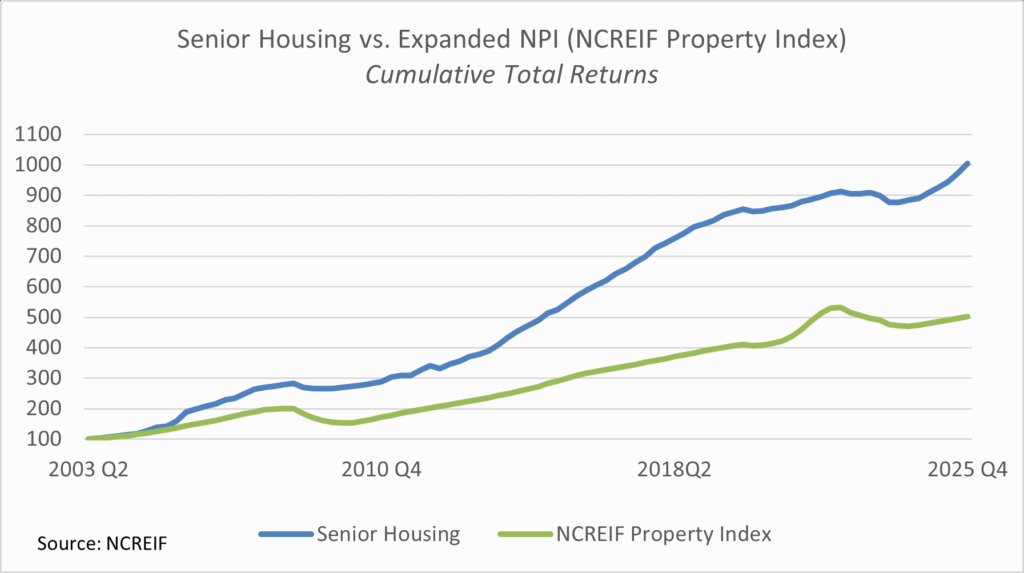

2025 represented a year of accelerating transaction activity in the senior housing market as participants looked to capitalize on the unprecedented supply/demand fundamentals within the industry. Momentum gathered throughout the year, with activity notably picking up in the second half of the year. The activity represented both smaller, as well as large transactions.

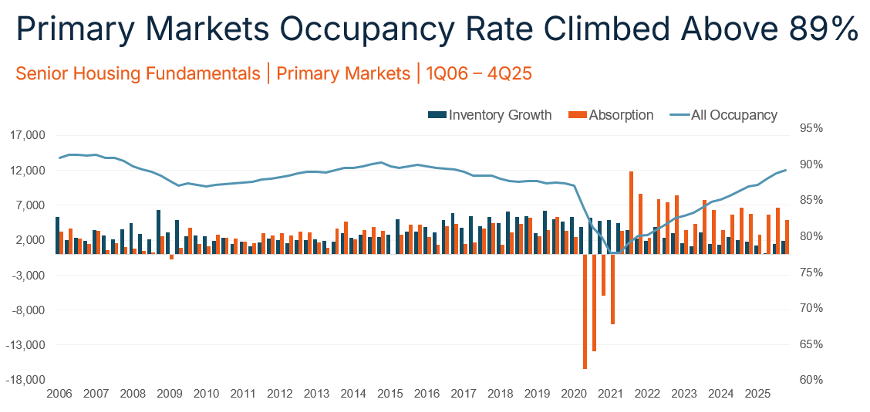

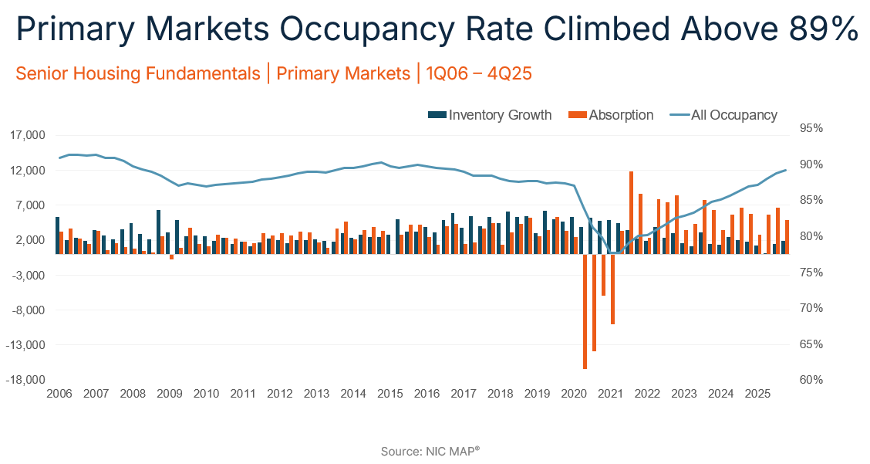

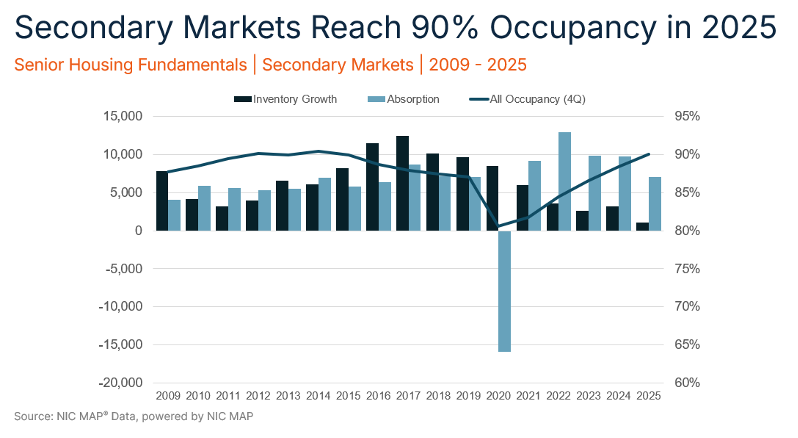

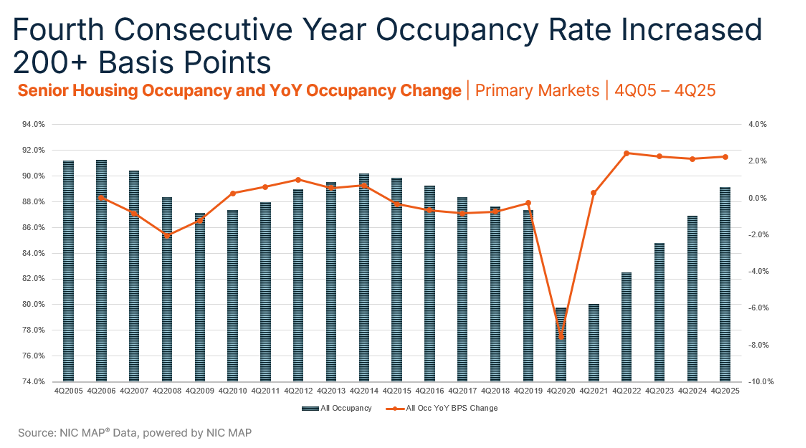

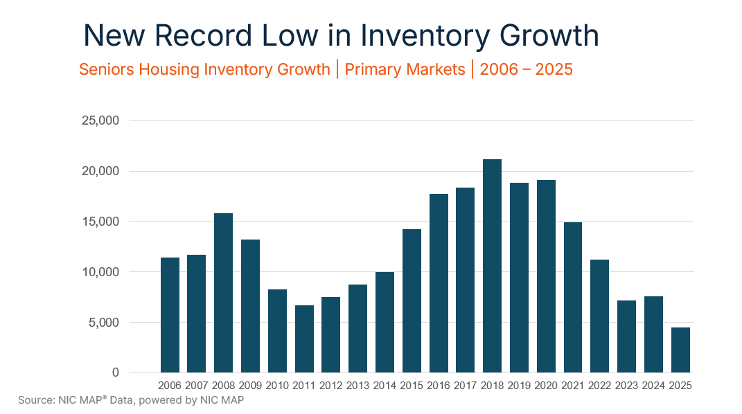

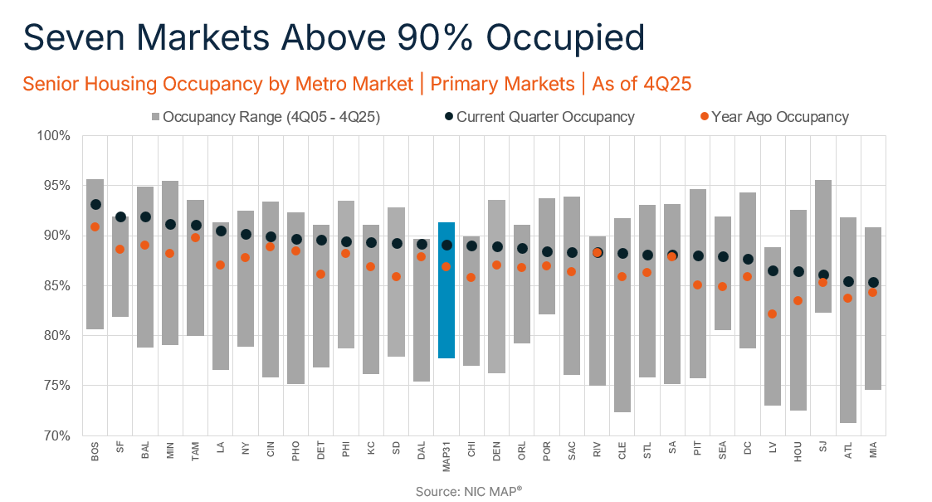

The robust M&A market has been driven by a demographic megatrend that is set to further accelerate with the leading edge of the Baby Boomer generation turning 80 this year. The 80+ age group – the key cohort for senior housing – is projected to grow by 28 percent over the next five years. At the same time, new development remains at historically low levels, and even the most attractive development projects are still a ways away from penciling. In this environment, participants are looking to acquire now and reap the benefits of the attractive fundamentals.

In addition, senior housing is a large, highly fragmented market. Private investors, owner-operators and non-profits continue to own about 86% of this approximately $450 billion to $600 billion market, with long-term, REIT ownership still only in the mid-teens. This provides ample room for continued transaction growth.

Throughout the year, REITs with experience in senior housing represented the largest and most active buyer group. Senior housing is a unique asset class that requires deep expertise for success. REITs with a track record for completing transactions, scalable operational platforms and strong industry relationships, including effective collaboration with outstanding senior housing operators, have competitive advantages in generating deal flow and long-term success.

The largest REITs have led the way. Ventas (VTR) alone closed $4.8 billion of senior housing investments from 4Q24 through February 2, 2026. Healthpeak (DOC) also announced the formation and planned initial public offering of Janus Living, a new REIT dedicated to senior housing.

Smaller-to-mid-sized REITs have also increased activity. American Healthcare REIT (AHR) closed $575 million in 2025 through November, National Health Investors (NHI) closed $392 million in 2025 as of December, Sabra (SBRA) closed more than $280 million through 3Q25 and CareTrust REIT (CTRE) entered into the SHOP business with its first acquisition for $40 million.

In November, there was also a notable industry merger with Sonida Senior Living (SNDA) announcing a merger with CNL Healthcare Properties. The $1.8 billion deal, set to close in the first half of 2026, sets up the newly combined company to further compete in the acquisition market.

Just as notably, private buyers – including numerous newer private equity funds led by industry veterans and groups that are new entrants into senior housing altogether – have started competing for deals. Transactions in the $30 million to $100 million range, which are more accessible for a wider range of buyers compared to larger transactions, are where competition is the heaviest.

Heading into 2026, expect competition for deals to continue heating up as investors try to position themselves ahead of the most attractive parts of the supply/demand curve. Those with a successful transaction track record and proven platform remain positioned to win in an increasingly competitive environment. And despite the increase in overall competition, there remain significant opportunities to acquire assets at a discount to replacement cost and that deliver attractive risk-adjusted returns across a range of investment profiles.

Overall, the senior housing industry has unprecedented momentum, and the transaction market is no different. The investment market will play an integral role in determining who are the biggest and best participants as the industry’s demand continues to accelerate.