U.S. economy created 98,000 jobs in March 2017

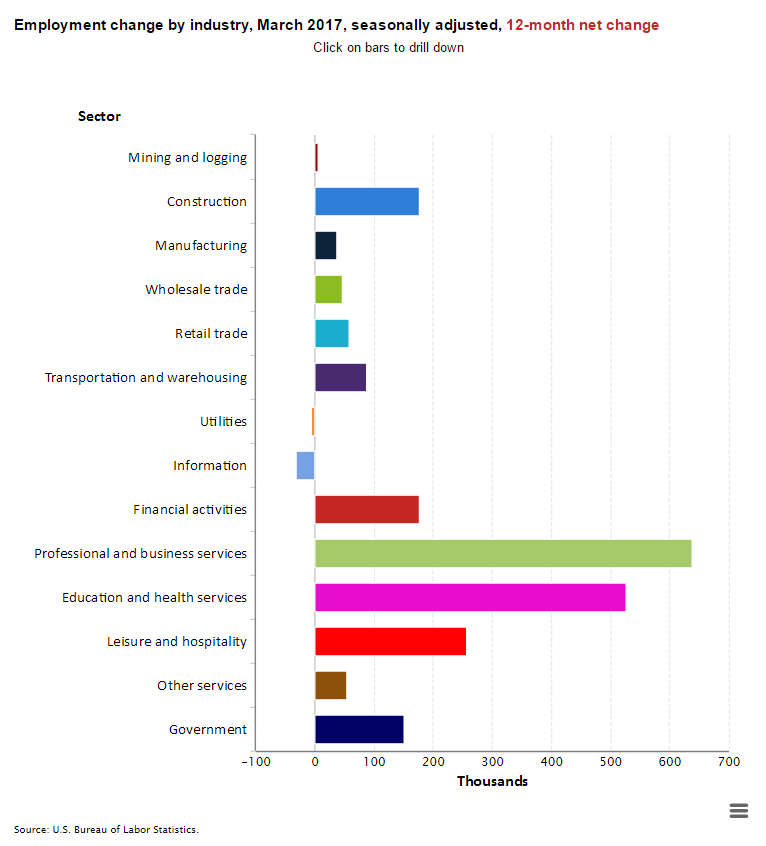

The Labor Department reported on Friday that nonfarm payrolls increased by a seasonally-adjusted 98,000 positions in March, well below the consensus 180,000 estimate. This followed gains of 219,000 in February and 216,000 in January. Revisions to January and February preliminary estimates subtracted 38,000 jobs from what was initially reported. Monthly revisions result from additional reports received from businesses since the last published estimates and from the recalculation of seasonal factors. Over the past 3 months, job gains have averaged 178,000 per month.

The marked slowdown in payrolls in March to 98,000 from earlier in the year, partly reflected the effects of weather on hiring patterns. January and February were unusually warm winter months, while a major winter storm occurred in mid-March (February was the second warmest on record across the U.S.). The three-month average job gain of 178,000 remains strong and compares favorably to the 187,000 average monthly gain in 2016.

The main weakness in March was in construction, which added only 6,000 jobs, leisure and hospitality, which added only 9,000 jobs and retail which lost nearly 30,000 jobs. In January and February, those three sectors added an average of 70,000 jobs per month versus a loss of 15,000 in March. Employment in health care rose by 14,000 in March. Over the past three months of this year, the sector has added an average of 20,000 jobs per month, compared with an average monthly gain of 32,000 in 2016.

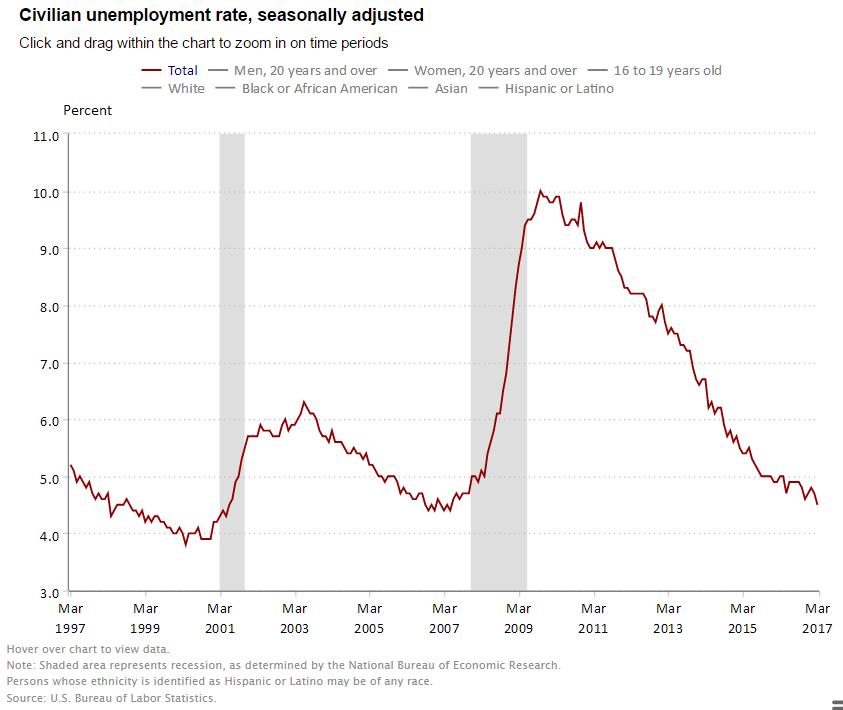

The unemployment rate fell 20 basis points to a near decade-low of 4.5% in March; it has not been lower since May 2007. The unemployment rate is derived from a separate survey than the payroll employment number sited above. The Labor Department has two surveys, one of businesses and one of households. The unemployment data is based on the household survey, while the hiring employment data is based on the business survey.

Further downward pressure on the unemployment rate is likely to occur in the coming months as job growth exceeds labor force growth. This will put it further below the so called full-employment or natural equilibrium level; indeed, the official estimate by the Federal Reserve of the full-employment level of unemployment is 4.7%. A rate much below this rate is believed to fuel inflation through upward pressure on wage rates.

A broader measure of unemployment, which includes those who are working part time but would prefer full-time jobs and those that they have given up searching—the U-6 unemployment rate—fell 30 basis points to a nine-and-a half year low of 8.9% in March.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work was little changed at 63.0% in February. It is very low by historic standards and in part reflects the effects of retiring baby boomers.

The number of unemployed persons declined by 326,000 to 7.2 million. The number of long-term unemployed, i.e., those unemployed for more than 6 months, totaled 1.7 million and accounted for roughly 23.3% of those unemployed. Over the year, the number of long-term unemployed has declined by 526,000.

Average hourly earnings for all employees on private nonfarm payrolls increased by five cents to $26.14 in March. Over the year, average hourly earnings have risen by 68 cents or 2.7%. This is up from 2.6% on average in 2016, 2.3% in 2015 and 2.1% in 2014. Increases in minimum wage rates in many states and tightening labor markets may start to put further pressure on this measure of earnings.

Combined with the drop in the jobless rate to 4.5% and the upward 2.7% year-over-year increase in wages, the data on the labor market will provide a compelling reason for the Federal Reserve to consider further rate hikes at its next meeting on May 2nd and 3rd. The data suggest that the economy is strong enough to absorb further interest rate increases. Moreover, the Federal Reserve’s preferred measure of inflation—the PCE–is close to 2%, the Fed’s stated inflation objective. The combination of low stable inflation and full employment—will give the Fed confidence that further rate hikes are in order. At this point, they have stated that two more rate hikes are planned for 2017. The Fed has also implied that it plans to start gradually reducing a large portfolio of mortgage and Treasury bonds on its balance sheet, a further way to make monetary policy less accommodative.