Public REITs Continue to be Major Investors in U.S. Seniors Housing & Care Properties

In light of REIT Week, NIC wanted to share valuable insight into the impact of health care REITs related to seniors housing and care. Health care REITs own and operate properties including senior housing and skilled nursing properties, hospitals and other medical office buildings. Low interest rates, attrative financing, solid returns and robust demand are all factors that indicate that health care REITs will continue to pursue seniors housing and care assets.

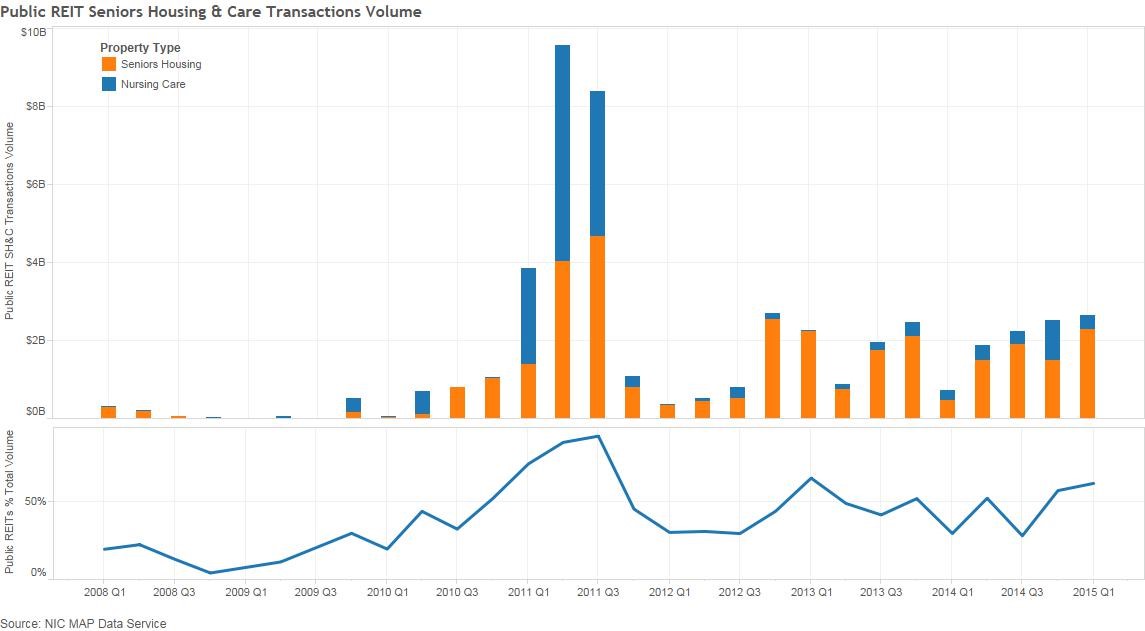

The transactions market for seniors housing & care (SH&C) properties in the U.S. remained active in the first quarter, with more than $4.0 billion in property transactions. Publicly-traded health care REITs continued to be the dominant investors, with their volume representing more than 60% of overall SH&C transactions volume. The majority of their SH&C acquisitions during the first quarter were in seniors housing, totaling nearly $2.3 billion compared to $370 million in nursing care acquisitions.

While the booming pace of SH&C transactions volume from the public REITs during 2011 was a record-setting anomaly, the public REITs have maintained significant investment activity in the years since. The public REITs have invested more than $18.0 billion in seniors housing properties since 2012, representing nearly half of overall seniors housing volume. Their investment in nursing care properties has been sizably lower at only $3.6 billion, but that still represents nearly 30% of all nursing care transactions volume during that time.

Since 2011, investment within SH&C has spurred tremendous growth in the publicREITs, as their running SH&C volume through the first quarter of 2015 has totaled nearly $45 billion, which represents 58% of overall SH&C volume during that time. The ‘big three’ have accounted for nearly $33 billion of that activity, spurring them to be now rankedamongst the largest globalREITs, withHCN at #8,Ventas at #11, andHCP at #20. The story for continued investment in the coming years remains compelling, given the combination of favorable returns and the forthcoming U.S. demographic tsunami.

Interested in learning more about transactions related data?