Occupancy Rate for Senior Living Communities Increased in 2025 as Construction Stalled

18 consecutive quarters of rising occupancy bolsters sector performance as lag in construction grows, adding to consumer supply pressures

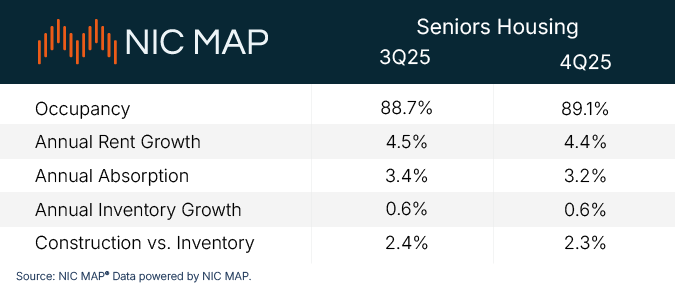

ANNAPOLIS, Md. (January 15, 2026) – Strong demand for senior housing amidst limited new inventory is boosting occupancy rates and underscoring the need for sustained investment in new development, according to the National Investment Center for Seniors Housing & Care (NIC) using newly released data from NIC MAP. Senior housing occupancy grew 2.2 percentage points for the year, ending 2025 at 89.1%, an increase of 0.4 percentage points from 3Q25 (88.7%). This is the 18th consecutive quarter of occupancy rate increases.

NIC analysts say the combination of high demand and limited construction drove occupancy across all senior living property types in the fourth quarter. Independent living occupancy was above 90% and assisted living occupancy was 87.7%.

Active Adult occupancy reached nearly 92% in the fourth quarter. These communities cater to mostly healthy adults age 55+ who want to live in a community designed for active lifestyles and interaction with peers and who do not yet need or want on-site healthcare services.

Occupied senior housing units increased from roughly 630,000 in the third quarter of 2025 to nearly 635,000 in the fourth quarter. Overall, the number of occupied units in the 31 Primary Markets tracked by NIC MAP increased by nearly 20,000 in 2025, a more than 3% gain compared to 2024. Growth in inventory was below 1% in 4Q25 for the third consecutive quarter, and fewer than 1,900 new units opened in the fourth quarter.

“With the first Baby Boomers turning 80 in 2026, we anticipate that the demand for housing and services will continue to grow. The rising occupancies and low inventory growth is going to lead to some real-life challenges for older adults and their families in certain markets,” said Lisa McCracken, NIC’s head of research and analytics. “The reality is, if there are limited options available, others may step in to provide alternatives if the senior housing supply is constrained.”

Experts say middle-income older adults—people who do not qualify for subsidized housing and related services but lack the resources to fully pay for senior housing themselves—are especially affected by the current supply-and-demand dynamics. Given the rising operating and development costs, most new communities are serving higher-income residents, underscoring the growing need for viable middle-market solutions, according to NIC experts.

NIC MAP tracks occupancy rates in 31 primary markets across the country, and seven markets had occupancy rates above 90% in the fourth quarter, compared to five in the previous quarter. Three markets are nearly fully occupied, with rates above 90%: Boston (93.1%), San Francisco (91.9%), and Baltimore (91.9%). Only five markets had occupancy rates below 87%, with the lowest being Miami (85.4%), Atlanta (85.5%), and San Jose (86.1%).

“A 200 basis point gain in one calendar year is a solid rate of growth that shows no signs of slowing,” said Arick Morton, CEO of NIC MAP. “Absent new supply entering the market, it’s likely that many markets will begin to register all-time highs in the near and medium-term.”

A summary of the NIC MAP Market Fundamentals Data, by NIC MAP, is below. An abridged report featuring the newly released data will be available at 4:30 p.m. ET on Thursday, January 15. While the report is a complimentary resource, only NIC MAP clients have exclusive access to the underlying data and additional metrics at the metro level.

About the National Investment Center for Seniors Housing & Care

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. For more information, visit NIC’s website and follow NIC on LinkedIn, Facebook, and Instagram.

About NIC MAP

NIC MAP believes data drives outcomes. We provide purpose-built data exclusively for senior housing, offering relevant, market-specific insights you won’t find anywhere else, and we’re empowering the senior housing industry to stay nimble and achieve optimal results. Our platform supports robust decision-making with real-time access to occupancy rates, transaction details, and construction project tracking, enabling industry leaders — including the top senior housing operators, largest government agencies and major investors — to navigate market complexities and capitalize on investment opportunities effectively. For more information, visit www.nicmap.com.