Are More Skilled Nursing Consolidations in Our Future?

Skilled nursing operators—and those who invest in the sector—are no strangers to challenges. Over the past few years, government, payor, and operator initiatives across the country have been working to create a new health care delivery and payment system, and these initiatives are expected to continue for the foreseeable future. In fact, some industry leaders suggest that it could be two years until we see a narrowing of networks and partner alignment that will expose the winners and potential losers of the emerging system.

So what will happen in the meantime? One possibility is that we’ll see more consolidation within the sector over the next few years.

Market Value & Fragmentation

From an investor’s perspective, the estimated market value of skilled nursing properties in the U.S.is sizable. At the beginning of 2016, the estimated market value was $120.5 billion, based on an estimated 1.46 million beds in investment-grade properties (i.e., properties of 25 or more beds) and at a value of $82,500 per bed.

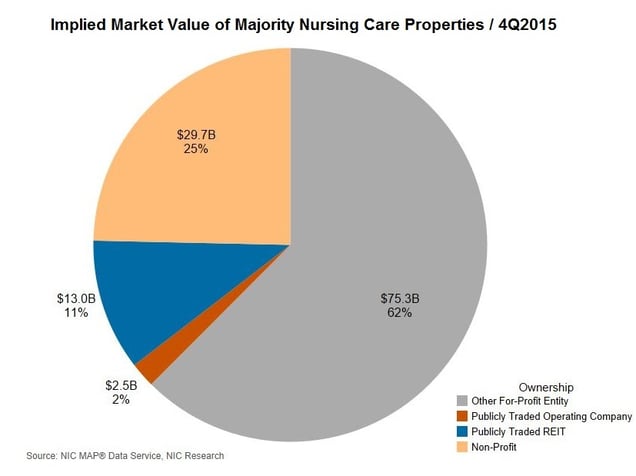

The following pie chart shows how this market value is divided among different owner types. As you can see, the publicly traded REITs represent $13 billion, which is only 11% of the total market value. The publicly traded operating companies own $2.5 billion, or about 2% of the market value. Non-profit entities own 25%, or $29.7 billion. The biggest piece of the market value pie is held by for-profit entities, including private REITs and owners, who own $75.3 billion, or 62% of the market value.

What this chart could indicate is that there is potential for consolidation within the sector. A few publicly traded REITs in the sector, for example, already have sizeable investments in the sector and have the ability to explore deal opportunities in the $75.3 billion slice owned by other for-profit buyers. In addition, many for-profit buyers might start looking for new opportunities as well, such as potentially buying out other private buyers.

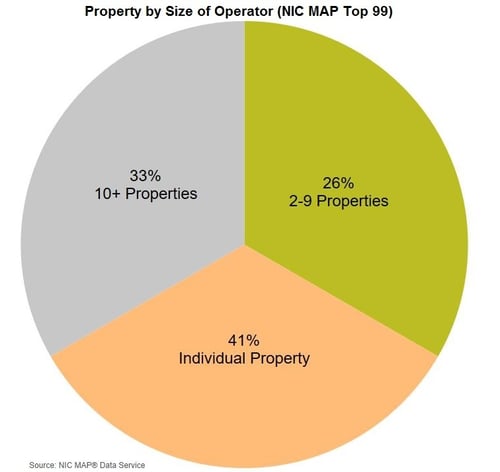

As the next chart shows, there is fragmentation among skilled nursing operators, as well, which could lead to operator consolidation. The chart shows, within the top 99 metropolitan markets, the percent of properties by size of operator based on the respective operator’s number of properties. Approximately 33% of skilled nursing properties are operated by an operator with 10 or more properties, and only 26% of properties are operated by an operator with 2–9 properties. That leaves 41% of all properties being operated by an individual operating company.

Looking at the pie chart, it would not be surprising to see a larger operator of 10-plus properties look to take over a smaller operator in order to gain market share and increase efficiencies at the corporate and property levels. At the same time, there is plenty of opportunity for one-off acquisitions of individual-property operators. We have already heard of some regional operators starting to pursue this approach as a strategy to grow and take advantage of the current environment.

Whichever approach investors and operators take—to consolidate or sit back and wait—there will be many interested parties watching this market closely over the next several years.

For those interested in better understanding the trends for the operating metrics of skilled nursing properties, NIC’s Skilled Nursing Data Report provides that time series data.