The NIC Analytics team presented findings during a webinar with NIC MAP Vision clients on January 18, to review key senior housing data trends during the fourth quarter of 2023.

NIC Analytics, along with the NIC MAP Vision team, implemented a new quarterly webinar format in which the second half features a deep dive on a special topic. In January’s webinar, Larry Graeve from Weitz Construction and Omar Zar, NIC Senior Principal in Research and Analytics, delved into senior housing construction trends. Their presentations were followed by a lively moderated discussion with Lisa McCracken, NIC’s Head of Research & Analytics. NIC hopes NIC MAP Vision clients enjoyed this new webinar format and welcome any comments or suggestions.

Key takeaways from the fourth quarter data included the following:

Takeaway #1: Primary Market Fundamentals on Track for Occupancy Recovery in Second Half of 2024

- The occupancy rate for the 31 NIC MAP Primary Markets rose 0.8 percentage points to 85.1% in the fourth quarter. This marked the tenth consecutive quarter of occupancy gains.

- Occupancy is 7.3 percentage points above its pandemic-related low of 77.8% recorded in mid-2021 and only 1.9 percentage points below its pre-pandemic level of 87.1% in the first quarter of 2020.

- Robust demand coupled with moderate levels of new supply has driven occupancy gains, and at this current pace, senior housing occupancy rates are on track to recover to pre-pandemic levels in the second half of 2024.

Takeaway #2: Secondary Markets’ Occupancy Rate Has Recovered to Pre-pandemic Levels

- For the 68 NIC MAP Secondary Markets, the occupancy rate in 2023 increased by 2.2 percentage points during the fourth quarter to 87.0%, which is 0.2 percentage points more than its pre-pandemic level.

- When breaking out occupancy by property type, the more needs-driven majority assisted living properties have led this recovery, with occupancy 1.2 percentage points above its pre-pandemic level, while the more choice-based majority independent living properties have only 0.9 percentage points left to recover.

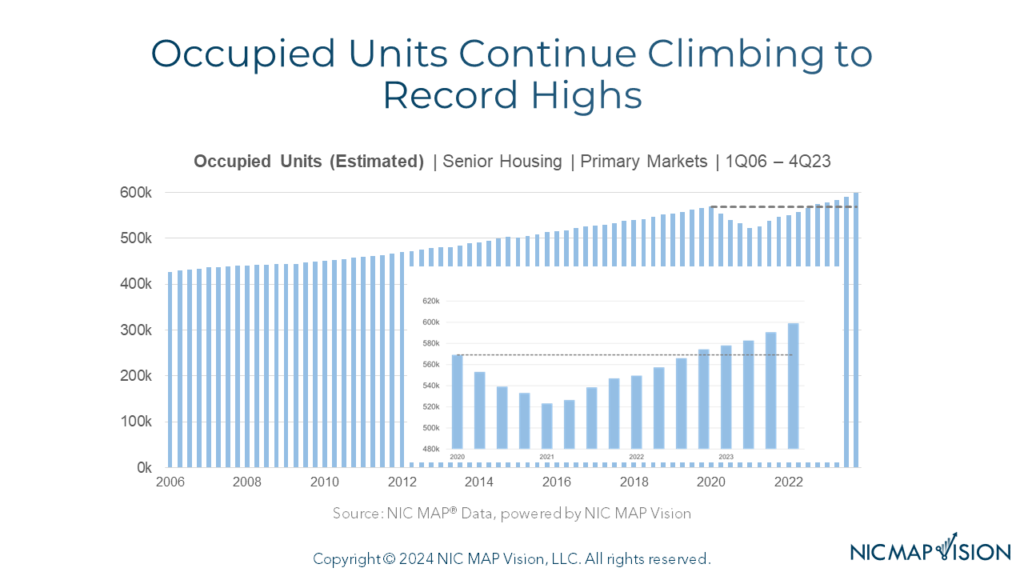

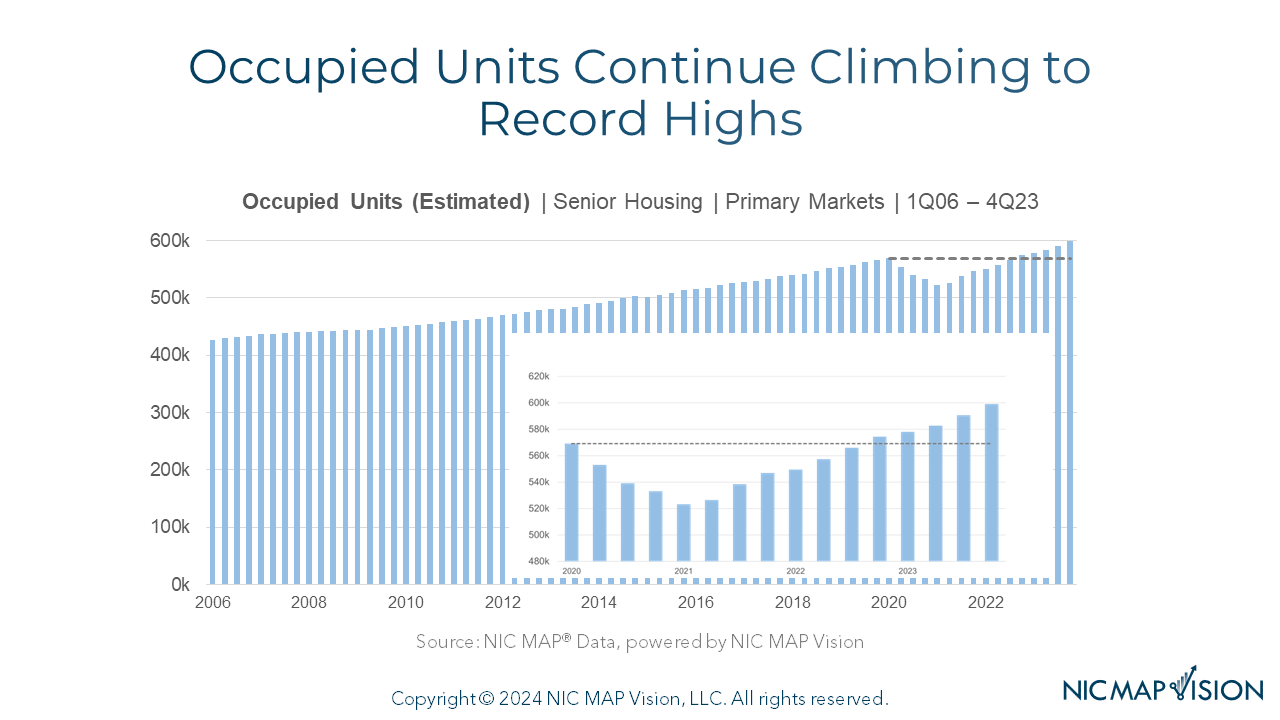

Takeaway #3: Occupied Units Continue Climbing to Record Highs

- The total number of occupied senior housing units for the 31 Primary Markets set another high in the fourth quarter, rising to 598,995 units. This was 29,905 units higher than the pre-pandemic first quarter of 2020 level.

- This trend of record high occupied units is similar for the 68 Secondary Markets as well and shows that today more older adults than even before are residents in senior housing properties, which speaks to the tremendous need for housing and care.

Takeaway #4: Inventory Growth Remains Relatively Moderate

- Inventory growth for the 31 Primary Markets totaled 9,552 units in 2023, down from 11,078 units in 2022.

- Overall, inventory growth has generally trended down from its high point of 21,314 units in 2018 as supply chain issues, labor shortages, and less favorable financing conditions have weighed on new supply.

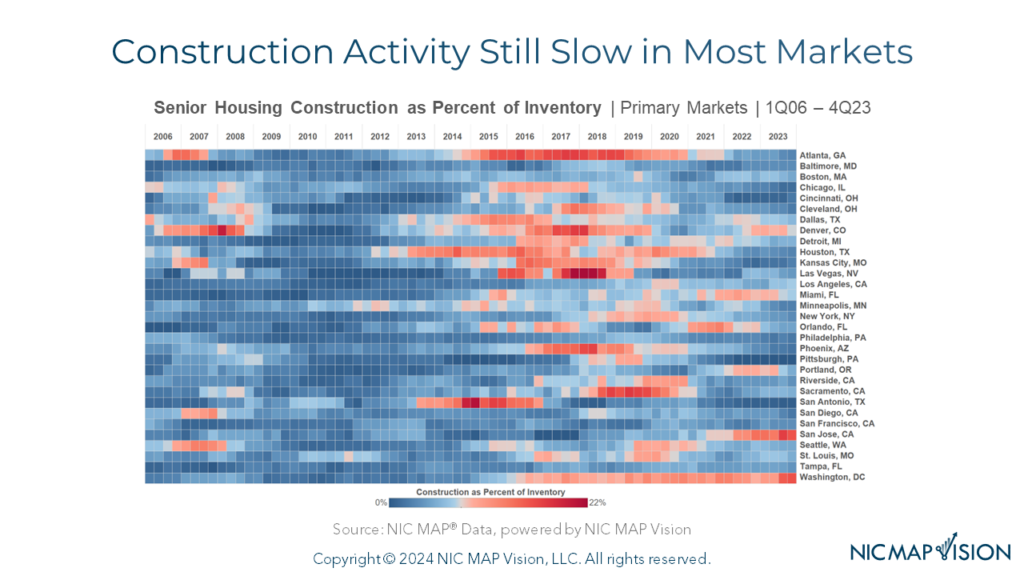

Takeaway #5: Construction Activity Still Slow in Most Markets

- By metropolitan market, this heat map below shows which Primary Markets are experiencing the most construction activity, with blue tones indicating that construction activity is relatively “cool” and red tones indicating markets with the most construction activity.

- Washington, DC and San Jose have the most construction underway each totaling 16% of existing inventory, followed by Denver at 8% and Los Angeles and Miami, which were each at 7%.

The 2024 capital markets outlook is that much remains the same. Credit is scarce and the capital markets remain unpredictable. Whether the Fed will cut rates in four months, six months, or even nine months, many investors believe that defense is the best offense. The preceding ten years created a fascinating environment with cap rate compression to historic lows and a substantial amount of newly issued debt. Today, the industry is entering a period of transition where cap rates are starting to progress upward, and historic levels of debt are being repriced in a higher cost of capital environment.

The 2024 capital markets outlook is that much remains the same. Credit is scarce and the capital markets remain unpredictable. Whether the Fed will cut rates in four months, six months, or even nine months, many investors believe that defense is the best offense. The preceding ten years created a fascinating environment with cap rate compression to historic lows and a substantial amount of newly issued debt. Today, the industry is entering a period of transition where cap rates are starting to progress upward, and historic levels of debt are being repriced in a higher cost of capital environment. Longo: One of the great things about planning the NIC Spring Conference is bringing together industry leaders with a wealth of experience to harvest their insights. Conference sessions are curated to build on these insights and bring together experienced speakers who will discuss how to leverage insights to create value. This year’s key insights revolve around leveraging technology, pursuing healthcare partnerships, and enhancing enterprise value through ancillary services.

Longo: One of the great things about planning the NIC Spring Conference is bringing together industry leaders with a wealth of experience to harvest their insights. Conference sessions are curated to build on these insights and bring together experienced speakers who will discuss how to leverage insights to create value. This year’s key insights revolve around leveraging technology, pursuing healthcare partnerships, and enhancing enterprise value through ancillary services. Blumenthal: The Spring Conference in March comes at the juncture of results coming out from many of the NIC research initiatives and an inflection point in the capital markets. The sessions the planning committee has developed leverage these results to identify solutions to the challenges of margin erosion, a changing consumer base, and the middle market. The key insights attendees will take from the conference will allow them to proactively position their businesses to improve and thrive.

Blumenthal: The Spring Conference in March comes at the juncture of results coming out from many of the NIC research initiatives and an inflection point in the capital markets. The sessions the planning committee has developed leverage these results to identify solutions to the challenges of margin erosion, a changing consumer base, and the middle market. The key insights attendees will take from the conference will allow them to proactively position their businesses to improve and thrive.