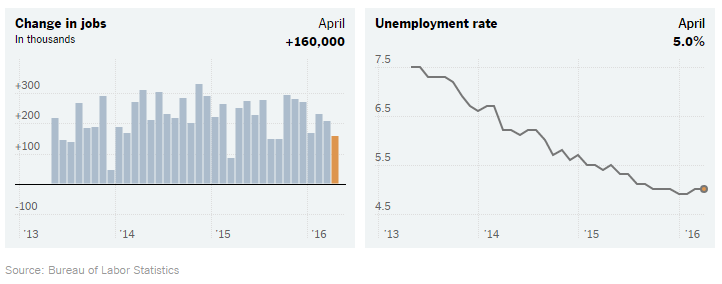

At 160,000 April’s Job Gains Slowed from Recent Pace

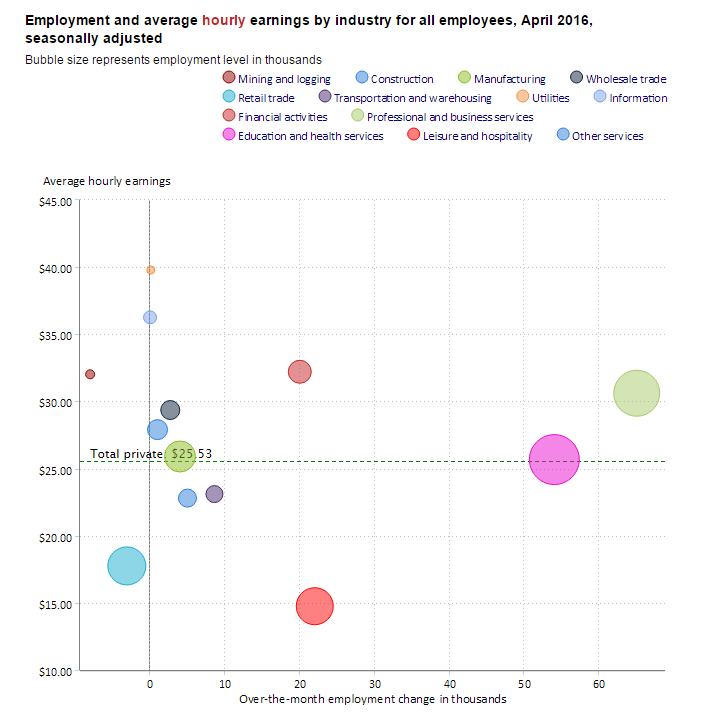

The Labor Department reported that nonfarm employment increased by 160,000 positions in April, less than the 200,000 positions consensus projection. Over the past 12 months, monthly job increases have averaged 232,000. Employment increased in in professional and business services, health care, and financial activities. Job losses continued in mining. The change in total nonfarm payroll employment for February was revised from 245,000 to 233,000, and the change for March was revised from 215,000 to 208,000.

In April, health care employment rose by 44,000. Over the year, health care employment has increased by 502,000.

The unemployment rate remained steady at 5.0% in April, the same as in March. The number of unemployed persons was little changed at 7.9 million. Both measures have shown slight movement since August.

The wider measure of unemployment, the U-6 measure, fell to 9.7% from 9.8% in March. This measure of unemployment includes those workers in part-time positions or too discouraged to look for work. The number of long-term unemployed (those jobless for 27 weeks or more) declined by 150,000 to 2.1 million in April and accounted for 25.7% of the unemployed.

Average hourly earnings for all employees on private nonfarm payrolls increased by 8 cents to $25.53 in April, following a 6-cent decline in March. Over the year, average hourly earnings have risen by 2.5%. This measure of wage growth continues to be relatively weak, despite the tightening in the labor force.

Source: Bureau of Labor Statistics

It’s likely that the Federal Reserve will regard this report as an indication of a slowing domestic economy. The April jobs number along with the weak GDP number reported for the first quarter (a gain of 0.5% at an annualized rate) will give pause to the Fed as it considers raising interest rates at its June 14-15th FOMC meeting.