The pricing power in senior housing is no longer uniform; it is stratified by segments and shaped by turnover, affordability pressures, and the balance between choice and care necessity.

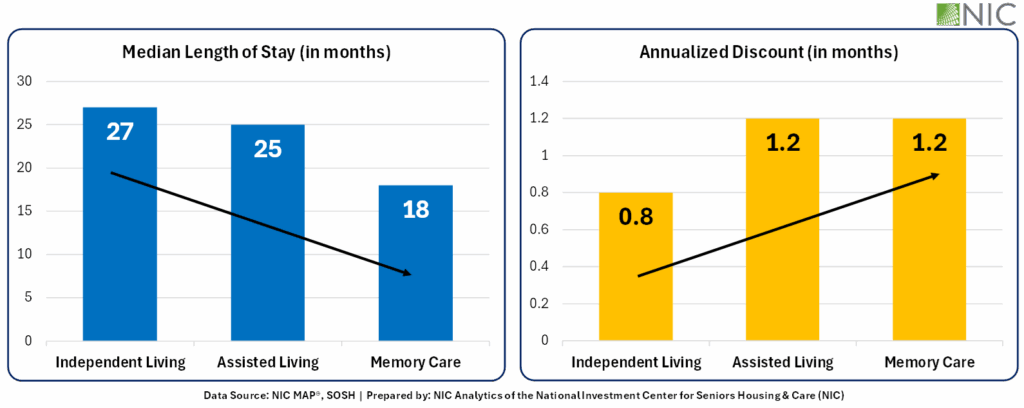

The second quarter of 2025 reinforced an important theme for the senior housing industry. Independent living (IL), as a choice-based segment, is achieving the strongest rent growth and the lowest reliance on discounts, while need-based care segments – assisted living (AL) and memory care (MC) – are grappling with rising discounting practices and tighter affordability constraints. Pricing power is increasingly a function of turnover dynamics and resident ability to pay. Segments with longer lengths of stay and lower reliance on concessions, most notably IL, are not only delivering stronger returns today but also feeding demand into the next stages of the care continuum.

Despite these variations in pricing, absorption across all segments remained positive, with move-ins exceeding move-outs for the 17th consecutive month. These positive absorption patterns highlight resilient demand, although in AL and MC that strength is coming at the cost of deeper concessions.

Independent Living Segment: A Standout Performer in Rent Growth

IL is emerging as the clear leader in rent growth. Asking rates increased by 6.7% and in-place rents rose by 9.1% year-over-year as of June 2025, but the most striking development was in initial rates, which surged 16.9% to a record high. Equally notable, discounts narrowed sharply. On average, residents moved in at rates only $298 below asking in June 2025, equivalent to 0.8 months of rent on an annualized basis. One year earlier, that gap was more than double ($634, equivalent to 1.8 months).

The combination of higher rent growth and lower discounts reflects not only strong market demand but also the positioning of IL as a lifestyle choice, where residents are willing and able to pay for independence and amenities. Importantly, IL residents are often tomorrow’s AL and MC residents, meaning today’s strength in IL rent growth is also a leading indicator of the type of demand moving through the care continuum.

Assisted Living Care Segment: Moderate Rent Growth but Rising Discounts

By contrast, the AL segment delivered more moderate rent growth, highlighting its positioning as a need-based segment. Asking and in-place rents increased by 5.9% and 5.5%, respectively, while initial rents rose just 4.2% from year-earlier levels. At the same time, discounts widened to $673, or about 1.2 months of rent, compared with one month the prior year.

These trends suggest that while demand remains steady, operators are leaning on greater concessions to further drive move-ins and balance affordability. For many families, AL is a need-based decision made under financial constraints, which heightens price sensitivity and limits how much operators can push rents before turning to discounts.

Memory Care Segment: Rent Growth Deceleration and Affordability Pressures

MC, meanwhile, is experiencing the sharpest slowdown. Asking rents grew 5.1% year-over-year in June 2025, down from 5.8% in 2024. Initial rates rose by just 2.2%, less than half the pace of the previous year. Discounts widened considerably, averaging $898, or 1.2 months on an annualized basis, up from 0.9 months last June.

With a median stay of only 18 months, MC remains the shortest-tenure segment, and higher turnover is increasingly translating into deeper discounts.

Additional key takeaways are available to NIC MAP subscribers in the full report.

About the Report: The NIC MAP Seniors Housing Actual Rates Report provides aggregate national data from approximately 300,000 units within more than 2,500 properties across the U.S. operated by over 50 senior housing providers. The operators included in the current sample tend to be larger, professionally managed, and investment-grade operators as a requirement for participation is restricted to operators who manage 5 or more properties. Visit the NIC MAP website for more information.

###