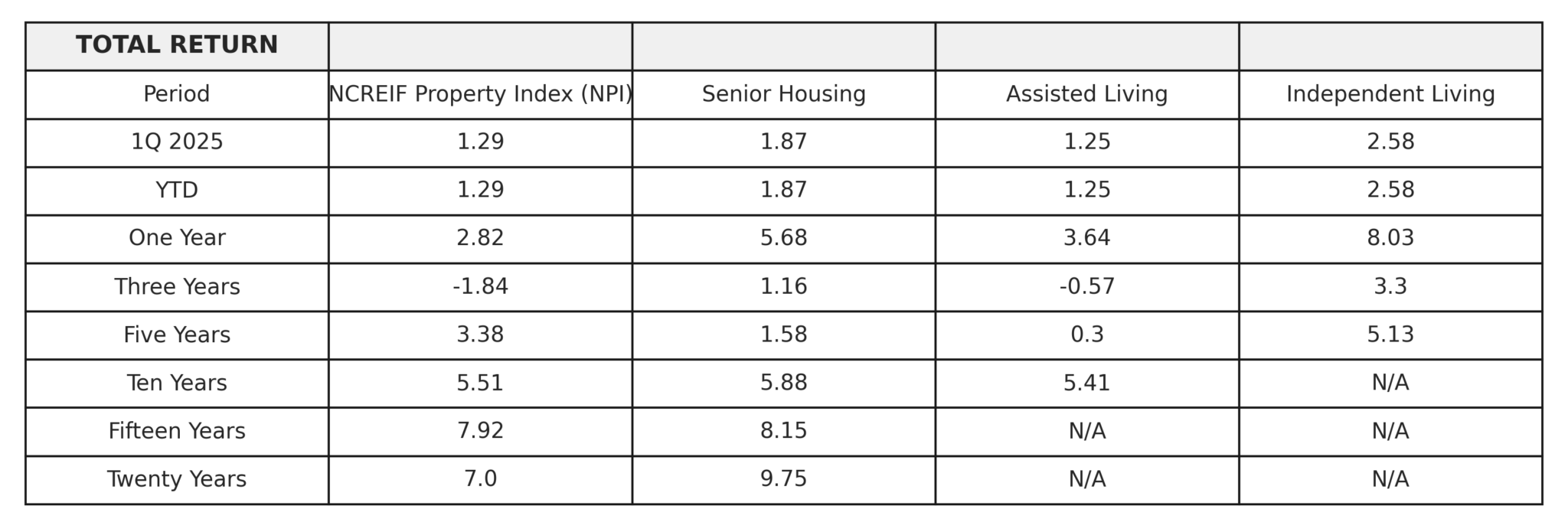

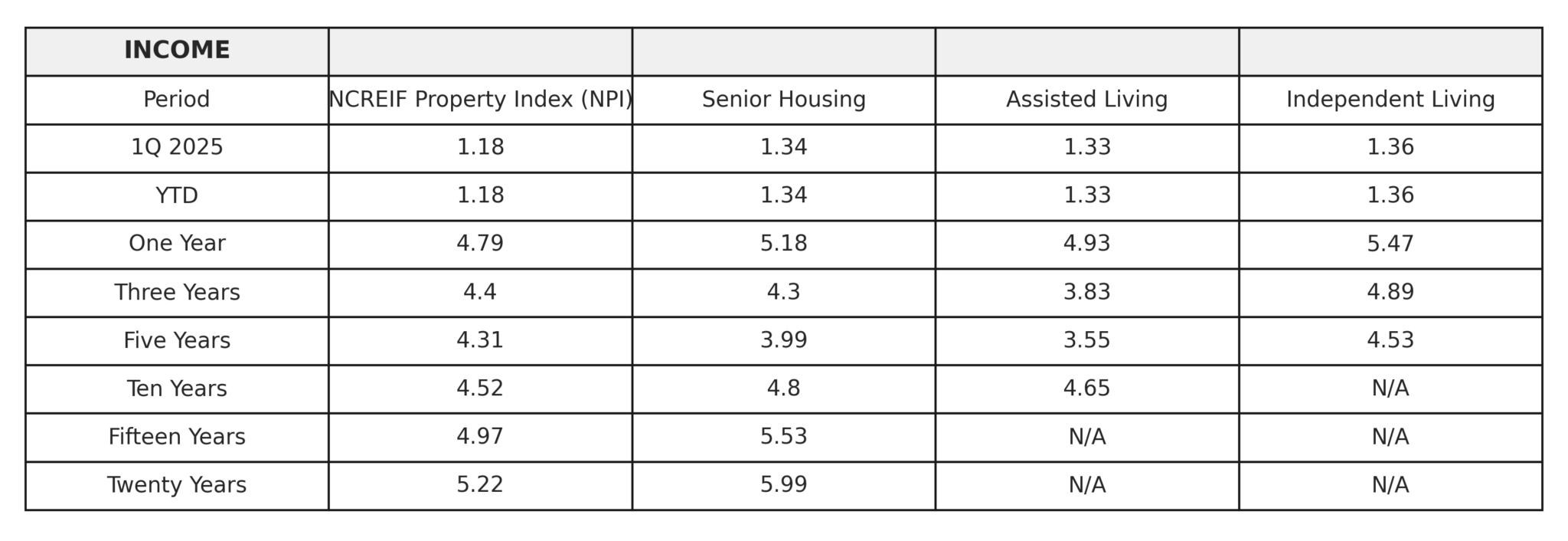

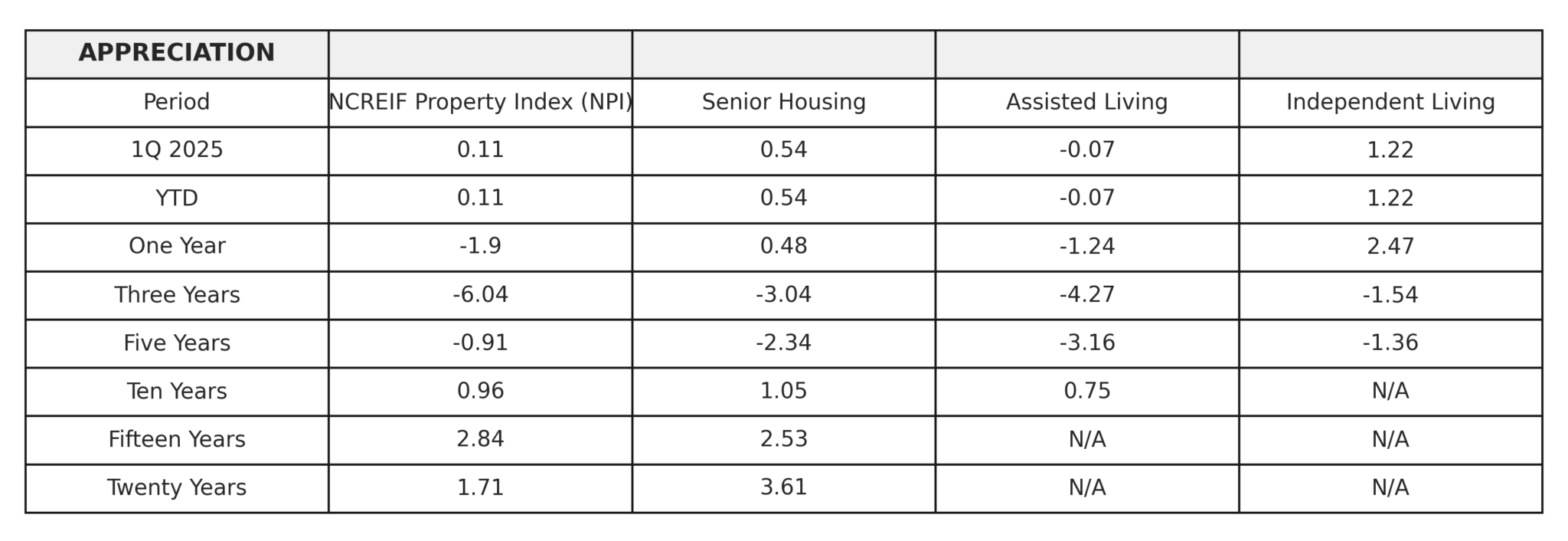

Senior housing posted a positive total return of 1.87% in the first quarter of 2025, the highest NCREIF property type return for the quarter. Senior housing outperformed the broader Expanded NPI by nearly 60 basis points, with the index posting a total return of 1.29%. Senior housing capital appreciation in the first quarter was positive with valuations increasing 0.54%. The capital appreciation return is the change in value net of any capital expenditures incurred during the quarter. Senior housing income in the first quarter was also positive, yielding 1.34%. For the broader NPI in the first quarter, both capital appreciation (+0.11%) and income yield (1.18%) were positive.

By senior housing property subtype, independent living (+2.58%) outperformed assisted living (+1.25%) in the first quarter. In recent years, independent living has also outperformed assisted living over the one-, three-, and five-year periods. This outperformance may be driven by higher margins typically generated in lower acuity settings such as independent living, which require less staffing and labor expenses than higher acuity settings such as assisted living. Additionally, independent living has had higher occupancy rates during this period. Over the longer run, since NCREIF began tracking returns data for these subtypes roughly a decade ago, both assisted living and independent living posted similar returns averaging more than 5% annually.

Annualized Total Returns by NCREIF Property Subtype

As of 3/31/2025; Unlevered

Source: NCREIF, 1Q 2025, Unlevered Annualized Total Returns

Compared to other NCREIF property types over the 10-, 15-, and 20-year periods, senior housing was the strongest property type except for industrial and self storage, outperforming the NPI on an annualized basis by 37, 23, and 275 basis points, respectively. Since the 2003 inception of NCREIF’s senior housing historical series, income yield drove roughly 60% of senior housing total returns, while price appreciation contributed roughly 40%. These performance measures reflect the returns of 214 senior housing properties valued at $12.03 billion in the first quarter. Overall, the number of senior housing properties tracked within the NPI has grown significantly from the 56 properties initially tracked in 2003.

Annualized Total Returns by NCREIF Property Subtype

As of 3/31/2025; Unlevered

Source: NCREIF, 1Q 2025, Unlevered Annualized Total Returns

Senior housing market fundamentals remained positive in 2025, with the occupancy rate for the 31 NIC MAP Primary Markets increasing 0.3 percentage points to 87.4% in the first quarter, driven by net absorption of senior housing units outpacing the number of new units arriving online. By property type, occupancy rates for independent living have made slightly higher gains in recent quarters than assisted living, which is a reversal of trends in 2022 and 2023. In the first quarter, independent living increased to an average occupancy rate of 89.0%, while assisted living increased to 85.8%.

| Source: NCREIF, 1Q 2025, Unlevered Annualized Total Returns |