Senior Housing: Where Demand Meets Opportunity: Proven Performance, Consistent Returns

Senior housing is a market primed for expansion and transformation. Driven by aging demographics and increased longevity, demand is accelerating faster than supply, offering large-scale investment potential. As of 1Q25, senior housing tops the NCREIF Property Index (NPI) in total returns and leads all major commercial real estate sectors in occupancy growth. 1

Senior housing has historically been a reliable performer, delivering compelling risk-adjusted investment returns, often with lower volatility than traditional property types. Its consistency and demographic tailwinds make it an attractive investment opportunity in today’s market.

Capital providers looking to invest in this dynamic sector, now is the time.

Why Expand into Senior Housing?

Rising Demand Equals Expanding Growth Opportunities

Senior housing occupancy growth is outperforming other major CRE sectors for the first time in nearly two decades, making it an attractive investment opportunity. 2

Diversify with Confidence: Long-Term Stability & Competitive Returns

Investors seeking long-term stability and reduced portfolio risk can diversify their portfolios with this asset class that is often insulated from traditional market fluctuations and offers relatively stable cash flows, sustained rent growth, competitive cap rates, and historically low volatility. 3

Familiar Fundamentals, An Opportunity to Make a Difference

While senior housing shares familiar traits with traditional CRE property types, it brings unique challenges: regulatory frameworks, operational intensity, and a deeply care-driven, community-focused model. Success in this sector goes beyond maximizing occupancy and NOI; it requires meeting the evolving needs of an aging population and delivering meaningful solutions to one of society’s most urgent demographic shifts.

HOW NIC HELPS YOU SUCCEED IN SENIOR HOUSING

Networking with Industry Leaders

Connect with the industry’s top players—including key lenders, equity investors, REITs, and service providers—at the premier senior housing and care conferences like the upcoming 2026 NIC Spring Conference.

Market Entry Insight, with the Community in Mind

Senior housing offers compelling returns – but comes with distinct complexities, including regulatory oversight, operational intensity, and distinct consumer needs. For capital providers, success hinges on understanding how senior housing differs from traditional CRE and aligning with the right operating partners to deliver a successful product. NIC provides the resources and connections so you can invest confidently.

Data-Driven Insights and Key Trends

Leverage NIC’s expert-driven resources on key capital investment trends, performance metrics, and senior housing fundamentals, to evaluate opportunities, reduce uncertainty, and guide strategic decisions with clarity.

Strengthen your business relationships, secure partnerships, and gain insights directly from experts driving the industry forward.

Data. Analytics. Connections

NIC is the premier networking, research, and education source for senior housing leaders. Success takes insight. Check out these NIC resources and take advantage of our networking and education opportunities to prepare for success in the industry.

NIC Events

Join industry leaders and network with future partners at upcoming NIC events, the premier senior housing conferences.

Join our upcoming conference now.

NIC Academy

NIC Academy is your resource for SH education and the industry’s only professional certification program.

Earn your certification.

NIC Insider Newsletter

Access the latest SH news, research, and trends to improve your awareness and deepen your sector knowledge.

Subscribe to NIC’s Insider.Access exclusive NIC resources to familiarize yourself with the industry:

NIC Investment Guide, 7th Ed.

Order your copy today and position yourself at the forefront of this dynamic sector.

Read more

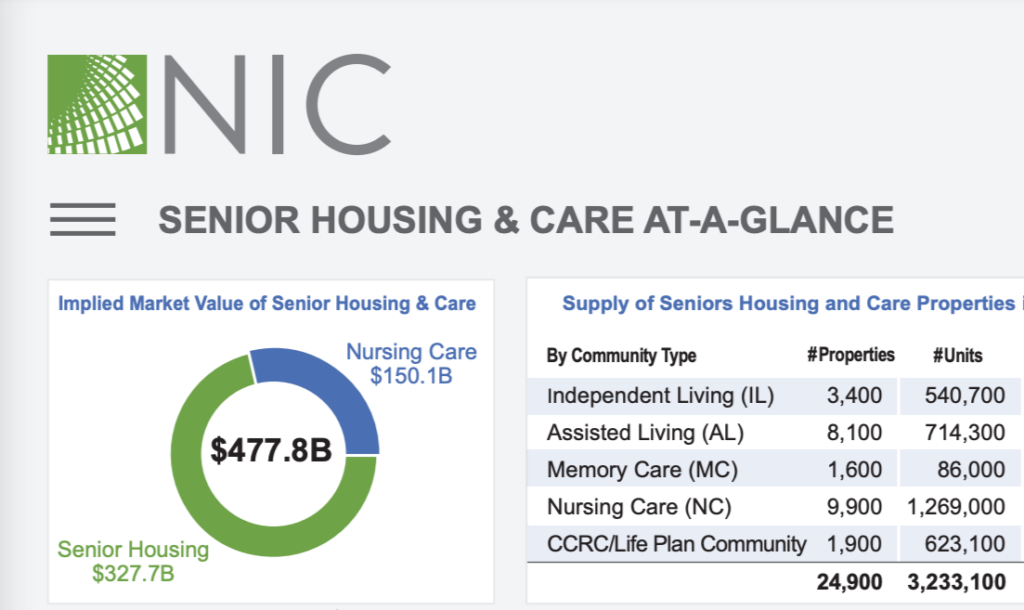

Senior Housing & Care At-A-Glance

A snapshot on the senior housing and care sector with summary data on market value, supply, returns, ownership types, and more.

Read more

2025 Growth Outlook

Demographic tailwinds and improving performance drive strong outlook for 2025.

Read more

From Recovery to Sustainable Growth

Occupancy rates approaching 90% signal a powerful opportunity for growth in senior housing.

Read more

Credit & Investment Outlook Webinar

October 15, 2025 — Replay the latest NIC webinar on senior housing investment trends.

Watch replay

NIC Lending Trends Report

Rising loan volumes, falling delinquencies: cautious optimism in senior housing lending.

Read more

Why Invest in Senior Housing

Senior housing occupancy growth is outperforming other major CRE sectors for the first time in nearly two decades, making it an attractive investment opportunity.

Read moreGet the Latest NIC Capital Market Insights

Be the first to hear about NIC’s research, events, and tools designed for capital providers in senior housing and care.

Footnotes

- NIC, Senior Housing Posts Highest NCREIF Property Type Return in First Quarter 2025, May 2, 2025. Available here. ↩

- NIC, Projections Hold: Senior Housing Occupancy on Track, Leading CRE in Occupancy Growth, May 22, 2025. Available here. ↩

- National Investment Center for Seniors Housing & Care (NIC), Senior Housing 2024 Total Return of 3.6% Outperforms Broader NCREIF Property Index by 3.1 Percentage Points, January 17, 2025. View article here. ↩

- NIC, Looking Into the Future: How Much Seniors Housing Will Be Needed, 2023. View white paper here. ↩