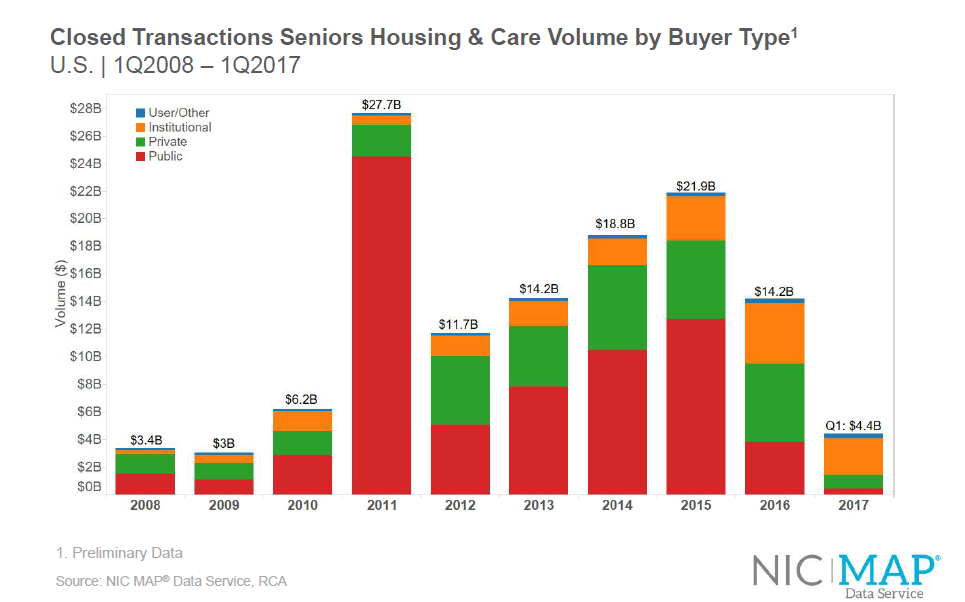

Institutional Buyers Drive Transaction Volume Increase

The preliminary data for seniors housing and care Q1 2017 transactions volume showed a significant uptick from the prior quarter. Volume totaled $4.4 billion in the first quarter. The increase in volume was mainly driven by the public REIT divestitures and the institutional players, namely Blackstone, stepping in to acquire properties.

The first quarter of the year is usually one of the weakest quarters in terms of transactions volume due to the usual rush to close deals at the end of the year, leaving the pipeline a bit empty going into the first quarter. However, this year’s first quarter had one of the strongest starts of the last 5 years. The strong results were mostly due to a few large deals, including one for more than $1 billion.

Several large transactions of note include:

- Blackstone closed on 60 Brookdale properties from HCP representing $1.1 billion in volume, with more than 5,500 units and a price per unit of more than $200,000.

- Blackstone, in another large deal, closed on the Senior Lifestyle portfolio from Welltower for $747 million, including 25 properties with more than 3,600 units and a price per unit of more than $200,000.

- The Chinese life insurance company, Taikang Life Insurance, purchased a partial interest in the Northstar portfolio. According to a press release, the transaction was valued at about $460 million and included more than 200 properties.

Buyers Shift as Public Share Continues to Fall

The main story is the fact that the public buyers’ share of volume continued to decrease in early 2017. However, unlike in previous quarters when public buyer activity declined and depressed overall volume, this past quarter was strong because the institutional buyer, as mentioned previously, completed some significant deals.

Public buyer volume in Q1 2017 dropped 36% to only $421 million from what was already a relatively low volume of $657 million in the prior quarter. Each quarter now seems to tally a lower volume than the previous quarter for the public companies, namely the public REITs. When compared to Q1 2016, with volume of $920 million, the public buyer volume in Q1 2017 dropped significantly by 53 percent. A fairly interesting statistic is the fact that this past quarter was the lowest quarterly closed transaction volume for the public companies since the first quarter of 2010 when the volume recorded was only $103 million.

Public companies now only represent 9% of total buyer closed transaction volume. A changing market, including cost of capital increases, new construction coming online, and higher property prices, have made public REITs adjust their strategy. They have decided to be more selective and have now become net sellers in this current market cycle.

On the flip side, the institutional buyer has acquired some of the REIT assets. Active buyers include Blackstone, and some international investors. The institutional buyer now represents 61% of buyer volume, a significant shift from 2015 and 2016 when the group represented only 15% and 31% of volume, respectively.

Purchases by private buyers—private REITs and private partnerships—have started to slow, with private transaction volume declining by 26% from last quarter. However, private buyers have maintained a consistent volume. This was the 15th consecutive quarter with closings totaling $1 billion or more, though the private buyer now only represents 23% of buyer volume.

Stay tuned for more transactions detail next month.