Assisted living occupancy at lowest level since early 2010

FOR IMMEDIATE RELEASE: Monday, January 9, 2017

Contact: Biba Aidoo, 443-837-2430 or communications@nic.org

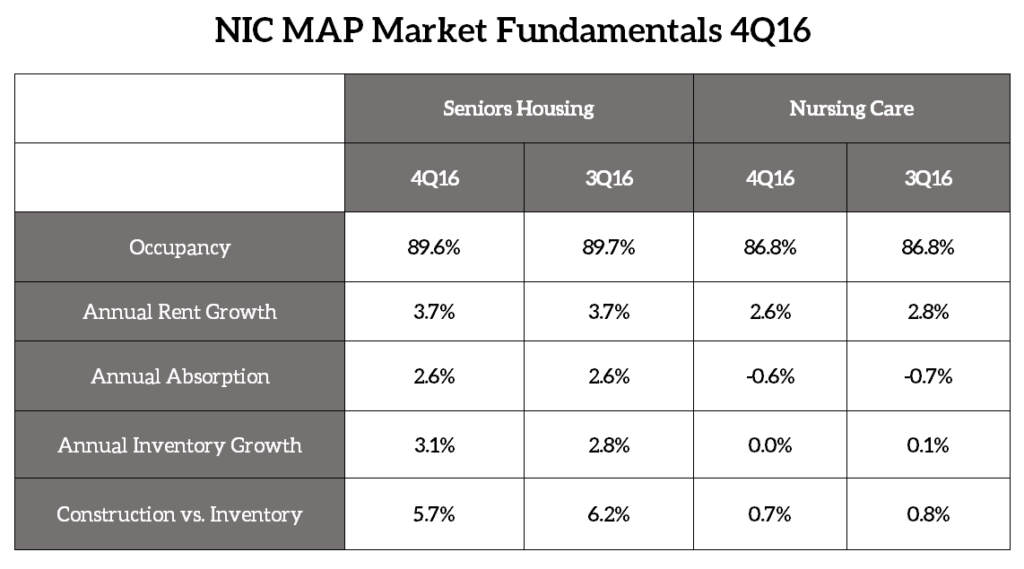

ANNAPOLIS, Md. – The occupancy rate for seniors housing properties in the fourth quarter of 2016 averaged 89.6%, as net additions in inventory outpaced absorption of units. This represented a decrease of 0.1 percentage point from the prior quarter, and was down 0.5 percentage point from year-earlier levels. During the past four years, occupancy has averaged 89.7%. As of the fourth quarter of 2016, occupancy was 2.7 percentage points above its cyclical low of 86.9% during the first quarter of 2010 and 0.7 percentage point below its most recent high of 90.3% in the fourth quarter of 2014.

The occupancy rates for independent living properties and assisted living properties averaged 91.1% and 87.6%, respectively, during the fourth quarter of 2016. When compared to the prior quarter, the occupancy rate for independent living was up 0.1 percentage point. Occupancy for independent living was down 0.2 percentage point from its year-earlier seven-year high of 91.3%. The occupancy rate for assisted living was down 0.3 percentage point from the third quarter and down 0.7 percentage point from year-earlier levels. Occupancy for assisted living was at its lowest level since early 2010.

Seniors housing annual absorption was 2.6% as of the fourth quarter of 2016, unchanged from the third quarter of 2016 and up from 2.3% one year earlier. The seniors housing annual inventory growth rate in the fourth quarter of 2016 was 3.1%, up 0.3 percentage point from the prior quarter and its fastest pace since at least 2006.

“It was a very active quarter for inventory growth. More than 5,900 units were delivered on a net basis, the most in a single quarter since NIC’s data collection began in 2006,” said Beth Burnham Mace, chief economist for NIC. “Inventory gains were strongest in assisted living, where nearly 4,100 units came online. The growth was not surprising in light of the number of units started 18 to 24 months ago—it often takes 18 to 24 months from ground breaking to opening. It is also notable that net absorption of senior living units reached a record high level during the quarter. Demand was very strong, just not strong enough to offset the growth in inventory.”

Current construction as a share of existing inventory for seniors housing slowed 0.5 percentage point from its recent high of 6.2% in the third quarter of 2016 to 5.7% as of the fourth quarter of 2016, and was at its lowest level since the second quarter of 2015.

Seniors housing construction starts during the fourth quarter of 2016 preliminarily totaled 3,554 units, which included 882 independent living units and 2,672 assisted living units. On a four-quarter basis, starts totaled 17,719 units, the weakest pace since the fourth quarter of 2014.

During the fourth quarter of 2016, the average rate of seniors housing’s annual asking rent growth was 3.7%, which was the same as in the prior quarter and 0.9 percentage points above its pace one year earlier during the fourth quarter of 2015.

“This was the same growth rate that we saw in the third quarter and marked the fastest growth rate for asking rents in nearly ten years,” noted Chuck Harry, NIC’s chief of research and analytics. “From year-earlier levels, this same-store growth was fastest for independent living properties, whose asking rents increased by 4.0%, compared to the 3.1% gain seen in assisted living properties.”

The nursing care occupancy rate held steady at 86.8% during the fourth quarter of 2016, remaining at its lowest level since at least 2005.

The nursing care annual inventory growth rate was nearly zero in the fourth quarter of 2016, while annual absorption was down by -0.6%. Private pay rents for the sector grew 2.6% year over year this quarter, down 0.5 percentage point from year-earlier levels, marking the slowest rent growth since at least 2006.

[Note: For 4Q16 NIC MAP data specific to your local metro market, please refer to the regional key metrics charts.]

###

About NIC

The National Investment Center for Seniors Housing & Care (NIC) is a 501(c)3 organization established in 1991 whose mission is to enable access and choice by providing data, analytics and connections that bring together investors and providers. For more information, visit natinvcenterdv.wpengine.com, and follow NIC on Twitter.

Since 1991, NIC has been the leading source of research, data, and analytics for owners, operators, developers, capital providers, researchers, academics, public policy analysts, and others interested in meeting the housing and care needs of America’s seniors. NIC has proudly sponsored the Seniors Housing & Care Journal, a peer-reviewed journal for applied research in the seniors housing and care field, since 1993. One of NIC’s major initiatives to further its mission is the NIC MAP® Data Service (NIC MAP). NIC MAP’s web-based suite of research and analytic tools track and report seniors housing and care data for more than 14,000 properties within 140 U.S. metropolitan markets. Established in 2004, NIC MAP creates transparency for seniors housing and care by offering accurate, unbiased, and actionable market-level data on all of the sector’s property types and care segments, including independent living, assisted living, memory care, and nursing care, as well as continued care retirement communities (CCRCs). Our data is updated quarterly, monthly, and weekly, and is inclusive of property-level inventory by unit type, sales transactions, properties under construction and in the planning phase, aggregated occupancy and rent comparables, demographics, and much more. For more information, call 410-267-0504.