At 215,000, March’s Job Gains Remain Strong

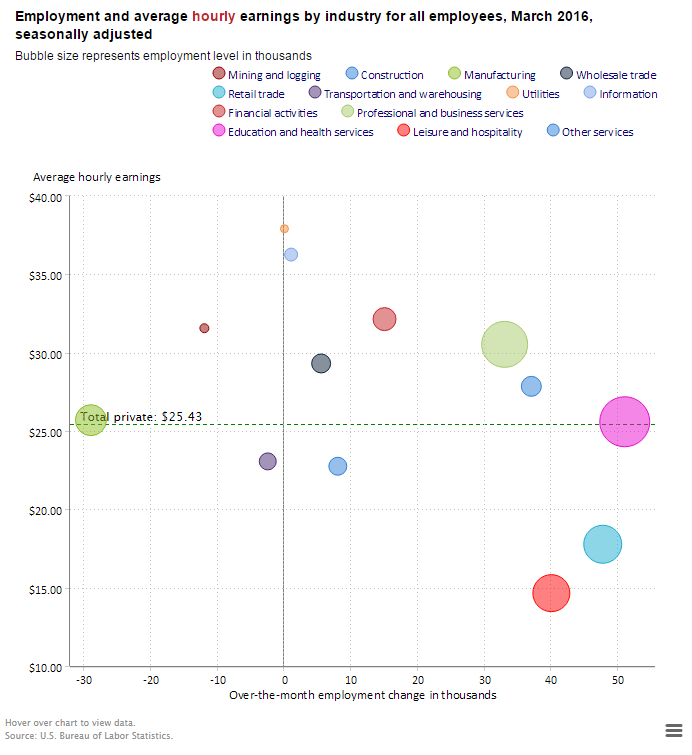

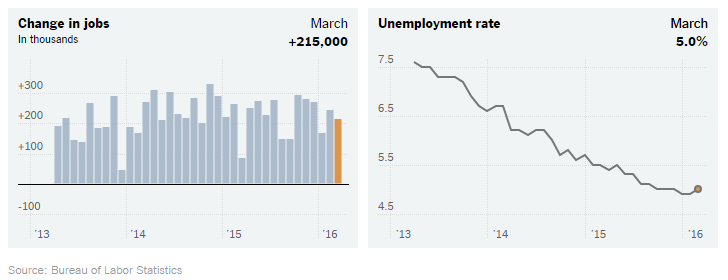

The Labor Department reported that nonfarm employment increased by a healthy 215,000 positions in March. Employment increased in the retail trade, construction, and health care sectors. Job losses occurred in manufacturing and mining. The change in payroll employment for January was revised from 172,000 to 168,000, and the change for February was revised from 242,000 to 245,000. With these revisions, employment gains in January and February combined were 1,000 less than previously reported. The median forecast in a Bloomberg survey called for a 205,000 job increase in March. For the private sector, March’s job gains marked the 73rd consecutive month of positive gains.

Employment in health care increased by 37,000 over the month, about in line with the average monthly gain over the prior 12 months. In March, employment rose in ambulatory health care services (27,000) and hospitals (10,000). Over the year, health care employment has increased by 503,000.

The unemployment rate was 5.0% in March, up slightly from 4.9% in February. The number of unemployed persons was little changed at 8.0 million. Both measures have shown little movement since August. The household survey, which is used for the unemployment rate results, showed a healthy 246,000 employment gain in March, while the labor force increased by an even larger 396,000. The labor force has now increased by more than two million persons in the past five months. The labor force participation rate has jumped from a low of 62.4% last September to a two-year high of 63.0% in March. This is good sign of strength in the labor market.

The wider measure of unemployment, the U-6 measure, rose to 9.8% from 9.7%. This measure of unemployment includes those workers in part-time positions or too discouraged to look for work. The number of long-term unemployed (those jobless for 27 weeks or more) was essentially unchanged at 2.2 million in March and has shown little movement since June. In March, these individuals accounted for 27.6% of the unemployed.

In March, average hourly earnings for all employees on private nonfarm payrolls increased by 7 cents to $25.43, following a 2-cent decline in February. Over the year, average hourly earnings have risen by 2.3%. This measure of wage growth continues to be stubbornly weak, despite the tightening in the labor force.

It’s likely that the Federal Reserve will welcome this report as an indication of strength in the domestic economy but the Fed is not likely to immediately act on this report by further raising short term interest rates. Earlier this week, in a speech at the Economic Club of New York in New York City, Fed Chairwoman Yellen indicated that global economic and financial uncertainty pose risks to the U.S. economy and justify a slower path of interest-rate increases. She gave investors a list of indicators they need to watch for future rate hikes. Among the additional considerations she indicated the Fed is tracking are the following:

- Stabilization in foreign economies and their financial markets

- A slowdown in the appreciation of the dollar that would subsequently help the U.S. manufacturing sector

- Stabilization in commodity prices to help foreign producers and global economies

- A stronger domestic housing sector

This was a broader list of considerations than what is commonly viewed as the indicators that the Fed tracks for domestic monetary policy. The U.S. Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives—full employment and inflation–are often referred to as the Federal Reserve’s dual mandate and are commonly viewed as lens through which the Fed tracks the economy.