The NIC Analytics team presented findings during a webinar with NIC MAP clients on October 9th, sharing key senior housing data trends during the third quarter of 2025. Additionally, Tom Grape, Founder, Chairman & CEO at Benchmark Senior Living and Andy Kohlberg, President & CEO at Kisco Senior Living joined Lisa McCracken, Head of Research & Analytics at NIC, for a CEO panel discussion on recent trends.

Key takeaways included the following:

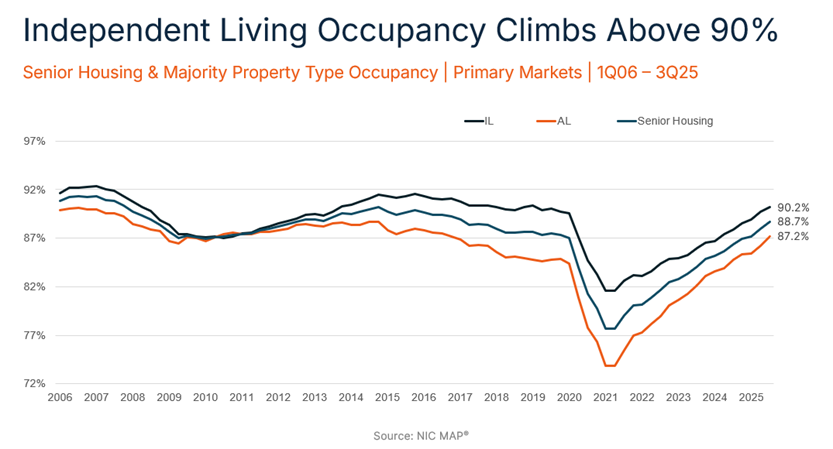

Takeaway #1: Independent Living Occupancy Rate Climbs Above 90%

- The occupancy rate for independent living (IL) communities surpassed 90% in the third quarter, increasing 0.5 percentage points to 90.2%.

- For assisted living (AL) communities, the occupancy rate jumped nearly a full percentage point to 87.2%.

- These strong trends in both property types illustrate the choice-driven demand from the younger or healthier older adults moving into IL, as well as the need-driven demand from those seeking AL services and care.

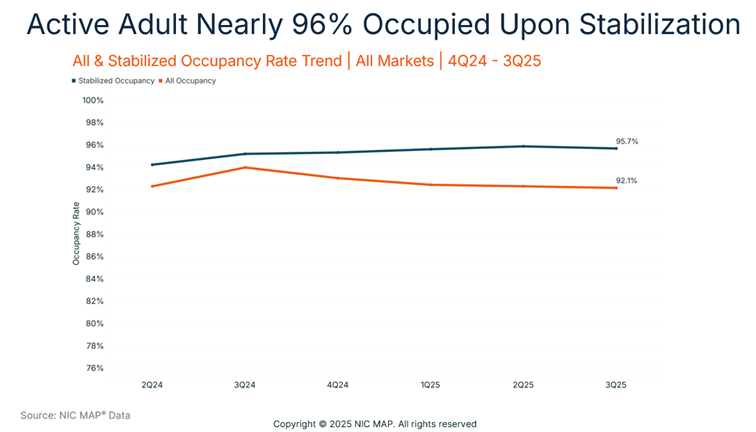

Takeaway #2: Active Adult Nearly 96% Occupied Upon Stabilization

- The active adult occupancy rate stood at 92.1% in the third quarter, edging down 0.2 percentage points from the prior quarter, but still well above 90% occupied.

- The active adult occupancy rate includes all properties, including those still in lease-up. As a result, the dip may be driven from new units arriving online that are still being absorbed.

- Overall, occupancy rates have ranged from 92% to 94% over the past six quarters since NIC MAP began tracking this data.

- For active adult communities open at least two years, occupancy rates are near 96%.

Takeaway #3: Inventory Growth Setting New Record Lows

- The cost of capital, materials, and labor, among other headwinds, continue to limit inventory growth.

- Fewer than 1,400 new units were opened in the third quarter, and inventory growth remained well below 1% for the second consecutive quarter, with only 0.7% inventory growth from a year earlier.

- This muted new supply is setting new record lows since NIC MAP began tracking this data in 2007.

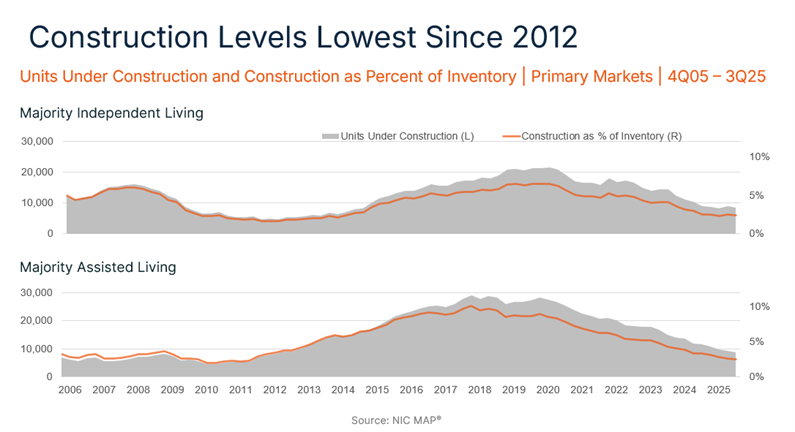

Takeaway #4: Construction Levels Lowest Since 2012

- For both IL and AL properties, the number of units under construction continued to decline, falling to only 17,000 units combined in the third quarter, levels last seen in early 2012.

Takeaway #5: Negative Inventory Growth in 26% of Primary Markets

- Eight of the 31 Primary Markets have less senior housing units today in their markets than they did three years ago.

- This decline in senior housing inventory is due to property closures, or to units being converted to other uses, without enough new communities or new units being opened to replace them.

- San Antonio has nearly 4% less inventory today compared to three years ago, followed by Pittsburgh at nearly 3% less; Riverside at 2% less; and Tampa and San Diego at 1% less.

- Houston, Baltimore, and Los Angeles round out the eight metro areas with shrinking senior housing inventory.