In this article, NIC Analytics revisits senior housing unit mix (the proportion of studios, one-bedroom, two-bedroom units, and increasingly, even three-bedroom or larger units), and occupancy trends across independent living (IL) and assisted living (AL) properties using data from the second quarter of 2025. The analysis offers a current snapshot of how unit sizes are distributed, how they are performing, what has changed over the last decade, and what is taking place with new senior housing developments coming on the market today.

Key Takeaways:

- While unit mix has not changed much across the last decade, rising occupancy in larger units, especially in assisted living, signals a shift in preferences among segments of the demand base.

- Developers are responding to these changing preferences, with more two- and three- bedroom units entering the pipeline.

- A successful unit mix balances care needs with new lifestyle expectations and shared living potential.

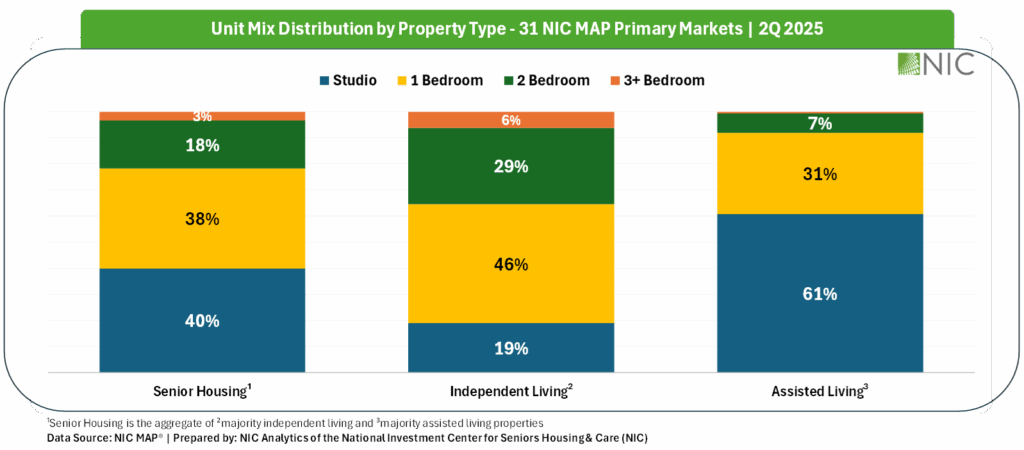

Current Unit Mix: Studios Still Dominate Assisted Living, But Independent Living Sees Size Diversity

Across all senior housing properties (IL + AL combined), studios make up the largest share of the unit mix at 40%, followed closely by one-bedroom units at 38%, and two-bedroom units at 18%, then a small share – just 3% – consists of three-bedroom or larger options.

However, when broken down by property type, important distinctions emerge: Independent living properties skew toward larger units (one- and two-bedrooms) while assisted living properties are heavily weighted toward smaller units (studios).

These differences may reflect the functional and financial needs of residents. Independent living residents often prioritize space, privacy, and lifestyle, while assisted living residents may prioritize affordability and accessibility, especially as care needs increase. Additionally, more couples generally reside in independent living than in assisted living, which generally translates into larger units.

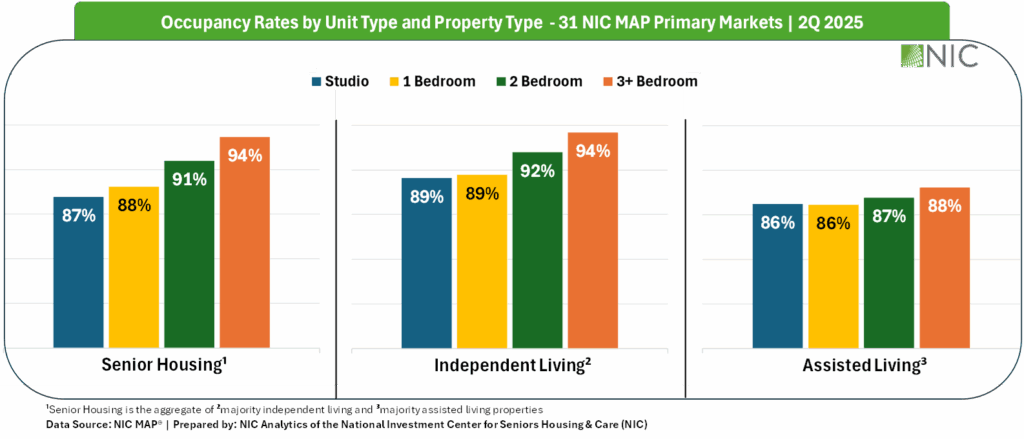

Occupancy by Unit Type: Bigger Units, Higher Occupancy?

Occupancy patterns as of the second quarter of 2025 offer further insights. Larger units are performing better across both property types. While assisted living still maintains relatively high occupancy for studio units, there is now a clear pattern between unit size and occupancy across the board, particularly in independent living. This suggests increasing resident preference for more spacious accommodations, even among residents requiring assistance.

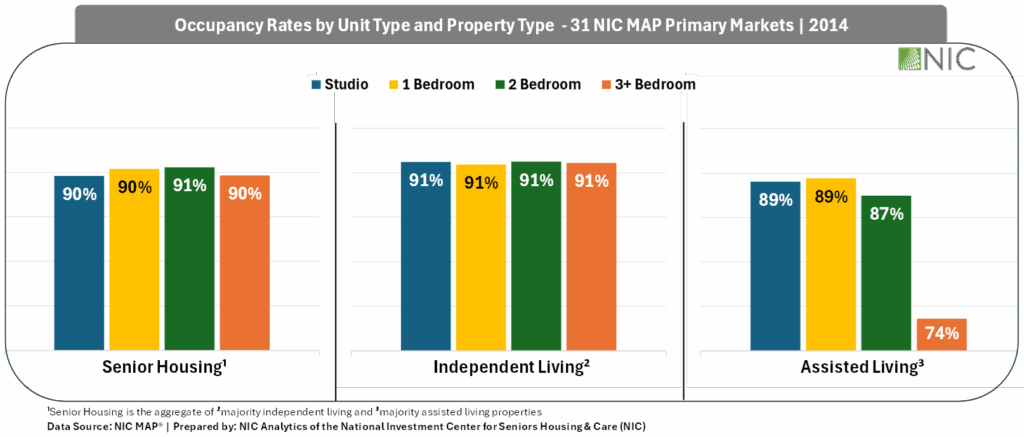

A Look Back: Stability in Mix, But Shifts in Preference

Interestingly, the unit mix distribution has not changed dramatically over the past decade. Studios continued to dominate assisted living, and independent living remained the more diverse offering in terms of size. But what has changed is resident demand for larger units.

A decade ago, occupancy was relatively flat across unit types. The notable exception was 3+ bedroom assisted living units, which hovered in the mid-70% range, suggesting they were mismatched with the needs or preferences of residents at the time. In 2025, however, occupancy for those units is closer to 88%, hinting that preferences in independent living may be bleeding into assisted living as residents transition through the continuum of care.

This trend may reflect a generational shift in expectations, or perhaps a cohort of residents entering assisted living with greater financial means or stronger lifestyle preferences for space, privacy, and comfort.

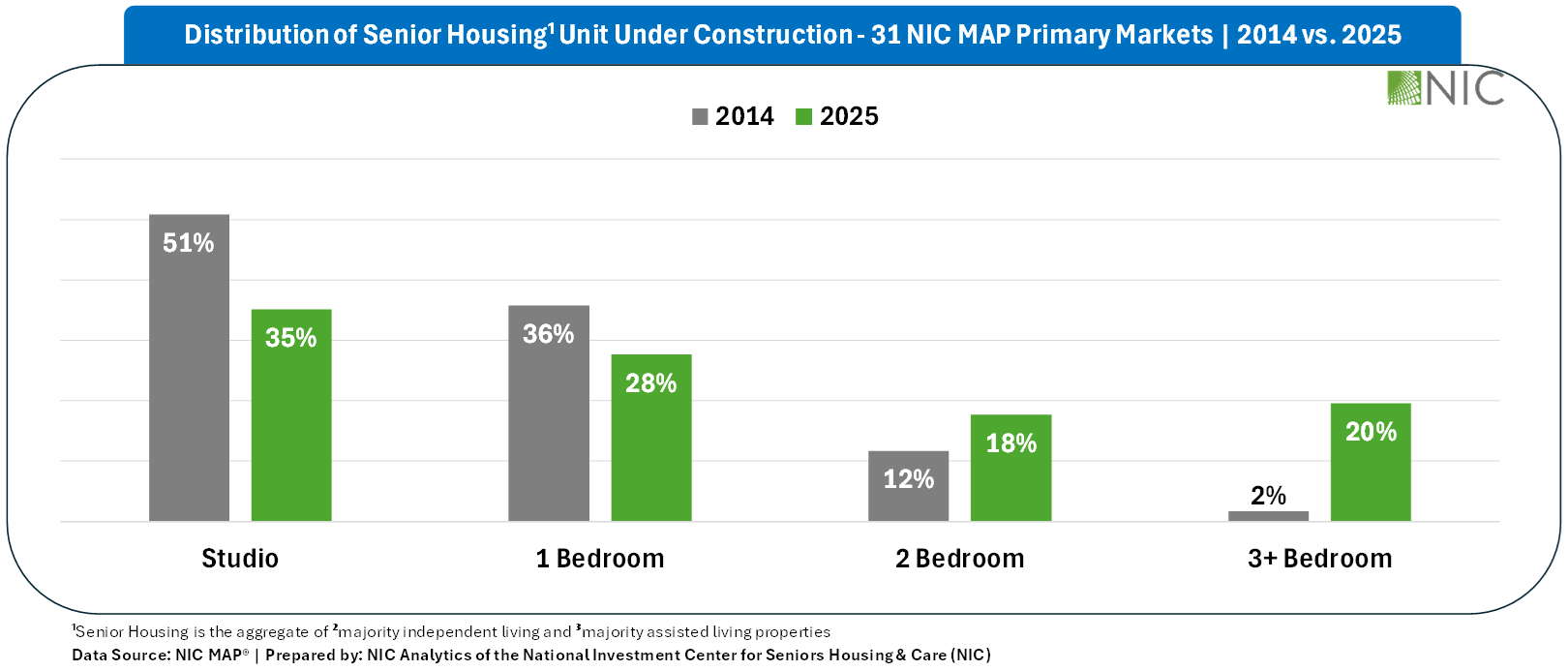

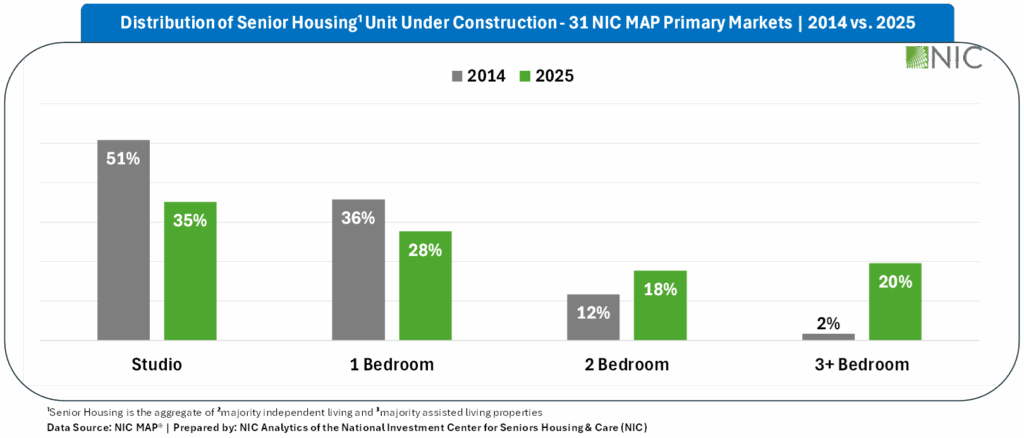

Senior Housing Development Trends Confirm the Shift

The changing preferences in unit mix are not just showing up in occupancy, they are also reflected in what is being built. A decade ago, studios made up over half (51%) of all senior housing units under construction. In 2025, that share has dropped to 35%, while construction of larger units has materially increased. Notably, two-bedroom or larger units, once just 14% of new development, now account for 38% of new units coming onto the market. This shift suggests that developers are responding to the changing preferences among segments of the demand base.

In conclusion, market factors such as location, demographics, and income profiles all influence unit mix decisions, along with the vision of the owner or operator. While studios remain essential, particularly in assisted living, where affordability and accessibility are key, larger units are increasingly demonstrating stronger occupancy performance and emerging as a high-performing niche.

Looking ahead, larger units may gain further traction among middle-income residents seeking shared living arrangements that lower costs while enhancing efficiency and social connection. Conversely, there may be opportunities to market the less desirable studios to a middle-income senior through strategic market positioning. As the aging population continues to transform, the most successful properties will be those that align care needs with lifestyle aspirations, designing unit mixes that reflect not only acuity, but also the changing values and expectations of the next generation of residents.

Note this analysis only includes properties reporting the unit mixes within the senior housing properties. This means that properties with unknown unit mixes were excluded from the analysis.