President & CEO / NIC

With its strong mix of educational sessions, networking opportunities, and Texas-style fun, the 2025 NIC Fall Conference once again demonstrated the power of bringing people together. Drawing nearly 3,200 attendees, the Conference was held Sept. 8-10 in Austin, Texas. It marked the 35th anniversary of the NIC Fall Conference and was the second largest event in its history.

“NIC conferences remain the premiere gatherings for industry executives to network and gain insights on current industry conditions,” said NIC CEO Ray Braun. “This underscores both NIC’s role as the sector’s leading convener as well as the momentum driving senior housing today.”

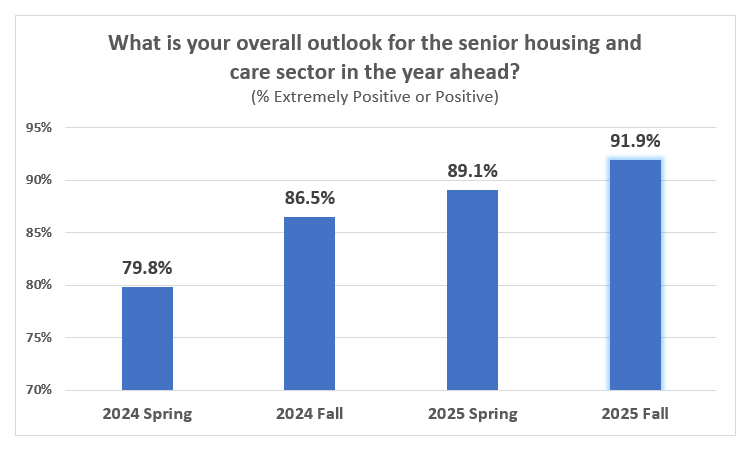

The Conference theme—Rising Demand, Expanding Opportunity—highlighted the industry’s enviable position. Consumer demand is quickly outpacing current supply. New investors are jumping into the sector while experienced owners and operators are expanding and fine-tuning their approaches. One conference participant characterized the current senior housing sector as enjoying a “Goldilocks moment.”

At the same time, the industry faces challenges to address the affordability gap and changing consumer preferences. And while additional supply is vital, capital constraints and cost escalations continue to slow new development.

Rich and Robust Programming

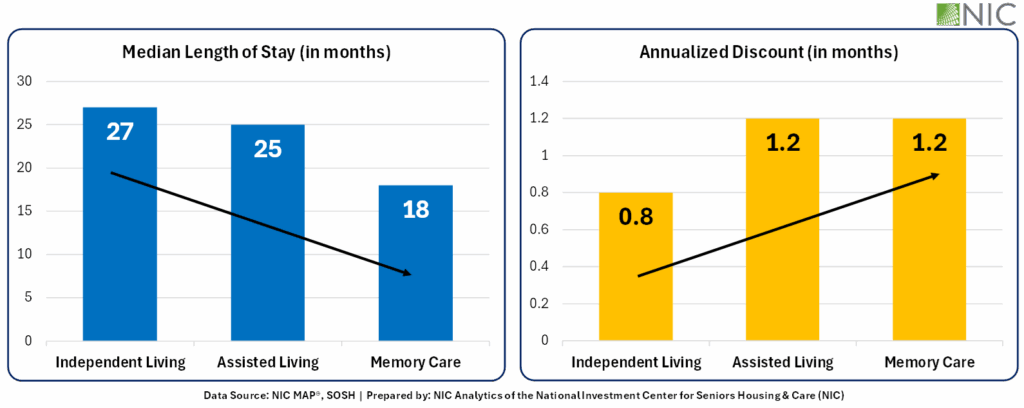

Ground-breaking research was introduced at the Conference. NIC again partnered with NORC at the University of Chicago, building on previous studies, to determine the value of senior housing, including for those living with dementia.

Co-founder & Strategic Advisor / NIC

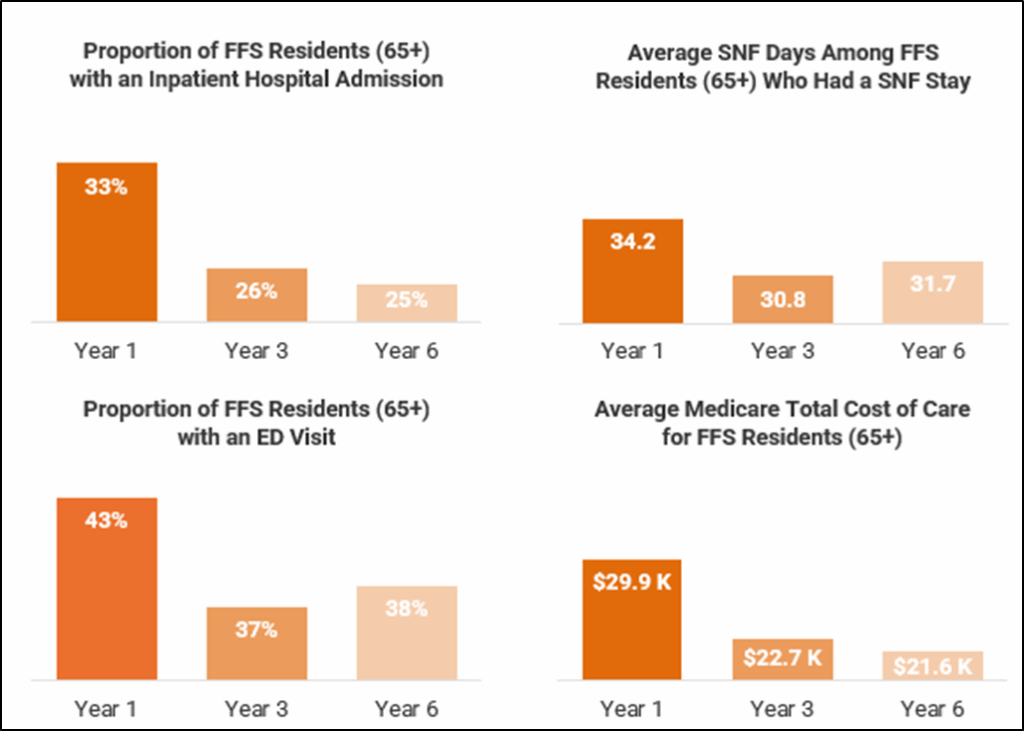

The results show improvements in frailty and stability the longer the resident lives in senior housing. In fact, the number of hospitalizations and readmissions were reduced, providing relief for family caregivers, and establishing timely access to care in a supportive environment, ultimately leading to greater longevity.

Lisa McCracken, NIC Head of Research & Analytics, led a panel discussion on the latest NORC research and the implications for senior housing. Panelist Tom Cassels, managing director at Manatt Health, commented, “Senior housing communities bend the trend to be proactive about health.”

Senior Fellow | Brookings Institution

Sharing his deep knowledge and extensive expertise, NIC Co-Founder and Strategic Advisor Bob Kramer led a “lessons learned” panel of highly experienced executives on how to prepare for the future of senior living. “By looking back at the past 30 years of growth in our industry, we’re presenting six lessons learned from both the successes — they’ve been notable — and the mistakes and failures so that hopefully we can all be wiser in the next growth cycle,” said Kramer. One lesson: Develop your business model starting with the customer you plan to serve and how you plan to serve them.

The Conference featured a total of 12 educational sessions, curated to provide actionable insights. “You can always take away something from all of the educational sessions,” said attendee Katrina Resch, executive assistant at Priority Life Care.

Highlights from other sessions included:

- Experts provided an update on capital markets and valuations: Where they are now and where they’re headed. “The additional capital coming into the sector will allow us to tackle the housing demands that are on the horizon,” said KeyBank Senior Vice President Morgin Morris.

- An outlook on policies directly impacting the sector from the new administration in Washington, D.C.

- Economist Wendy Edelberg unpacked the domestic and global economic playbook, spotlighting the indicators to watch.

- Growing sources of new capital such as family offices, donor-advised funds and pension funds. “It might be hard to understand the space, but understanding the demographics is easy,” said Citrine Investment Group, Founder & President, Lynn Jerath.

- New products and new marketing messages for the older consumer—roadmaps to connect with the next generation of older adults.

- Overcoming barriers to new development. “The opportunity is significant,” said Stuart Jackson, executive vice president at Greystone.

As part of a session spotlighting the mission and heart of senior living, participants previewed the award-winning documentary Familiar Touch. The film is set in an actual assisted living community and brings the emotional realities of aging and memory loss to life from the perspective of the residents, families and caregivers. The viewing was followed by a panel discussion with the film’s director on the impact of person-centered care.

Founder & President | Citrine Investment Group

The Conference also featured seven Innovation Labs where participants came together for hands-on, interactive workshops. Popular topics included data driven insights, healthcare partnerships, and real-world AI solutions.

Attendees enjoyed a number of networking opportunities to engage in value-driven conversations, share lessons learned and grow productive relationships. Several Texas-themed receptions offered a relaxed and vibrant atmosphere. And yes, there were cowboy hats and country music.

“The NIC Fall Conference has allowed us to make connections with other operators, vendors, and people in our network. Everyone is in one place and in one city,” said attendee Laura Bierman, sales executive at Procare HR.

Executive Vice President | Greystone

Conference details were thoughtfully planned. Attendees enjoyed café-style meals, a specialty coffee bar, headshot lounge and relaxation station, among other perks.

A women’s meetup and first-time attendee gathering showcased the industry’s evolution and expansion. NIC’s Braun noted that over 500 attendees at the Fall Conference were first-time registrants, along with 150 new companies including many new capital providers.

“NIC continues to fulfill our mission of providing access and choice to older adults,” said Braun. “We foster relationships for the senior housing and care industry; produce groundbreaking research and analytics; develop next generation leadership; and showcase opportunities.”

—

Save the Dates

The 2026 NIC Spring Conference will be held March 30-April 1 in Nashville, TN. The 2026 NIC Growth Conference will be held May 13-14 in Indianapolis, IN.