January 2016

Seniors Housing Net Absorption Outpaces Inventory Growth in 4Q 2015

By Beth Burnham Mace, NIC’s Chief Economist

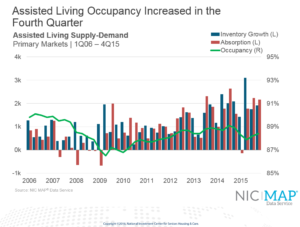

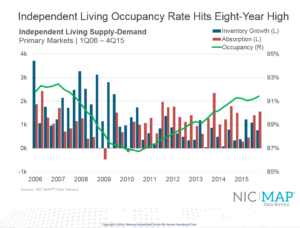

The average occupancy rate for seniors housing properties in the fourth quarter of 2015 was 90.1%, as net absorption of units outpaced the additions to inventory. This represented an increase of 20 basis points from the prior quarter, and was 20 basis points shy of its cyclical peak of 90.3% that was reached in the fourth quarter of 2014.

Since its cyclical low point of 86.9% in the first quarter of 2010, occupancy has risen by 330 basis points. Since that time, there have been nearly 50,000 seniors housing units that have come online, a 10% increase in inventory. Demand, as measured by net absorption or the change in occupied stock, increased by nearly 60,000 units over this same time period—hence the increase in occupancy.

The majority of new units coming online since early 2010 have occurred in assisted living properties (two-thirds of the overall seniors housing inventory growth or roughly 31,000 units). Construction of independent living properties has been less, but is starting to ramp up. In the fourth quarter, construction as a share of inventory for independent living climbed to 3.8%, up from 2.9% a year earlier and the most since early 2009. By comparison, construction as a share of inventory for assisted living is significantly higher at 7.9% in the fourth quarter, an all-time high and up from 6.5% in the fourth quarter of 2014.

The occupancy rate for independent living properties continued to be higher than that for assisted living during the fourth quarter of 2015—at 91.4% and 88.4%, respectively. Compared with the prior quarter, the occupancy rates for both independent living and assisted living increased by 20 basis points. Occupancy for independent living was still 10 basis points above year-ago levels, compared with assisted living, which was down 50 basis points from the fourth quarter of 2014. Despite the gradually growing pipeline in independent living, occupancy in the fourth quarter was at its highest level since 2007, while rent growth reached its strongest pace since 2009.

The occupancy rate for independent living has been higher than that of assisted living since 2012 when it was nearly the same. Since then, the gap has been widening toward 300 basis points as the effects of strong construction activity in assisted living have affected occupancy levels. On an absolute basis, there have been more units of assisted living absorbed on a net basis than independent living over this same period (24,000 versus 20,000 for the Top 31 Markets). The difference in occupancy performance reflects the difference in the size of each of the property type sectors (229,000 units of assisted living versus 293,000 units of independent living) and the greater amount of new supply that has been delivered for assisted living.

Looking ahead, there’s an expectation that demand for seniors housing will be supported by a reasonably strong national economy that is growing on par with the past year’s growth (2% to 2.5% GDP growth), favorable consumer confidence, and an improving housing market (both price appreciation and the pace of new and existing home sales). Demographics will also influence demand, with more than 5 million Americans aged 82 to 86 (the typical age of a resident) available as potential new residents. These favorable demand drivers are expected to allow absorption to keep pace largely with new construction activity and keep occupancy rates near today’s levels. There remains a risk, however, that supply could get ahead of demand fundamentals, particularly for assisted living where nearly 9,500 units are anticipated to be delivered over the course of 2016. As a result of these broad national pressures, operators and investors in seniors housing should be particularly mindful of their own supply and demand particulars in their local market areas since local area market conditions vary considerably.

Setting Strategies in a Sea of Change

Experts to Address Key Industry Topics at the 2016 NIC Spring Investment Forum

Establishing strategies for success is a top priority for companies in any industry. But for seniors housing and skilled nursing, it means figuring out how to achieve that success while navigating an environment of constant change.

Over 60 speakers who are experts in their fields will present at the 2016 NIC Spring Investment Forum, March 9–11 in Dallas. The Forum’s schedule of programming has been designed to deliver content directly applicable to seniors housing and skilled nursing to help attendees formulate approaches to set business and growth strategies for 2016 and beyond.

On the Economic Front

From its inauguration, the Forum has focused on providing capital seekers and capital providers the knowledge and connections they need to do business. This year is no different. Multiple sessions will explore the ups and downs of the market cycle and what changes might mean to the availability and cost of capital in 2016.

- Market Momentum: Economic Trends and Their Significance: Richard Fisher, former president of the Federal Reserve Board of Dallas, will provide his insights into where the economy stands today and where it is headed in the future. His observations will provide attendees an understanding of the role the economy plays in investment decision-making.

- An Update on Seniors Housing Development & Construction: NIC’s chief economist, Beth Mace, leads a panel to discuss the development that is happening in seniors housing and what criteria lenders, providers, and developers consider for new development and the acquisition of an existing property.

Speakers: William Shine, Synovus Bank; Christopher Kazantis, AEW Capital Management L.P.; and Lori Alford, Avanti Senior Living

- What Skilled Nursing Investors Need to Know about the Five-Star Quality Rating System: With the rapid move to an outcomes-based, quality-based payment system, it’s becoming more essential than ever for investors to evaluate the quality of care being provided by operators of skilled nursing properties. This session will explore what the system tells an investor about an individual property operator, and how they can use it and other quality assessment data during due diligence.

Speaker: Steven Littlehale, PointRight

- The Right Capital Sources for Optimal Growth & Success: Kevin McMeen of MidCap Financial moderates a panel of leading industry capital providers who will discuss current capital market conditions, the types of debt and equity that are available, pros and cons of each, and the best ways to finance your expansion or conversion projects.

Speakers: Eric Mendelsohn, National Health Investors; S. David Selznick, Kayne Anderson Real Estate Advisors; Adam Sherman, RED Capital Group; and Cathy Voreyer, Wells Fargo Multifamily Capital

Collaboration and Coordination

Creating partnerships and expanding service offerings will be common themes in many of the Forum’s concurrent sessions, as sweeping changes in how we deliver and pay for health care prompt operators to redefine what they do and who they work with:

- Participating in a Care Coordination Model: The care coordination model is bringing the skilled nursing industry substantial financial and organizational changes. Brian Fuller of naviHealth will lead panelists in a discussion as they share concrete examples of how risk-sharing affects business models and value, and explain bundled payments and their impact on organizational returns.

Speakers: Tom C. Coble, Elmbrook Management Company; Ken Kaminski, Azalea Orthopedics; and Geoff Teed, Paradigm Provider Partners

- Synergistic Partnering: Creating Strategic, Mutually Beneficial Partnerships: During this session moderated by Torey Riso, Care Investment Trust LLC, discover how organizations are using partnerships to create new opportunities and maintain a competitive edge. Panelists will share their lessons learned from evaluating alignment of mission, markets, and business models, assessing risks and benefits, and adjusting expectations based on actual results achieved.

Speakers: Rocklon B. Chapin, Benedictine Health System; Dan Lindh, Presbyterian Homes and Services; and Dr. Penny Wheeler, Allina Health

- Stepping Up to the Plate: Opportunities and Challenges for Assisted Living in the New Integrated Health Care Delivery Model: The new health care delivery model for seniors presents assisted living with valuable opportunities to evolve its market by serving as a coordinator and integrator of care for residents who prefer the assisted living or CCRC setting. As health care delivery continues to change, private pay senior care providers must adapt or risk getting left out of the new integrated care networks.

Speakers: David C. Grabowski, Harvard Medical School; and Kevin O’Neil, Brookdale Senior Living

- Coordinating and Collaborating Care: Why Seniors Housing & Skilled Nursing Operators Need to Partner: Creating health care delivery partnerships beyond the walls of a community can enhance marketability and potentially improve census/income streams. In this session, panelists will explain how they formed partnerships, what value was created, and why capital providers are attracted to this forward-thinking.

Speakers: Lynne S. Katzmann, Juniper Communities; Danial A. Hirschfield, Genesis Rehabilitation Services; and David Stordy, Mainstreet.

For a full schedule of events, including detailed overviews of all general and concurrent sessions, visit the Forum’s website.

NIC Internship Program Offers Students Real-World Experience in Seniors Housing Industry

Furthering its mission of leadership development within the seniors housing and care industry, the NIC internship program pairs students in highly regarded specialized programs at top-tier universities with leading firms in the seniors housing and care industry. The goal is to attract and develop talented individuals, increase the awareness within the academic community of the unique dynamics, challenges, and opportunities within the seniors housing and care industry, and provide value to participating companies, interns, and universities alike.

Recently, NIC Future Leaders Council (FLC) member, Justin Skiver, S.V.P. – Investments at Welltower, caught up with Matthew Carrus, MBA Candidate, Class of 2016 at Kenan-Flager Business School, UNC at Chapel Hill, to discuss his recent NIC internship experiences.

FLC: What interests you about the seniors housing industry and how did you first hear about NIC internship program?

Carrus: Prior to joining the MBA program at UNC Kenan-Flagler, I worked for my family’s healthcare services company. Having grown up around the healthcare industry, I witnessed firsthand the challenges that faced our healthcare system and was intrigued by the opportunities to take part in its transformation. In my previous role I frequently interacted with stakeholders in the seniors housing industry and was compelled by the impact of real estate on their business. While searching for internships, I was surprised to come across so many opportunities in the healthcare real estate space and began to focus my efforts on seniors housing real estate positions, at which point I found NIC’s Internship Program.

FLC: What were your expectations for the internship and did those change once you started?

Carrus: Given my lack of prior real estate experience, it was critical for me to take a deep dive into real estate valuation. I wanted to get as much underwriting and modeling experience as possible, while getting a sense of the various stages of the acquisition process. Welltower’s internship had a customer management component that I hoped would allow me to get some exposure to the asset management side of the business. Ideally, I wanted to work on live transactions that had real impact to the organization to get a better sense of how REITs viewed the real estate investment world.

While I had many lofty goals for the summer, the one thing you realize when you begin is that you cannot control deal volume. I was pleased at how well Welltower was able to strike the right balance between creating a structured rotation and allowing me the flexibility to move throughout investment teams as interesting deals and projects arose. As a result, I was able to get both a breadth of experience across different types of transactions and get very specific on a number of investment opportunities.

FLC: What was the focus of your internship?

Carrus: As an investment and customer management intern, I focused on underwriting and asset management processes. While working with various investment teams, I took part in the analysis of investment opportunities and experienced the process from initial valuation through closing.

Particular deals that I worked on ranged from the acquisition of a three asset portfolio in Alberta, Canada, to the acquisition of a public company with 23 properties, and many more interesting and complex transactions. I also had the opportunity to conduct research projects throughout the summer that included a market share report, UK competitive landscape review, and an operator coverage analysis.

FLC: What did you find most beneficial from the internship?

Carrus: My summer at Welltower provided me with a great sense of the deal process. I also gained insight into the importance of underwriting the operator and business, and creating value through relationships with best-in-class operators. I was also exposed to in-depth financial modeling, including pro-forma creation and testing assumptions through sensitivity analysis. While understanding financial returns is important, perhaps the most beneficial takeaway of my summer was the understanding that real estate can have a hugely positive impact on the healthcare system.

FLC: How do you feel your internship impacted your ability to find a new position?

Carrus: Welltower’s internship program provided me with a well-rounded experience and strong foundation in underwriting skills. In addition, Welltower’s focus on professional development through regular feedback during the internship process gave me valuable insight into my strengths and areas for improvement. Working for one of the preeminent publicly traded companies in the seniors housing space with a sophisticated investment platform gives me credibility as I seek to leverage my experiences and interest in the healthcare real estate space.

With opportunities available for both undergraduate and graduate students, the program is focused on internships within the finance and/or operations departments at some of the industry’s leading REITs, investment banks, seniors housing and care providers, management companies, consultants, and industry organizations. Interested students can access the program’s website at www.nicfutureleaders.org to view specific intern opportunities as well as learn more about the host companies.