January 2018

Innovative Investment Strategies to be Highlighted at NIC Spring Forum

Insider January 2018Investment strategies and opportunities in the senior living market are rapidly evolving as new investors pour into the space. Private equity firms are seeking non-real estate based senior care platforms, alongside traditional bricks-and-mortar investors looking for alternative approaches.

What are the secrets to investment success today? Where do these new sources of capital see opportunities?

Answers to these and other provocative questions will be spotlighted at the 2018 NIC Spring Investment Forum during a panel discussion titled, “A Fireside Chat with Equity Players in Senior Care.” The session—highlighting an insider’s view of cutting-edge investment strategies—will be led by Ben Firestone, founding partner and senior managing director at Chicago-based Blueprint Healthcare.

“The panelists are investors and also disruptors,” noted Firestone. “Their approach doesn’t always follow a traditional path,” he added. “Our goal is to have a provocative conversation about where investments in the senior care sector are headed.”

“Session attendees will have their eyes opened,” said Firestone. He explained that the paths of real estate and non-real estate investing are crossing in the senior care sector. “Investors need to understand the new market dynamics to succeed,” said Firestone.

The 2018 NIC Spring Investment Forum is being held March 7-9 at the Omni Dallas Hotel.

Firestone’s session is one of six educational sessions at the Spring Forum focused on the topic area of Investing & Valuation. Other topic areas to be addressed at the Forum include Risk & Return and Value Creation & Partnerships. A total of 17 educational sessions will be offered during the three-day Forum.

The investment session will feature panelists who represent new sources of equity to the sector. The speakers will include: Frank Small, managing director of GMF Capital, a private equity firm focused on opportunistic investments; and John Stasinos, managing director of the healthcare real estate practice area at Cindat Capital Management, an aggregator of Asian capital investing in U.S. properties. The panel will also include an investor seeking opportunities in the non-real estate side of the senior living market in areas such as home care and new technologies.

“The speakers will detail their strategies,” said Firestone. The panel will also discuss recent transactions and offer insights on the future of investments in skilled nursing, seniors housing, home care and other non-real estate services. Other topics to be discussed include foreign capital procurement, operator alignment and risk mitigation strategies.

Previewing the session, Stasinos of Cindat Capital said attendees will learn about the flexibility of new equity capital in the market. He explained that the “flexibility” extends to the asset class and investment in real estate or operations—all structured with hold periods to match operators’ need to harvest the value they’ve created. “These new dedicated healthcare investment vehicles are here to stay, and an option well worth learning about,” he said.

Key takeaways from the session include:

- Learning about new capital sources

- Hearing from investors about their investment and financial structural preferences, criteria and general expectations

- Gaining insight into recent transactions, and the challenges and opportunities presented by those deals

- Understanding the different approaches of real estate and non-real estate based investments

Looking ahead, the panelists will also make predictions on the investment outlook for the senior living and care market a year from now, and five years from now. “It will be an intriguing discussion,” said Firestone.

Registration for the 2018 NIC Spring Investment Forum is now open. Early bird rates end Jan. 10. Click here for details.

Combining Supply Data to Maximize Investment Opportunity

By Lana Peck with Data Support from Molly McCarter

Is your investment strategy to be first in? Has a development site been identified or is a proposal being considered? Does the project’s marketing strategy need to be fine-tuned in order to keep on track with the proforma? Or are you hunting for areas of sales opportunity for a new expansion? Regardless of the goal, thoroughly understanding a market’s supply dynamics is a crucial first step that can make or break the success of a project or investment.

Seniors housing, like all commercial real estate has cycles—periods where there is significant development and others when there is little. In the most recent cycle, seniors housing development has ramped up significantly since the availability of capital has become plentiful in the past several years following the immediate aftermath of the Recession. One way to gauge this activity is to consider both the levels of construction under way and the number of properties that have not yet stabilized to understand the long-range historical cycling of occupancy patterns and near-term trending.

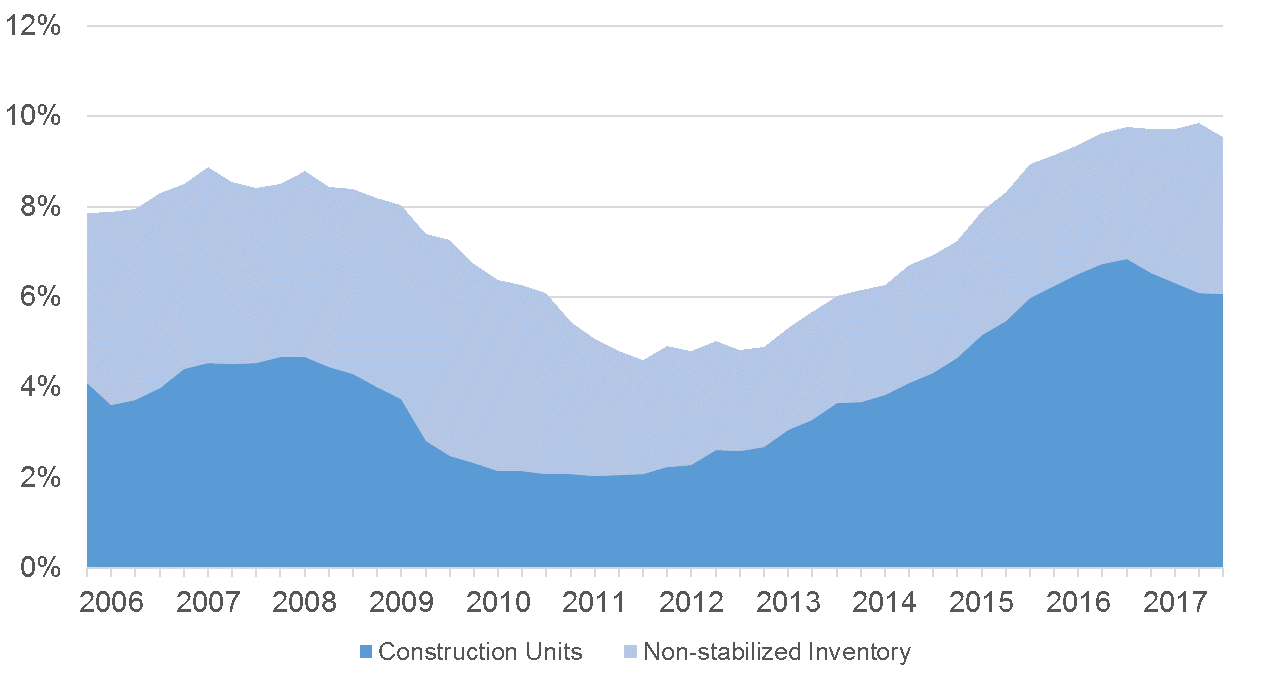

Non-Stabilized Inventory Plus Units Under Construction

The chart below illustrates the combination of these two measures as a share of inventory for the NIC MAP Primary Markets. Dark blue represents units under construction, and light blue represents non-stabilized inventory. In the third quarter of 2017, non-stabilized inventory represented 9.5% of today’s stock. As the chart shows, this has been in the same range since early 2017 (but has been rising since early 2011 when it equaled 4.6%.) As of the third quarter, about 36% of these competitive seniors housing units were not yet stabilized, up from 30% in early 2016, indicating that the non-stabilized units are taking a larger toll on occupancy.

SH Units Under Construction & Non-Stabalized Inventory as a % of Existing Supply

Primary Markets | As of 3Q17

Long-Range Historical Cycles and Near-Term Trends

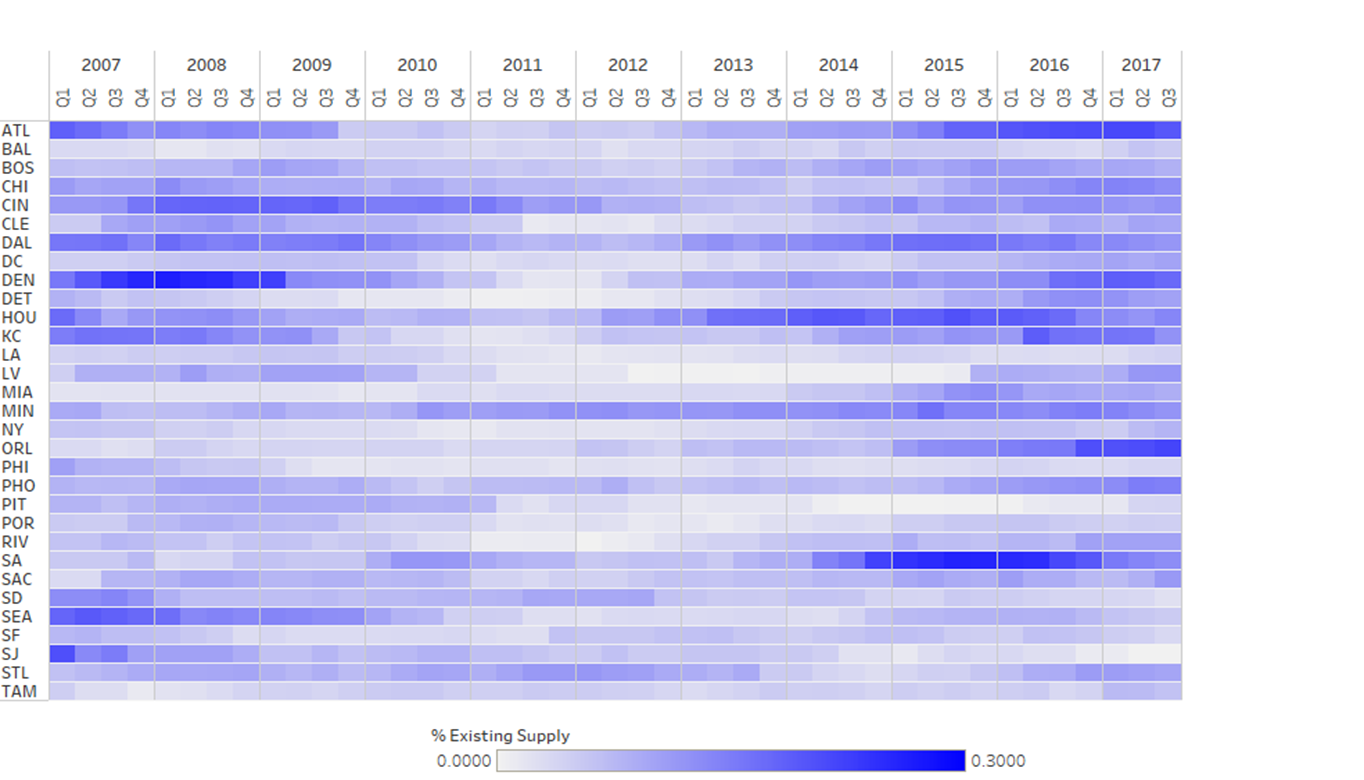

The next chart depicts this concept at the metropolitan area level and shows how the degree of competitiveness has changed over time. In this chart, the darker the shading, the higher the concentration of units under construction plus non-stabilized units as a share of existing supply.

Seniors Housing Units Under Construction & Unstabilized Inventor

Primary Markets | As of 3Q17

Atlanta and Orlando stand out with a high degree of competition. The darkest colored metropolitan markets are Atlanta and Orlando with more than 20% of their stock either non-stabilized or currently under construction. Ten other metropolitan markets have more than 12% and fall into the same category, including Denver, Phoenix, Houston, San Antonio, Chicago, Kansas City, Cincinnati, Minneapolis, Dallas and Las Vegas. At the other end of the spectrum (the lighter shading), San Jose, San Diego, San Francisco, Philadelphia and Pittsburgh each have less than 4% of their stock either non-stabilized or currently under construction.

Detail Completes the Picture

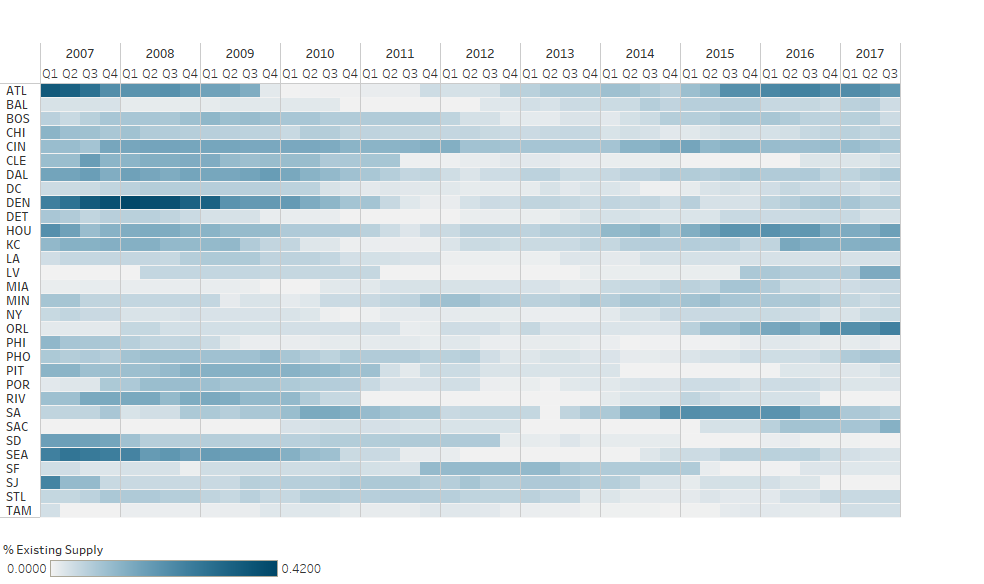

Digging deeper, comparing and contrasting independent and assisted living shows divergent patterns from the aggregated seniors housing data just discussed. The next two charts illustrate the effects of the Recession on investor preferences, and offer insight into recent trends and development and lease-up scenarios, on a market-by market basis.

For example, the lighter areas in the middle of the independent living chart—the time between roughly 2010 and 2015—show independent living’s combination of construction and non-stabilized occupancy (shown in light blue) as slightly anemic at the bottom of the cycle. This was a time when investors and developers showed preference for more needs-based assisted living housing options. Since then, metropolitan markets such as Atlanta, Houston, Kansas City, Las Vegas, Orlando, San Antonio, and Sacramento have increased their independent living stock, either non-stabilized or currently under construction. On the other hand, some markets such as Cleveland, Washington, D.C., Denver, Detroit, Los Angeles, New York, Philadelphia, Pittsburgh, Portland, Riverside, San Diego and Tampa have maintained relatively low-to-moderate competitive environments.

Majority IL Units Under Construction & Non-stabilized Inventory

Primary Markets | As of 3Q17

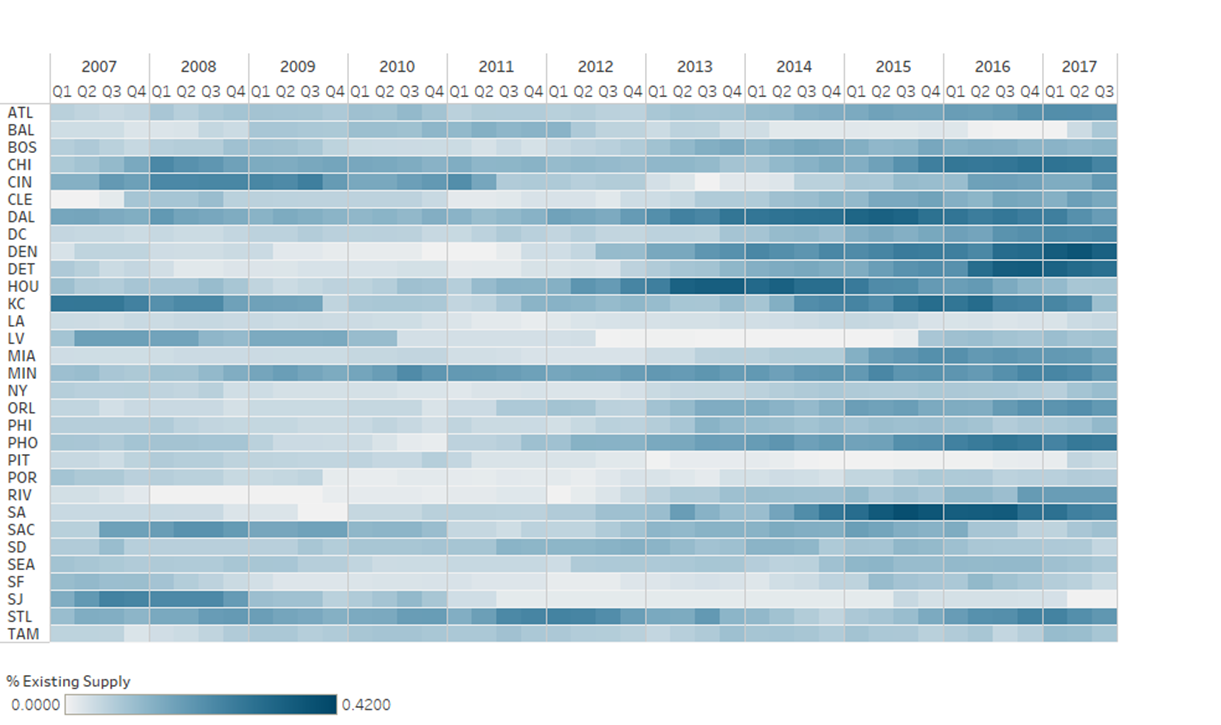

The darker blue shading shown on the assisted living chart reflects higher levels of construction and correlated occupancy pressures directly following the Recession for several metropolitan areas including Atlanta, Chicago, Washington D.C., Dallas, Denver, Detroit, Kansas City, Miami, Minneapolis, Orlando, Phoenix, San Antonio and St. Louis. Interestingly, looking at San Antonio and Dallas, the shading has become lighter, reflecting the fact that some of the recently developed properties are becoming more fully-leased. The relatively stronger growth in assisted living inventory reflects the preference of many investors to develop assisted living properties because of their need-based demand push and because assisted living fared better during the Recession and thus appeared to be less dependent upon the economic cycle. On the flip side, Baltimore, Los Angeles, Pittsburgh, and San Jose have less competition.

Majority AL Units Under Construction & Non-stabilized Inventory

Primary Markets | As of 3Q17

Considering the combination of non-stabilized inventory plus units under construction paints a compelling picture of the true level of competitive intensity in a market. This analysis is helpful to understand not only the long-range historical cycling of occupancy patterns but also near-term trending, providing valuable insight into market-level and product-level development cycles, and a more complete picture of supply that can influence the success of a project or investment.

NIC MAP Introduces New Feature: Trade Area Search by Drive Times & Traffic Flows

As part of the NIC MAP Data Service’s on-going upgrades to its product offerings, a new “Local Property Search” tool was launched in December that allows users to review trade areas based on drive time or driving distance from a seniors housing community, skilled nursing property or targeted location. The drive-time analysis can be customized for a specific trade area or primary market area (PMA) by selecting the number of minutes it takes to drive to a destination property or location, while selecting between three different traffic flow patterns: low, medium and high traffic conditions.

Fast and accurate drive-time estimates have been frequently requested by clients because they are helpful to:

- Research business expansions, and determine the demographic characteristics of a customizable market area for seniors and their adult children

- Compare demographic demand measurements to existing and future supply under different drive-time scenarios

- Understand the time it takes for your staff to get to work

- Discern a competitor’s trade area, and see where the overlap exists with your property

- Determine which locations are within 5, 10, 15 or 20-minutes of your property or specific site location

- Identify the time it takes to get to a hospital from your property under different traffic patterns

- Market to a specific drive-time area with detailed demand and supply insights

- Target new markets

- Identify and retain customers

- Shape sales and marketing contact and distribution lists by appropriate geographic areas

To calibrate for traffic patterns in drive-time analyses, our new trade area search parameters allow users to adjust driving distances using a traffic flow selection. The drive-time search parameters let the user generate boundaries that represent the maximum distance that can be traveled along a road network from a given point within a user-defined drive time, (5, 10, 15 or 20 minutes).

Drive-time analysis is important in property selection because adult children often influence parents’ decision to move. Therefore, feasibility studies often focus on the adult child’s role in helping select the appropriate property for aging parents. One key decision factor is the time it takes for the adult child to drive to a property.

In addition to conducting a drive-time search, users will still have the ability to create a custom polygon or radius search with the added functionality of a dual-radius search displaying two radii on the interactive map. To help streamline this process, the trade area search parameters now are found under the “Trade Area” header in “Local Property Search.”

Clients with access to the “Local Property Search” tool automatically saw these upgrades on December 14, 2017. If you would like to incorporate the “Local Property Search” tool into your product suite or learn more, please call NIC at 410-267-0504 or email support@nic.org, and you’ll be connected with Client Services.

Technology in the Aging Sector and Why It Matters: An Interview with Stephen Johnston of Aging 2.0

Stephen Johnston

Aging 2.0 is a global community of innovators taking on the biggest challenges in aging, building a bridge between innovators, technology companies, and startups in the aging and senior care industries. In an interview with Stephen Johnston, the co-founder and CEO of Aging 2.0, Andrew Smith, director of strategy & innovation, Brookdale Senior Living, and vice chair of NIC’s Future Leaders Council, explored current trends and why investors in the senior housing sector should pay attention to the latest innovations.

Smith: Who participates in the Aging 2.0 community and why?

Johnston: Our community has over 15,000 subscribers across 50 volunteer-run chapters in 20 countries, and our corporate innovation program has 170+ companies addressing the Grand in aging. These are companies from diverse areas that all believe in the power of using innovation to improve the lives of older people.

Smith: Like Brookdale, many operators experiment with new technologies and participate in the Aging 2.0 community of innovators. Why should investors in the senior housing sector take note?

Johnston: We’re seeing an increasing amount of interest from investors such as the REITs looking at new technologies that can help operators—either in delivering new efficiencies or helping differentiate them from competitors. We work with a number of REITs, such as Sabra and Welltower, that are looking for ways to help their portfolio companies filter through thousands of new ideas and find things that work for their unique needs. Technology is more and more critical to ensuring senior housing investments are profitable. Although we’ve been aware of the radical change in demographics for many decades, it’s only been in the past few years that we’ve been seeing broader, multi-stakeholder conversations around the potential impact that innovative technologies can have.

Smith: Looking back, what’s been a new technology that didn’t live up to the hype?

Johnston: One trick with new technology is to know when something is the right idea but just too early, or just plain the wrong idea. And these ‘wrong ideas’ are often the case of having great technology but not understanding user behavior. Many of the initial sensor-based products are great tech ideas, but they’ve met a wall of resistance by the older adults they were designed to help. Further, the business models haven’t been in place to take many of these ideas to scale. However good the tech is, if it can’t be distributed or paid for, it’s not going to scale.

Smith: What’s your assessment of the future of senior housing as it exists today?

Johnston: Senior housing is just one sector seeking to own the hearts, minds and wallets of older adults and their families; other players from the consumer tech space (e.g. Google, Apple), consumer goods (e.g. Procter & Gamble), and healthcare sectors are motivated to ‘own’ this demographic. In reality, nobody ‘owns’ the older adult, apart from themselves. Future winners will be the companies that deliver the most value to the individual. Senior housing has enormous innate advantages, as older adults spend the majority of their time within their walls and interacting with their staff and services. The senior housing industry is varied and complex with some exceptional innovators. However, the sector as a whole suffers from poor brand image, with many people vowing never to want the product that is being offered. A successful future for senior housing to me is one that transitions from a focus on medicalization and security to one that elevates and empowers older adults to let them live a unique life on their terms.

Smith: Disruption has been a buzzword for quite a few years. What does that mean in our industry? Is there a disruption afoot?

Johnston: Disruption is likely to appear first at the edges. Clayton Christensen’s concept applies most directly to ‘low-quality’ innovations that are attractive to certain users. As such, the major ‘disruptor’ to senior living will likely be seen when people who are on the fence about moving into a community delay their move for a month or two. The senior housing industry should expect that more and more people will have the ability to stay living independently, and could consider proactively going out to where these people are in the community and ‘disrupt the disruption’–create compelling options for people who have access to ever more personalized services to feel like they’re living independently. This will require collaboration with other partners working to deliver a broad spectrum of services, such as transport, food delivery, healthcare, and home maintenance among others.

How Technology Changes Consumer Expectations and Why Investors Should Take Note

By Andrew Smith, director of strategy & innovation, Brookdale Senior Living; Vice Chair of NIC’s Future Leaders Council

By Andrew Smith, director of strategy & innovation, Brookdale Senior Living; Vice Chair of NIC’s Future Leaders Council

Savvy investors in senior housing know how to evaluate the attractiveness of a geographic market, especially with the help of NIC MAP. The savvy investors know the critical importance of an operator because the location and beauty of your building won’t mean anything if it’s not staffed with high quality talent who truly care for the people who come in the door.

Investors may overlook or undervalue the critical role technology can play in the success of a community. How many hours are spent debating the merits of a theater versus an ice cream parlor? Sure, the pool table may show well on a tour, but what true customer unmet need does that address?

We should weigh those amenity investments against investments in high-speed internet, remote monitoring sensors, cameras, smart doors, and other infrastructure technologies that drive a meaningful enhancement to the resident, family and employee experience.

Customer expectations

Senior living customers continue to expect high quality staff and a safe and secure environment. Despite all the hand-wringing over the changing expectations of Baby Boomers, consumer values haven’t fundamentally changed. However, due to the way people transact business in other parts of their lives, the expectations of how those values are delivered have changed dramatically. Consumers expect transparency, ease of use, and instant access to information. Technology is critical in delivering on these expectations.

Here is one example of how technology could demonstrate quality through transparency and help to mitigate the negative outcomes associated with employee turnover. During the move-in process, the team learns the resident prefers her favorite blanket folded at the end of her bed a certain way, just like her late husband used to fold it when he made the bed. They note this preference in the resident’s digital profile which is shared with the housekeeping staff. Three months after the resident moves in, the housekeeper shares a photo of the perfectly made bed with the family who are delighted to see such personalized care. That housekeeper leaves, and a new one takes his place. The new housekeeper, however, sees the resident’s preference in her digital profile and continues to fold the blanker perfectly every time the bed is made.

This idealized, high-tech experience highlights how simple this can be, but how far away the industry is from leveraging technology to meet customer expectations. What are you doing to provide transparency and consistency in a high-turnover environment?

Employee expectations

The competitive labor market is another reason investors should pay attention to technology. My first job was as a dishwasher in a single-location barbecue restaurant. They now have an online application and mobile-enabled scheduling system for last-minute schedule changes and shift management. This is not a millennial-driven phenomenon. People expect employers to give them the tools to do their job and easy access to the information they need to do it well. New graduates from nursing school expect electronic records and have likely never seen a paper medication administration record (MAR). Technology is what employees expect.

Partner expectations

Lastly, consider the expectations of partners, especially clinical referral partners. Data are the new doughnuts. It used to be that your sales team would buy doughnuts, go to the local physician practice to woo the discharge planner, and generate business. Today, you have to bring a report of your clinical outcomes. The quality of your data and of your outcomes is how you’re measured. Without strong digital documentation and reporting, partners are likely to take their business elsewhere.

Putting it all together

All the critical stakeholders in senior living expect a level of technological maturity the industry currently fails to meet. The winners will be those that embrace these expectations and invest in the infrastructure to make it happen. This includes the hardware, software and processes necessary to deliver on the increased expectations of consumers, employees and partners. Here are two illustrative quotes from adult daughters:

“I would have loved a photo of mother attending the activity. Since the new activity director has been there, we do get pictures of mother from time to time. She’ll text or e-mail me a picture, and that’s just invaluable.”

“I wanted the camera because I’m a control freak. I’ve cared for her since my father died twenty something years ago. Then I had hands on with her here at home for 18 months. Just to stick her somewhere and walk away was just not in my DNA. These cameras are invaluable. In fact, if I was looking for a place now and I found a place that had cameras already in the rooms, then that’d be it.”