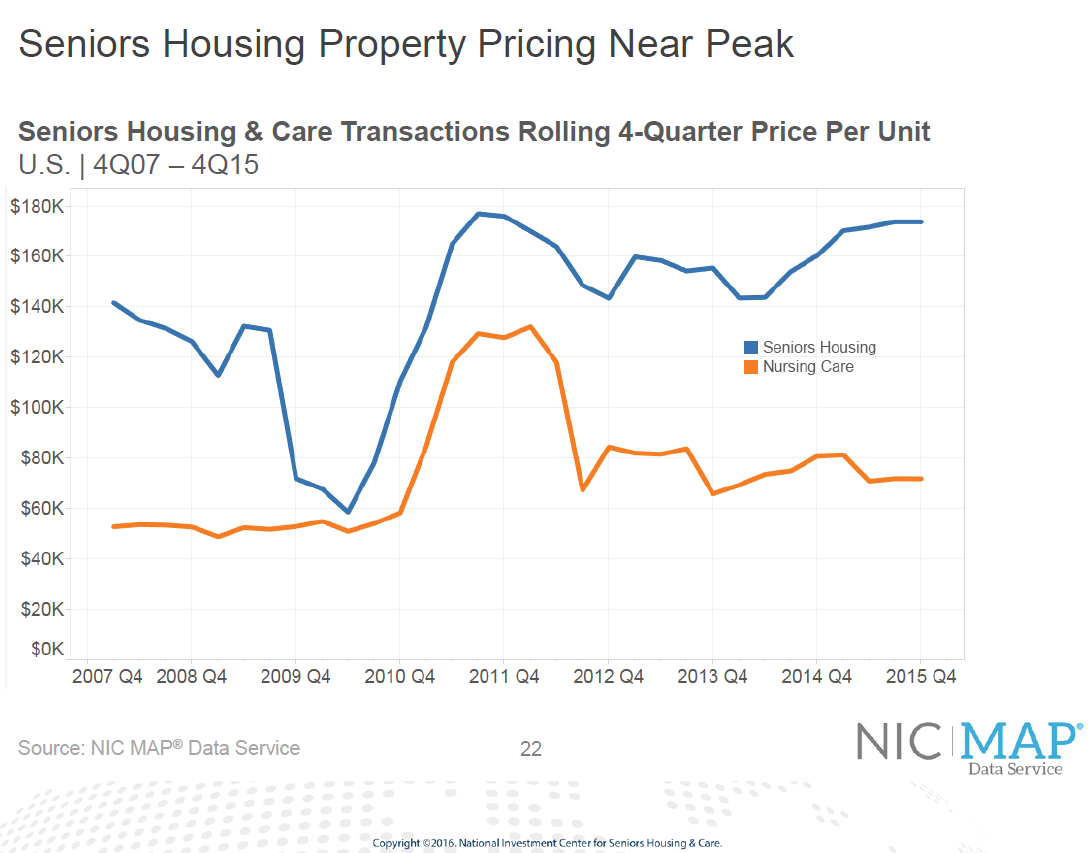

The average price per unit for seniors housing properties remained near record highs. As of the fourth quarter of 2015, the rolling four-quarter average price per unit for seniors housing properties was $174,000, up 8% from year-earlier levels. The rolling four-quarter average seniors housing cap rate was 7.6% as of the fourth quarter of 2015, the same as year-earlier levels. The rolling four-quarter average price per bed for nursing care properties was $72,000, down 11% from a year ago. The rolling 4-quarter average cap rate for nursing care decreased 60 basis points to an estimated 9.2% as of the fourth quarter of 2015.