Trends Show a Changing Sector Evolving to Meet Consumer and Business Needs

Thought leadership is at the core of NIC’s mission—empowering the sector with data and analytics that support informed decisions and move the industry forward.

This past year underscored why that mission matters. New capital sources and entities are entering the market. Shifting regulation, touching everything from staffing to healthcare coverage and eligibility, is influencing workforce retention and shaping efforts to expand affordable options and middle market supply. Technology is transforming operations and the resident experience. Active adult communities are accelerating in popularity. And the demographic wave that will require the specialized care and services that senior housing provides will continues to build.

Sitting at the precipice of change, the industry sentiment conveys a very optimistic tone. At the 2025 NIC Fall Conference, 92% of leaders reported feeling positive—or extremely positive—about the year ahead.

To provide evidence and insight that helps leaders navigate those trends, NIC’s Research and Analytics team continually analyzes various data sources and publishes timely insights year-round. The team’s Year in Review report compiles significant analyses, including dozens of reports, case studies, data releases, and expert commentaries.

Below are a few highlights of research shaping senior housing and care.

- Today’s older adults are aging differently than previous generations. More are living alone, placing a greater emphasis on their preventive health and wellness, and seeking communities that offer meaningful social connection with peers. These preferences are fueling the growth of the relatively young Active Adult rental segment, bringing occupancy to an average of 96%, which far outpaces all other types of senior living communities. NIC’s Investment Thesis for Active Adult Communities outlines the market dynamics, operating economics, valuations and long-term potential of this segment.

- Increasingly, the link between senior housing and better care can be quantified. One of the cornerstones of NIC’s research portfolio has been a multi-year initiative to measure how senior living settings have the potential to improve resident outcomes and quality of life. In 2025, researchers found that older adults who remain in senior housing for longer periods of time utilize fewer acute care services and see their health stabilize for several years after moving in. For older adults with neurodegenerative diseases, researchers found that senior housing can reduce the number of hospitalizations and readmissions, provide relief for family caregivers, and enable timely access to care in a supportive environment, ultimately leading to greater longevity. These outcomes reinforce the pivotal role that senior housing can play in living well, longer. Senior housing can be a critical partner in reducing strain on families and the broader healthcare system while promoting older adults’ health and well-being. We must continue to advance the value that senior housing plays in promoting better quality of life and health outcomes as more stakeholders seek solutions for the aging population.

- Workforce needs and other operational pressures require ever-changing strategies. Labor shortages, changing regulations across care settings, and projected demand for hundreds of thousands of additional direct-care workers continue to shape operators’ strategies. NIC analyzed these trends through a workforce webinar and companion blog that use the data to tell a powerful story—and highlight where solutions are emerging.

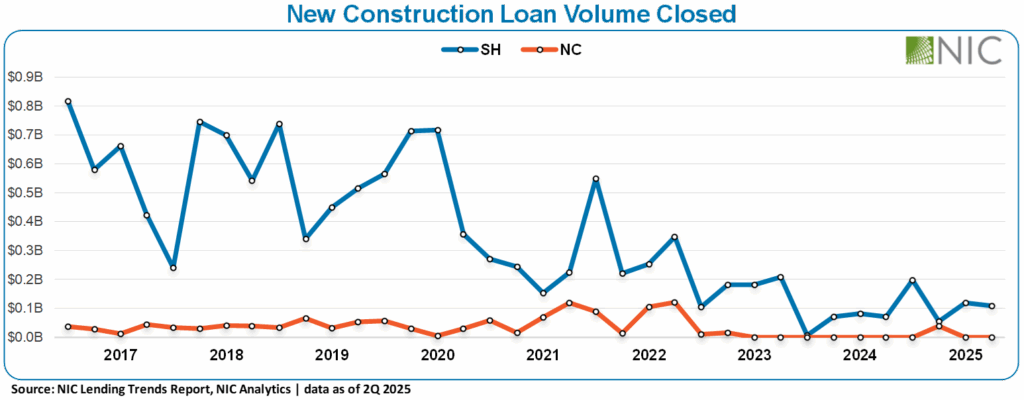

- Capital is flowing through the sector. Overall, the first half of 2025 showed a continuation of the positive credit performance trends observed in late 2024, with both the senior housing and skilled nursing sectors benefitting from improved cash flow conditions and firmer occupancy levels. NIC’s annual Lending Trends Report offers a spotlight on capital market conditions, reflecting lending activity of senior housing and care debt providers across the U.S.

- AgeTech is permeating all facets of senior housing and care—from care coordination to operations. But not every new piece of technology will be a viable solution for your organization. Everything needs to flow with your particular business model, whereas things like scalability and manageability are paramount. In this NIC Chats Podcast, guest Abby Miller Levy talks about how AgeTech can be used to improve workflows, reduce workloads so staff can focus on caring for residents; areas of opportunity, and advice for entrepreneurs seeking to enter the sector.

The 2025 trends of rising demand, new care and investment models, workforce pressures, and a growing recognition of senior housing as a critical health partner all reinforce the need for clear, reliable analytics. Throughout the year, NIC’s Research and Analytics team helped the industry interpret these shifts through data-driven reports, trend analyses, and thought leadership that informed strategy across the sector. Building on that momentum, the team will expand the industry’s knowledge base in 2026, producing new research, engaging emerging audiences, and continuing to serve as ambassadors who equip both leaders and new entrants with the insights needed to navigate a rapidly evolving landscape and advance the future of senior housing and care.

We look forward to more partnerships and progress in 2026, and as always, we welcome your inquiries and feedback on how the research team can help power your mission.