NIC Analytics released the NIC Lending Trends Report for the second half (2H) of 2024. This complimentary report includes data trends over eight years for senior housing and nursing care construction loans, mini-perm/bridge loans, permanent loans, and delinquencies from third quarter 2016 through fourth quarter 2024. The report is based on survey contributions from 18 participating lenders.

During 2H 2024, the Federal Reserve initiated a long-anticipated pivot in monetary policy with a series of interest rate cuts aimed at easing financial conditions amid moderating inflation and slowing economic momentum. Beginning in September, the Fed implemented three consecutive cuts, one each in September, November, and December, bringing the federal funds rate down to a target range of 4.25% to 4.50% by year-end.

Survey Comments from the Field:

NIC’s lending survey gathers both data for inclusion in the Lending Trends report and commentary on what is driving those trends. A summary of that commentary is provided below.

As noted by contributors, credit standards largely held steady in 2H 2024, with most lenders maintaining their approach from earlier in the year, while a few reported loosening requirements. Several noted increased competition, thinner spreads, and a greater appetite for growing loan balances, especially from banks.

While many lenders continued focusing on existing relationships, there was also evidence of renewed deal flow and selective onboarding of new clients, particularly for senior housing stabilized assets. Improved operating performance and rising occupancy rates supported lending confidence, although debt-service constraints remained a limiting factor amid persistent staffing challenges and cost pressures. Overall, the fall 2024 interest rate cuts helped restore cautious optimism and contributed to a more constructive lending environment heading into year-end.2024

New Permanent Loan Volume Closed Maintained Momentum Built Earlier in the Year

New permanent loan volumes remained relatively strong in 2H 2024, sustaining the momentum begun earlier in the year. For senior housing, volumes reached more than $2.8 billion in the second half of the year, keeping overall activity in the year 2024 well above any level observed since 2020.

Nursing care lending also outperformed recent years, with volumes reaching nearly $2.8 billion in 2H 2024 ($1.46 billion in Q3 and $1.31 billion in Q4), notably above historical norms. While borrowing costs remained elevated for much of the year, the Federal Reserve’s late-year rate cuts provided some relief, helping to support continued deal flow. This suggests a more stable lending environment, driven by improving property fundamentals, increased lender confidence, and a stronger appetite for long-term investments heading into 2025.

New Mini-Perm/Bridge Loan Activity Remained Cautious, With Signs of Improvement in Nursing Care

Bridge and mini-perm loan activity remained relatively low for senior housing in 2H 2024, with volumes still well below historical norms. After reaching $290 million in the third quarter, senior housing bridge loan volume fell to $200 million in the fourth quarter, highlighting the sector’s ongoing caution around short-term financing.

In contrast, nursing care saw a notable shift, with fourth quarter bridge and mini-perm loan volume surging to $619 million, marking a notable increase in the time series. This surge reflects renewed lender interest in select skilled nursing opportunities, buoyed by improved Medicaid rates and continued operational stabilization.

While borrowing costs remained elevated for much of the year, the Fed’s late-2024 rate cuts began to ease pressure, helping unlock more lending activity. Even so, short-term lending remained concentrated among stronger credits, with lenders favoring sponsors with demonstrated performance and lower risk profiles.

Construction Lending Still Soft/Subdued Despite Isolated Upticks

Construction loan activity remained subdued in the 2H 2024, with senior housing volumes continuing to trend below historical norms. After a brief uptick in the third quarter, volumes dropped once again in the fourth quarter, showing persistent lender caution toward new development. The number of senior housing units under construction remained near decade-low levels, reflecting ongoing hesitancy driven by cost pressures and overall economic uncertainty.

In nursing care, construction lending showed its first sign of life in over seven quarters, with a modest $38 million in volume recorded in the fourth quarter. While activity remained very limited, even this small uptick signals a marginal thaw in what has long been a stagnant development pipeline, although it remains consistent with pre-2020 levels where new construction was historically minimal. Despite recent interest rate cuts, lenders and developers appeared to be taking a conservative stance in 2H 2024, with most new capital directed toward existing assets rather than ground-up projects.

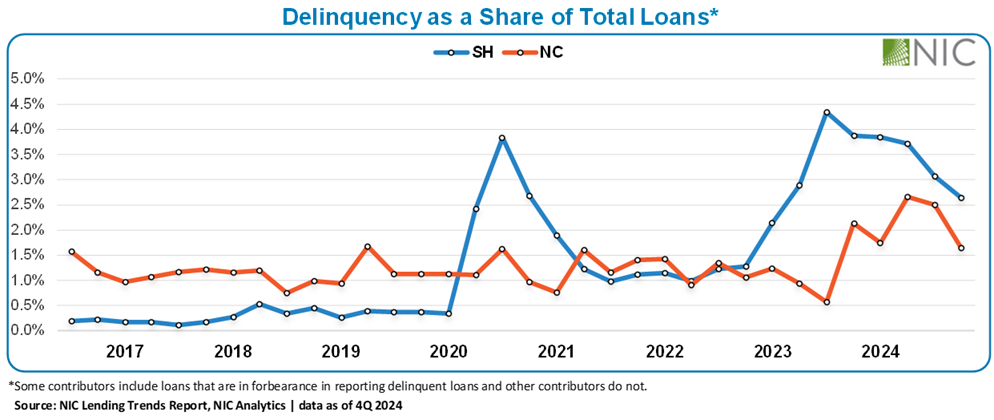

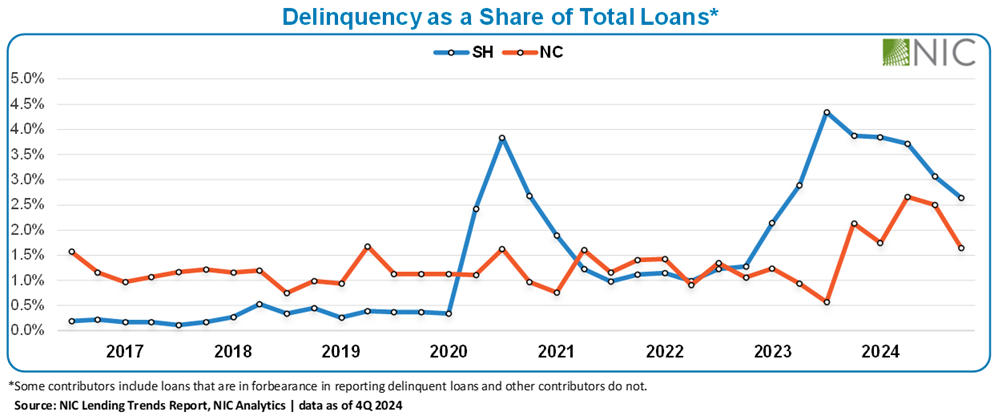

Senior Housing Delinquencies Eased Further as Nursing Care Shows Signs of Peaking

Delinquency rates for senior housing continued their downward trajectory in 2H 2024, marking five consecutive quarters of improvement since peaking in the third quarter of 2023. By year-end, delinquencies had fallen to 2.6% of total loans, well below earlier levels. (Note: loans in forbearance are included in the delinquent loan data for some debt providers, slightly influencing these figures.)

In contrast, nursing care delinquency rates remained relatively elevated through much of the year but showed a meaningful decline in the fourth quarter (1.6%), suggesting they may have peaked in the second quarter (2.7%). Despite this late improvement, the nursing care sector still faces notable financial strain, underscored by $98 million in reported foreclosures in 2H 2024 compared to $26 million for senior housing.

Download the complimentary 2H 2024 NIC Lending Trends Report for full details on these and other trends in senior housing and skilled nursing lending.

Note: This data is not to be interpreted as a census of all senior housing and skilled nursing lending activity in the U.S. but rather reflect lending activity from participants included in the survey sample only.

The NIC Lending Trends Report for the first half of 2025 is scheduled for release in December.

Interested in participating? The NIC Lending Trends Report helps NIC Analytics deliver on NIC’s mission to enable access and choice by further enhancing transparency of capital market trends in the senior housing and care sectors. We very much appreciate our data contributors. This report would not be possible without them.

If you would like to participate and contribute your data to future lending trends surveys, please contact us at analytics@nic.org. As a courtesy for providing data, data contributors receive this report before publication on the website. The information provided as part of the survey will be kept strictly confidential. Individual answers will be combined with all other responses. Data acquired from this survey will only be reported in the aggregate, and therefore, the resulting aggregated data will not be attributed to you or your company upon distribution.