U.S. economy created 261,000 jobs in October 2017.

The Labor Department reported that there were 261,000 jobs created in the U.S. economy in October. This was below the consensus expectation of 310,000 jobs. The smaller than expected October increase may have reflected upward revisions to the September employment estimates which showed that the effects of the hurricanes were less than initially reported. Indeed, the preliminary loss of 33,000 jobs in September were revised to a positive gain of 18,000 jobs. The average job gain for September and October was 140,000, below the 176,000 average of the first eight months of the year.

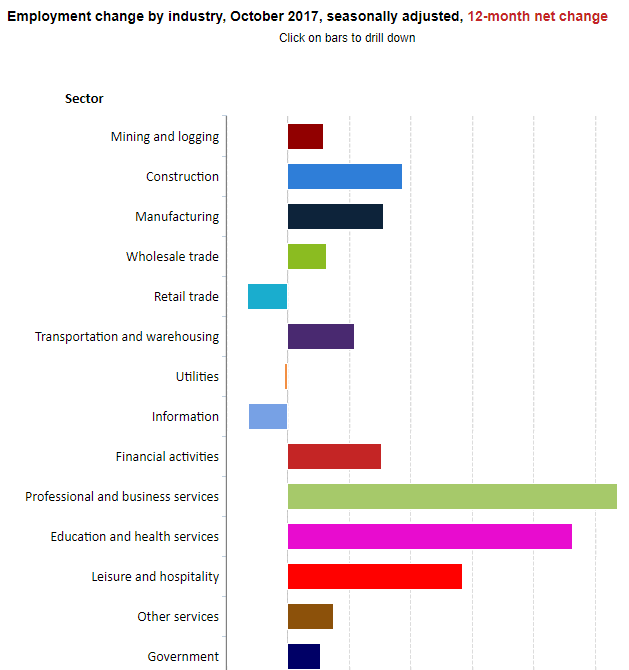

Health care added 22,000 jobs in October. Health care has added an average of 24,000 jobs per month thus far in 2017, compared with an average gain of 32,000 per month in 2016.

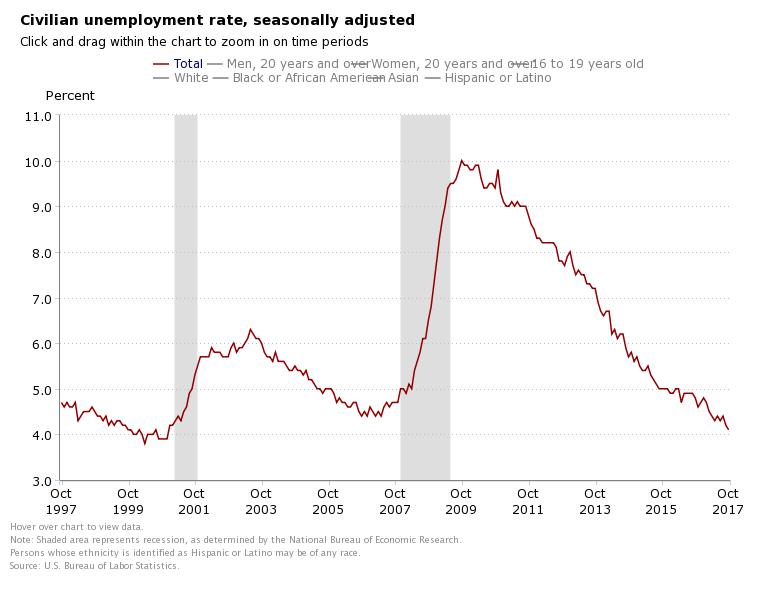

The report also showed that the unemployment rate fell to a 17-year low of 4.1% in October, down from 4.2% in September. The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.6 million and accounted for 24.8% of the unemployed. A broader measure of unemployment, which includes those who are working part time but would prefer full-time jobs and those that they have given up searching—the U-6 unemployment rate—fell to 7.9% from 8.3% in September. The U-6 estimate of joblessness has not been lower since December 2006.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work, fell to 62.7% from 63.1%. This measure has generally been very low by historic standards, at least partially reflecting the effects of retiring baby boomers. The employment-population ratio declined by 0.2% over the month to 60.2%. The employment-population ratio is up by 0.5% over the past year.

Average hourly earnings for all employees on private nonfarm payrolls rose in October to $26.53. Over the past 12 months, average hourly earnings have increased by 63 cents, or 2.4%. This is down from the 2.6% average in 2016. In 2015 this figure was 2.3% and in 2014, it was 2.1%.

Friday’s announcement is not likely to change Fed policy in the near-term. In separate news, President Trump announced the nomination of Jerome Powell to be the head of the Federal Reserve, replacing Janet Yellen in February 2018. It is expected that he will largely continue the Fed’s current policy of gradually normalizing interest rates in 2018 and beyond and continue to slowly unwind the Fed’s $4.5 trillion balance sheet. This suggests that there will still be one more rate increase in the Fed Funds rate to 1.4% by year-end 2017 under Janet Yellen’s jurisdiction and then several more in 2018, under Jerome Powell’s jurisdiction. The Fed has raised rates by a quarter percentage point four times since late 2015, and most recently to a range between 1.0% and 1.25% in June of this year, after keeping them near zero for seven years. The composition of the Board of the Federal Reserve will continue to change in 2018, as four more vacancies on the Federal Reserve Board, including the Vice Chair position, need to be filled by President Trump.