While the latest NIC data show skilled nursing and seniors housing occupancy and move-in rates declining and daily headlines seem to spotlight COVID-19 infections whenever they occur in these communities, the outlook from some of the sector’s most prominent analysts, while clear-eyed on short-term impacts and challenges, is not all bad. In fact, they see opportunities post-COVID. The third of NIC’s new series of “Leadership Huddle” webinars, held Thursday, April 23, drew over a thousand registrations from across the sector, and delivered again on the expectation of new data, expert analysis, and substantive discussion.

Hosted by NIC Chief Economist Beth Mace, the webinar, titled, “Prominent Real Estate Research Directors Discuss Market Trends and the Economic Outlook,” focused on the outlook for the U.S. economy over the next year, observations on current capital market conditions and assessments on the seniors housing sector from the point of view of investors. As Mace said in her opening remarks, she was joined by, “three of the most respected and brilliant minds in the commercial real estate industry.” As panelist Mary Ludgin, Senior Managing Director of Global Investment Research for Heitman pointed out, she and her fellow panelists, “bring insights that we’ve learned across the three prior recessions.”

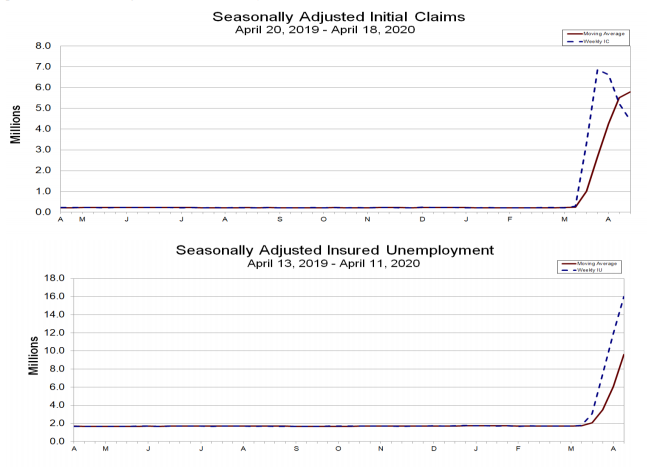

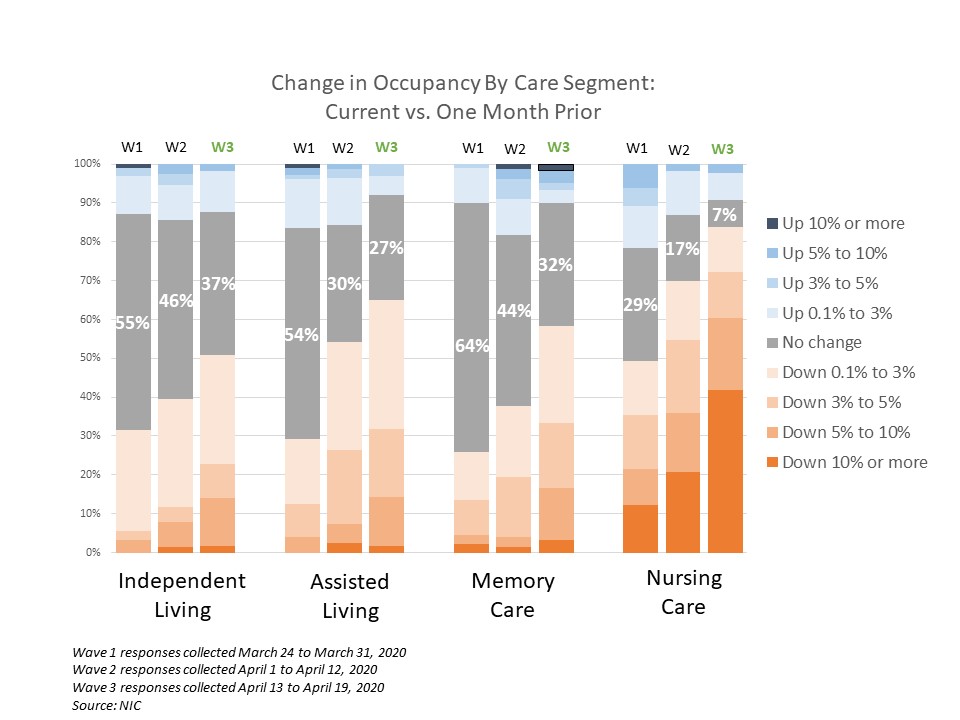

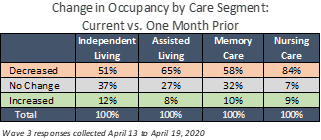

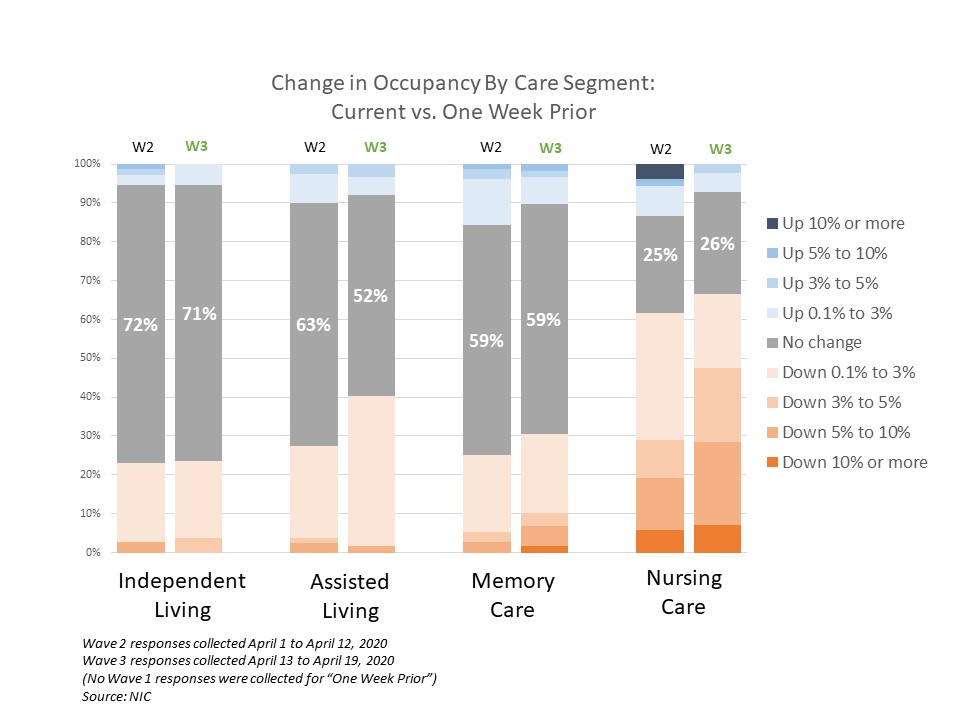

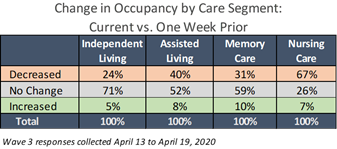

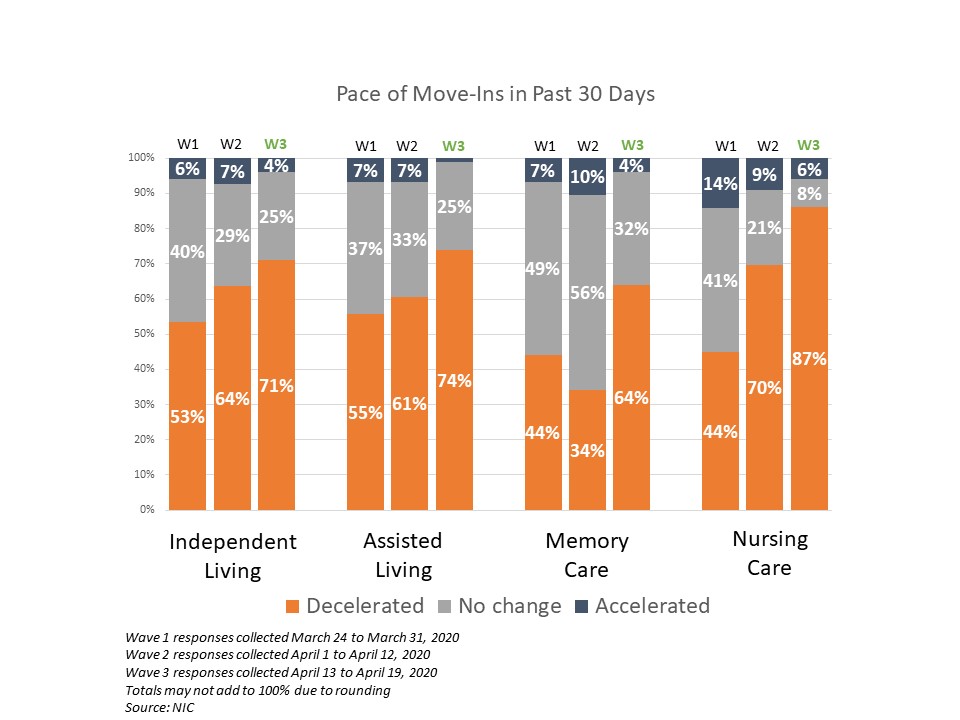

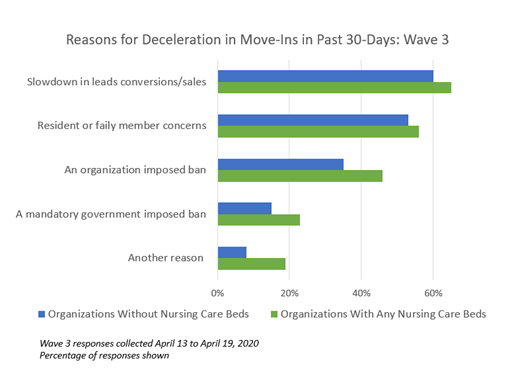

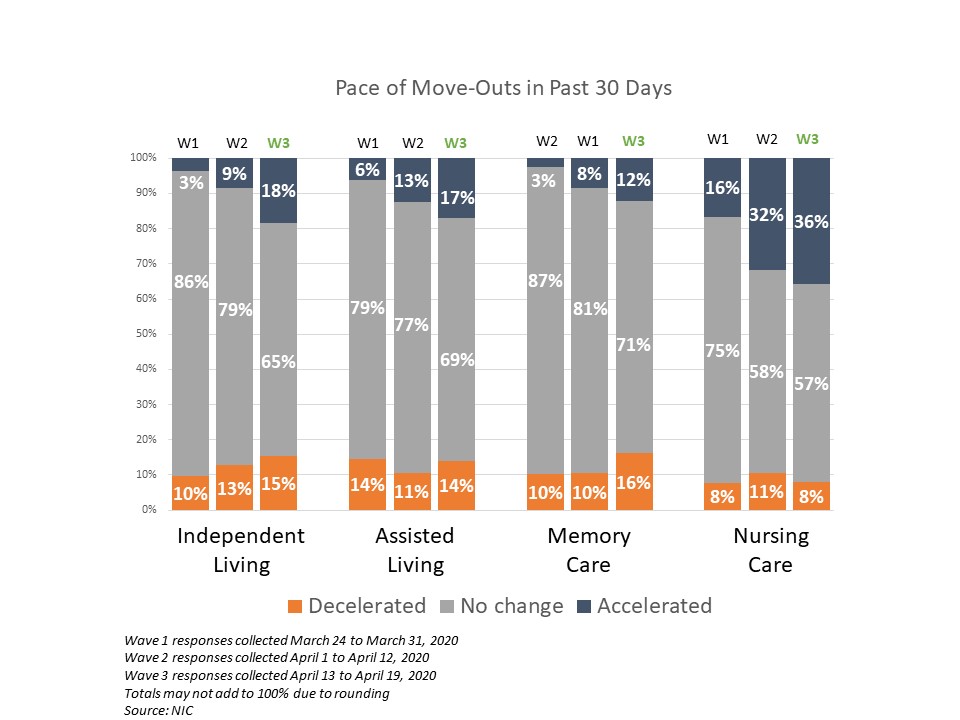

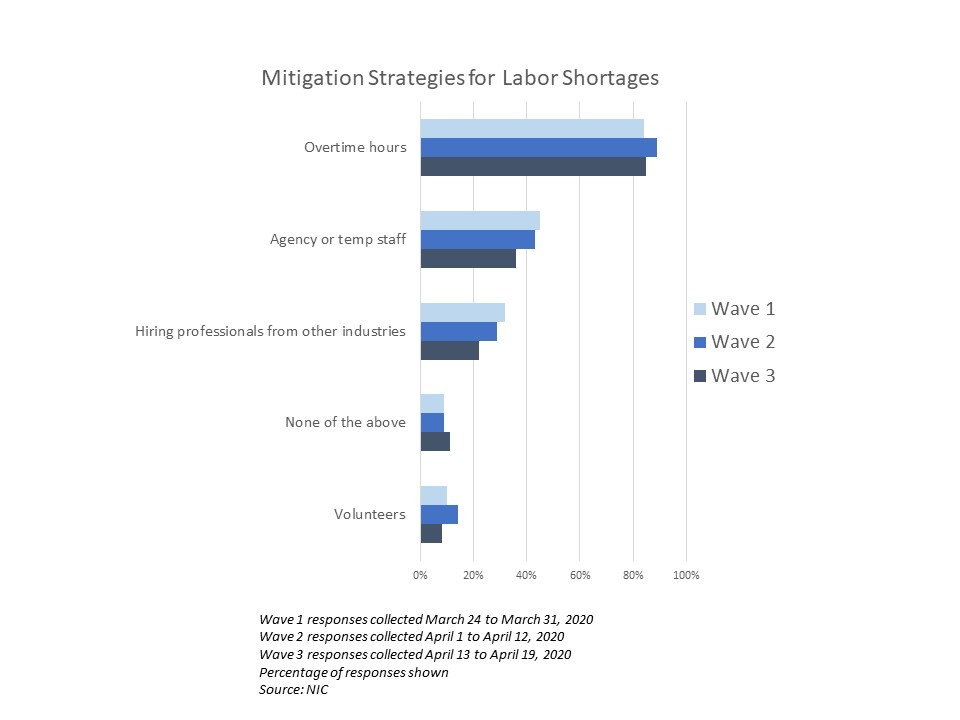

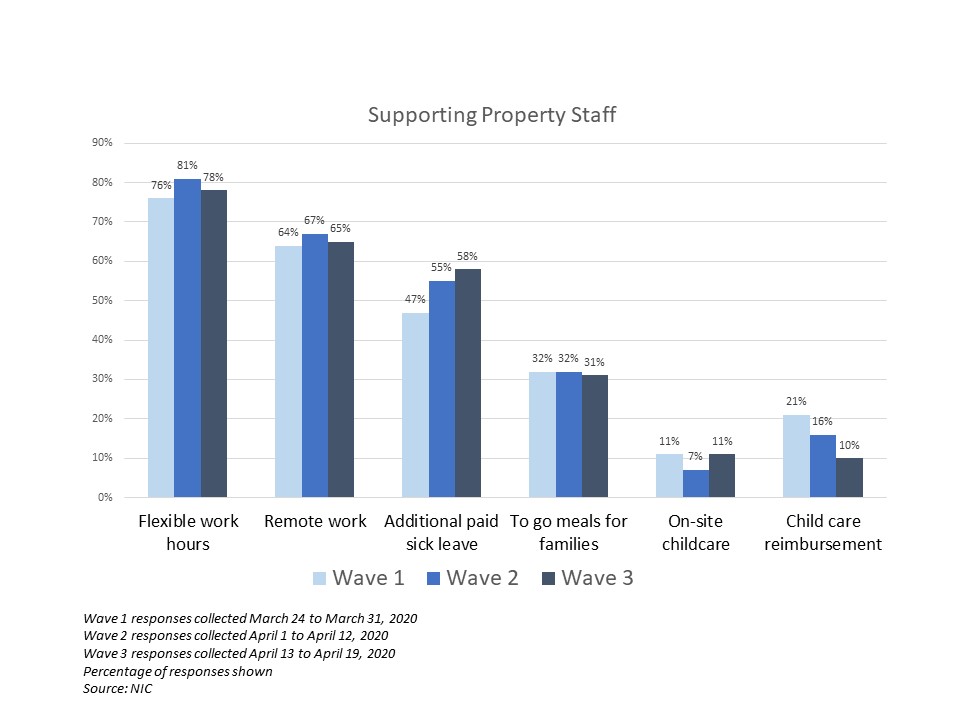

Mace presented new findings released that morning from Wave 3 of the weekly “NIC Executive Survey,” saying, “We would expect, due to the COVID, that you’re going to see a decrease in the occupancy rates, and in fact that’s what we have seen.” 84% of respondents with nursing care beds reported declines in occupancy, as did 65% reporting on assisted living, 58% memory care, and 51% on independent living. The survey, which showed results for the week ending April 19, 2020,also reflects a slowdown in move-in rates, with 87% of the respondents reporting a deceleration in move-ins for skilled nursing, 74% for assisted living, and 71% for independent living. Survey findings and analysis are posted weekly on the NIC Notes blog.

Discussing what the economy will look like a year from now, the panelists generally agreed that much depends on COVID-19-related factors, such as when a vaccine becomes available, testing of the general population occurs, and businesses are able to reopen. They also agreed that, while some return to ‘normalcy’ can be expected, not every sector will look the same. Calvin Schnure, SVP of Research & Economic Analysis at Nareit, said, “Keep in mind it’s not affecting all parts of the economy evenly, and there are going to be some things like travel, restaurants, theatres, and so on, that may not come back at all. The rest of this economy was in fairly good shape before this crisis hit, and that’s going to help lift the economy, but there are going to be different patterns of spending and patterns of activity.”

When asked what he’s telling his investment committee today, Michael Acton, Managing Director and Head of Research for AEW Capital Management, focused on the near-term impact on NOI, as well as cap rates, but indicated that the crisis will yield opportunities for investors who are ready for them. “There are going to be a lot of opportunities that show up, going forward from here. You can’t have a ten or eleven-year expansion without a lot of people being drawn into industries and investment opportunities that maybe they really shouldn’t be in. There’s very quickly going to be a revelation of weak hands versus very strong hands…we’re trying to get everybody…to be ready to act when things start to present themselves.”

Regarding lessons learned from the 2008/09 recession, Acton said that in general, you need to “triage” in three stages. First, you need to understand the debt maturities of your assets. Second, you need to keep an open dialog between your investors, asset managers and operators, and third you need to keep your team in place. “Things get harder through these events”. You also need to be sure that your capital structure has the flexibility that may be needed in a more challenged investment and economic environment.

Responding to the same question about what she is telling her investment committee, Ludgin pointed to the bid/ask spread, saying, “We don’t know what valuation metrics will be or what they should be. We don’t know what cash flows are, and therefore we’ll have buyers that have one view of value and sellers that have another view.” She expects to see, “a lot of structured transactions come out of this where those would-be sellers need capital, but they don’t want to sell at the prices buyers are willing to pay.”

Acton pointed to pricing decline patterns seen in REITs over the past several decades, and the fact the biggest declines historically have been closely followed by, “very outsized performance.” He commented that, “these periods of sharp decline, whether it is in the private market or the public market, do create very interesting entry points for investors.” But Acton also said that the seniors housing sector will face numerous challenges in the coming months. Move-ins, and, as a result, occupancy, will drop until the COVID-19 public health crisis is resolved.

As in the 2008 financial crisis, seniors who have trouble selling their homes will be unable to move in, and some adult children will be unable to support move-ins, due to the financial impacts of the crisis. While acknowledging higher infection rates and worse outcomes in skilled nursing, Acton’s big-picture view is that seniors housing is still a very sound sector. He said, “There are a lot of headlines out there that are making people anxious and nervous, but I think the (senior housing) sector as a whole is demonstrating that this is actually a remarkably safe place for your parents to be.”

For Schnure, the biggest risk facing the sector is that the “rising wave of older Americans moving into senior housing” might be “delayed” or even not occur at all. Comparing the sector to those which have seen less construction of supply in recent years, such as office, he pointed out that, with the high supply now on the market, seniors housing has less ability to absorb a drop in demand. He said, “seniors housing has to be able to absorb a fair amount of cushion, so that gives some extra work to do with this crisis.”

In Ludgin’s view, the complexity and operational expertise it takes to do well in a sector in which, “you have to get a lot of things right,” hasn’t been fully reflected in current pricing. She said, “So, I anticipate that there will be an expansion of cap rates in this sector, on a relative basis, in the near term. However, in the long term, she sees that demand remains “extremely strong,” saying, “This pandemic is not going to change that meaningfully, so I stay positive on this sector, but expect some near-term repricing.”

Webinar recordings and recap articles are available for this and prior webinars in the series, on the NIC Covid-19 Resource Center.