The NIC Analytics team presented findings during a webinar with NIC MAP clients on July 17, to review key senior housing data trends during the second quarter of 2025. Additionally, Mitch Brown, Principal at Senior Housing Consulting, Matt Pyzyk, Managing Director of Acquisitions at Green Courte Partners, and Ben Burke, Managing Partner at Headwaters Group, all members of NIC’s Active Adult Focus Area Committee, joined Caroline Clapp, Senior Principal at NIC, for a conversation on development pipelines, acquisition trends, transactions, and valuations for active adult rental communities.

Key takeaways included the following:

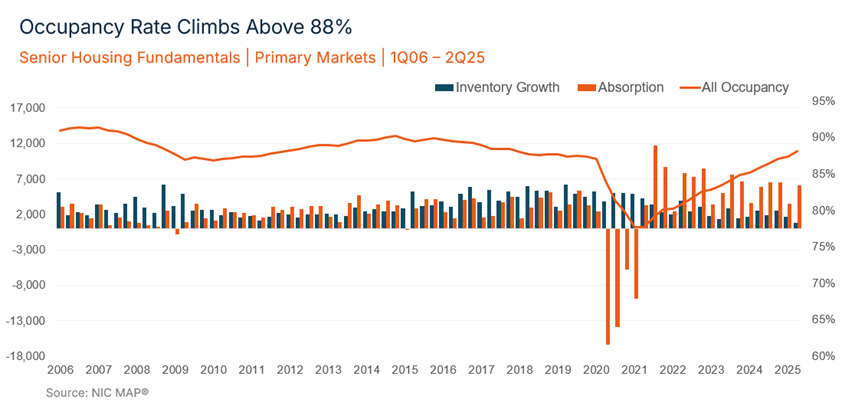

Takeaway #1: Senior Housing Occupancy Rates Climb Above 88%; Active Adult Above 92%

- The senior housing occupancy rate for the 31 NIC MAP Primary Markets rose 0.8 percentage points to 88.1% in the second quarter, driven by robust net absorption in both independent living and assisted living.

- Active adult rental communities were 92.3% occupied as of the second quarter.

Takeaway #2: Baby Boomers Driving Demand for Independent Living and Active Adult

- By property type, occupancy rates for independent living have made slightly higher gains in recent quarters than assisted living, which is a reversal of trends in 2022 and 2023.

- Over the three quarters ending June 30, independent living occupancy rates gained 0.4 percentage points more than assisted living, potentially indicating a pickup in demand from older Baby Boomers, while above 90% occupancy rates in active adult rental communities reflect demand from younger Baby Boomers.

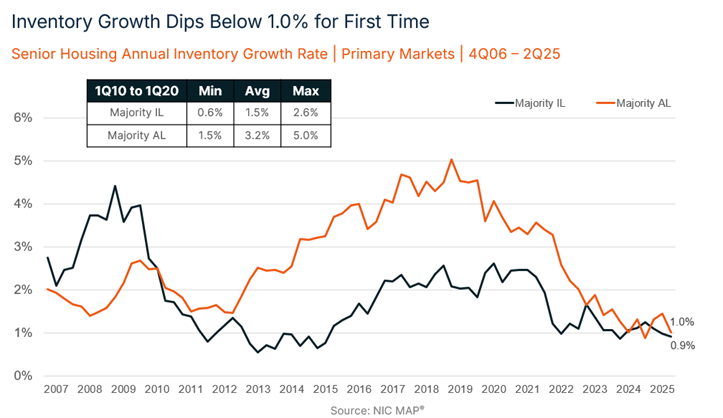

Takeaway #3: Senior Housing Inventory Growth Fell Below 1% for First Time

- Annual inventory growth fell to 0.97% year-over-year, falling below 1% for the first time since NIC MAP began tracking this data in 2006.

- As a result of declining new construction in recent years, senior housing inventory is shrinking in several markets where property closures or units being converted to other uses outweigh the number of new communities or units replacing them.

Takeaway #4: Active Adult Rental Communities Offer a Wide Range of Pricing Typically Below Senior Housing

- Among the 15 largest active adult rental markets, most metro areas offer a wide range of pricing, while some of the more affordable markets have somewhat tighter rent ranges.

- Overall, even the highest priced markets with median average monthly rents of more than $3,000 are below traditional senior housing asking rents, providing an alternative for older adults who desire to downsize from their current homes but do not yet need or want the services and care provided in traditional independent living.

Learn the latest on the active adult property type and connect with others in the field at NIC’s Active Adult Boot Camp coming up September 10 in Austin, Texas. Registration is now open! Opportunities are also available in the NIC Academy Active Adult Communities specialty course, available on demand, and during the 2025 NIC Fall Conference.