Mark Twain famously said that history doesn’t repeat itself, but it often rhymes. That framing feels especially relevant for senior housing today.

For years, the industry debated demand: Is it here yet? Is it strong enough? Is it sustainable? The current demographic momentum has tempered that debate. Senior housing is no longer defined by questions of demand; it is now constrained by the availability of supply. And that shift changes everything.

An Interesting Pattern Beneath the Surface

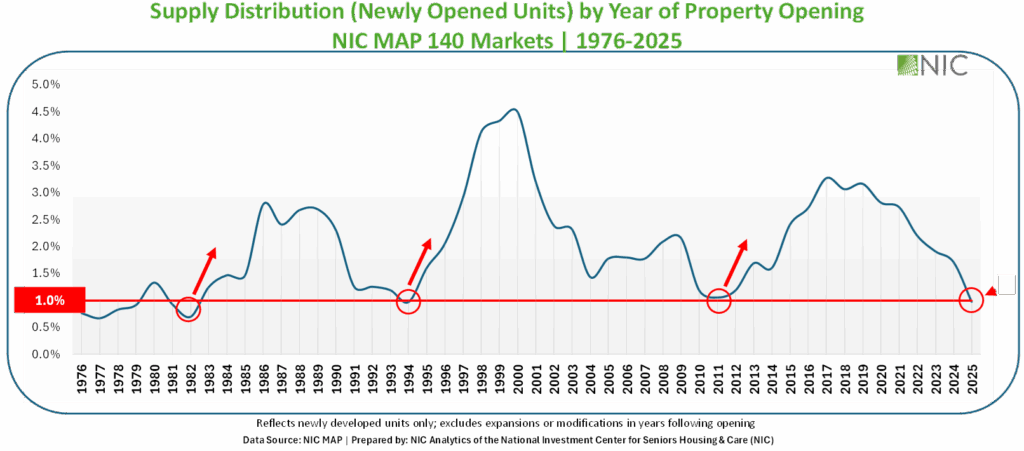

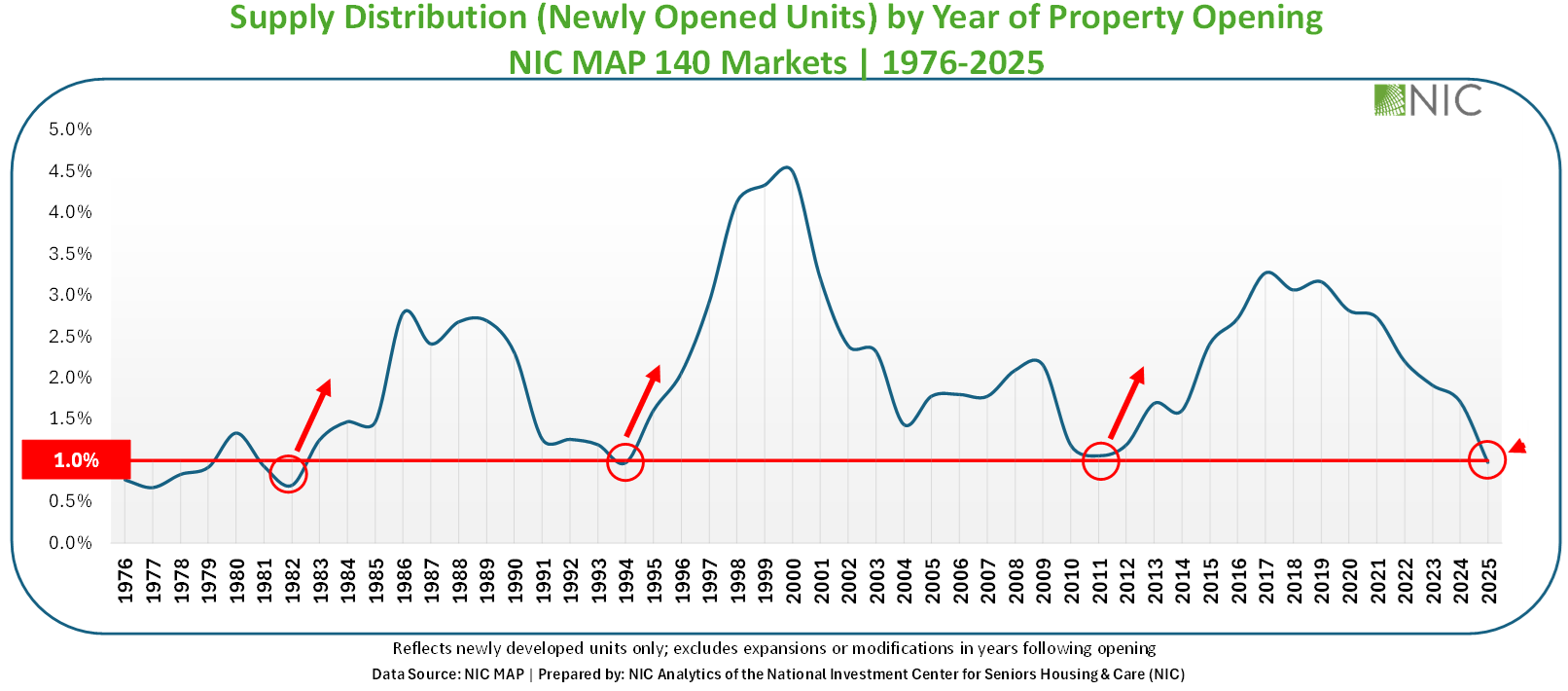

The chart below shows historic senior housing supply cycles over multiple decades. What stands out is not volatility, it’s consistency.

Each time new supply activity re-accelerated, it followed the same signal: new inventory dipped to roughly 1% of total stock. That was true in the early 1980s, the 1990s, and again around 2011.

In each case, development activity did not peak immediately. Instead, supply continued to build for five to six years before reaching cycle highs.

Today, senior housing finds itself once again at that same one-percent threshold (support level). This suggests we are in the early innings of the next supply cycle. But unlike prior cycles, the context has fundamentally changed.

Why the Next Cycle Will Be Different

In short, the next cycle will not be about getting ahead of demand. It will be about trying to catch up to it. But that catch-up will not happen quickly. Senior housing units under construction have been declining for several years, falling from about 50,000 units in 2019 to roughly 16,200 units in 2025. (For context, at the start of the last supply cycle in 2011, units under construction were below 13,000, lower than today’s level.) As a result, the next supply cycle will likely build more slowly, peak further out, and last longer than previous cycles.

Additionally, one of the most underappreciated challenges in senior housing development today is not just capital, it is time. This is not a snap-back environment, it is a long-duration build environment.

The average senior housing construction cycle has stretched to approximately 29 months. That means any project breaking ground today is unlikely to open before 2027 or 2028. Most importantly, every development decision today determines market position two to three years from now. This changes how development risks are evaluated; a 29-month cycle means market assumptions must hold longer and cost overruns compound faster.

Furthermore, new development today is constrained by three costs that can’t be engineered away: labor, materials, and money. Labor shortages, higher material costs, and higher interest rates are tightening project math. Some developers are not short on ideas; they are short on margin. That is why construction efficiency and design innovation are starting to matter as much as financing.

When is the Next One? Will History at Least Rhyme?

Looking ahead, supply growth is likely to remain low to moderate through 2026. If history does rhyme, the answer is not ‘now,’ but it is not far off either. The signals point to an upcoming cycle formation.

What is different this time is where development will restart. Most markets today are not even in the construction race. New development will begin in a much narrower set of markets, specifically where demand is strong and the development math pencils out. In other words, the old mantra of “location, location, location” is evolving into “location, economics, and execution.”

Development risk has been repriced upward. In many cases, return profiles no longer fully compensate for the risk, particularly when you factor in construction costs, lease-up timelines, and capital structure uncertainty.

That said, senior housing construction lending conditions have improved modestly. It is no longer an automatic ‘no.’ Lenders are backing proven sponsors, markets with clear demand visibility, and projects supported by pre-leasing and partnerships. Capital has become more selective and more disciplined.

Stepping back, capital engagement in senior housing continues to deepen ahead of the next supply cycle. Rising deal counts alongside rising pricing is typically a signal of healthier market confidence, not distressed selling. However, that capital is flowing primarily into existing assets, not new development. Historically, this is consistent with an early-cycle environment, where capital prioritizes stabilized assets before development activity returns.

For senior housing stakeholders, this is a moment to be forward-looking, to underwrite future demand growth, long-term pricing power, and to price the story early. Ultimately, development decisions today are about confidence in tomorrow’s growth.

And importantly, unlike the last supply cycle, which ran into oversupply in select markets, the next cycle will arrive in an environment of robust and accelerating demand, but it will not be broad-based, it will favor the right markets and the right projects.