August 2017

Fall Conference Session to Highlight New Research on the Future Demand for Memory Care

Jack Callison

Amid a construction wave of new memory care units, recent research findings have emerged that could have a direct and profound impact on the future demand for the care of those with Alzheimer’s disease and other forms of memory loss.

These research findings will be discussed in detail by leading experts at the 2017 NIC Fall Conference, taking place September 26-28 at the Sheraton Grand Chicago. The session, “The Future Demand for Alzheimer’s Care: What Current Research Reveals,” will be moderated by Jack Callison, CEO, Enlivant, a senior living provider based in Chicago.

NIC’s Senior Principal Lana Peck recently spoke with Callison to preview the session and the crucial research that will shape the need for memory care. What follows is a recap of the conversation and what conference attendees can expect to take away from the panel discussion.

Peck: What’s the catalyst for this session?

Callison: Investors, operators and capital providers need to make informed business decisions. One of the things top of mind for each of those groups is how future demand for products and services, in this case Alzheimer’s care, will be impacted either positively or negatively. A fascinating fact is that every 66 seconds someone in the U.S. develops Alzheimer’s disease, the only cause of death among the top 10 in America that cannot be prevented, cured, or even slowed. But new research has surfaced recently that could have a dramatic impact on the demand for services.

We wanted our NIC Fall Conference attendees to hear directly from some of the movers and shakers behind these new studies and research findings. These experts may challenge conventional wisdom and our previously held beliefs about the future of demand for Alzheimer’s care.

Peck: Who are the panelists?

Callison: We made a conscious decision to go outside the seniors housing and care industry to tap individuals who are at the tip of the spear, so to speak, in terms of leading research on Alzheimer’s disease. We have Maria Carrillo, the chief science officer at the Alzheimer’s Association, who also oversees the World Wide Alzheimer’s Disease Neuroimaging Initiative, a multi-country research effort aimed at finding the bio-markers for the early detection of the disease.

The second speaker is Dr. Pinchas Cohen, dean of the Davis School of Gerontology at the University of Southern California. He will share the latest non-pharmacological behavioral research findings that focus on environmental, cognitive and lifestyle decisions that impact the manifestations of the disease.

Jean Makesh is our third panelist. He is CEO and founder of the Lantern Group, an assisted living and memory care provider. Makesh is a scientifically-based entrepreneur who has designed and implemented highly innovative memory care approaches that are being used successfully throughout his senior living communities. He has also designed a virtual time capsule that facilitates memory and promotes functional independence.

It will be a high energy, interactive panel. As the moderator, I hope to facilitate a lively conversation whereby these outside Alzheimer’s experts share their findings and approaches, including what all of this means for the demand for Alzheimer’s care for the next decade or so.

Peck: Why is this discussion important to attendees at the NIC Conference?

Callison: Well, over five million Americans are affected by Alzheimer’s disease. Without a breakthrough cure, that number could explode to more than 16 million by 2050. An estimated 47 million people worldwide have the disease today. It’s easy to understand why so many capital providers, investors and operators are hyper-focused on what current research findings, either positive or negative, could portend for Alzheimer’s care demand.

Peck: Can you give us a hint of the possibilities for what their findings may mean for the future of Alzheimer’s care?

Callison: I’ll reserve that discussion for the panelists at the session. But there are two ends of the spectrum. On one end, a cure could be found for the disease and the need for care will decrease dramatically. Or, there could be a scenario where we become better at diagnosing the disease earlier in life, but there is no cure. The population of those who need care could expand dramatically and demand for products and services would explode. What attendees may hear from our panelists may frankly be viewed by some as provocative.

Peck: How so?

Callison: Lately, despite the significant dollars pouring into research (which is important and terrific), there hasn’t been a lot of positive news about finding a cure. But there are things we’ve learned recently that will impact demand. Industry stakeholders need to understand where the research is headed. There are a lot of talented operators doing great things from a programming perspective.

I think what’s new here from the scientific research is that we as operators may be able to significantly alter the course of this disease, whether you provide independent, assisted living, memory care, or skilled nursing care.

Peck: Memory care facilities have grown rapidly. Do you have any concerns about overbuilding?

Callison: Before we can answer the supply question, we have to answer the demand question. That’s what makes this session so relevant. What will happen to demand over a three-, five- or 10-year period? What is the research telling us? Then you can draw your own conclusions about whether the existing supply is too much or woefully inadequate. This is important and relevant content. Attendees will not only be educated about the possibilities, but the session will hopefully spark more intellectual curiosity and provide additional insight from leading experts outside of our industry in order to think about what this means for their business plan for the next decade and plan accordingly.

The session may very well challenge and disrupt the way we think about Alzheimer’s disease and what it means for future demand.

Thoughts from NIC’s Chief Economist

Beth Mace

After seven years of flat and virtually 0% nominal interest rates, the Federal Reserve Board (Fed) has now increased interest rates four times since December 2015, three of which happened in the past seven months. At the June Federal Open Market Committee (FOMC) meeting, officials raised rates to a range between 1% and 1.25%. In recent statements, the Fed has indicated that another rate hike is anticipated for 2017 to bring the Fed Funds rate—the interest rate that the Fed directly manages—to 1.4% by year end. Three additional quarter-point increases are planned for 2018, with the eventual goal of increasing the federal funds rate to 2.9% by year-end 2019.

Growth and inflation. The actions of the Fed stem from two beliefs, as well as an attempt to achieve the Federal Reserve’s dual mandate of full employment and stable prices. First, the Fed believes that the economy is at or near full employment—as measured by the rate of joblessness believed to fuel inflation through upward pressure on wage rates and currently pegged at 4.7%. In fact, the jobless rate stood at a near 16-year low of 4.4% in June while average hourly earnings were up by 2.5% from year-earlier levels. And, a second belief that some but not all members of the FOMC hold is that price stability, as measured by an inflation rate near the Fed’s preferred 2% target rate, is at hand.

The problem is that standard metrics of inflation are not cooperating and that the trend in inflation is actually softening. The most recent measure of the core Consumer Price Index (CPI), which excludes the volatile food and energy sectors, increased 1.7% from year-earlier levels in May, down from 2.3% in January. At the same time, the core implicit price deflator (PCE), the Fed’s preferred inflation metric, came in at 1.4% for the year ending in May.

Many members of the voting FOMC believe, however, that temporary factors, such as large discounts on wireless phones, contributed to recent weakness and that wage pressures are indeed mounting with job openings at record highs (6 million in April) and with the unemployment rate tumbling. They are also looking at the large number of states and municipalities that are raising their minimum wage rates. As a result, the Fed is likely to stay the course on normalizing rates unless some extraordinary exogenous shock happens to the national or global economies.

In addition, the Fed has indicated that it will soon start to reduce the central bank’s unprecedented large portfolio of bonds and other asset holdings on its $4.5 trillion balance sheet. The Board will accomplish this by slowly allowing some assets to mature without reinvesting the proceeds. During the recovery period following the last recession, the Federal Reserve purchased bonds and other securities as part of its Quantitative Easing program (QE) to add liquidity to the market. The Fed stopped adding to the balance sheet in 2014, but it has been reinvesting the proceeds of maturing assets to keep the Fed’s holdings steady. This new policy shift, if done inappropriately, has the potential to boost long-term interest rates. Such an unwind has never occurred and the Fed is cautious about the impact it could have on markets.

The upshot of all of this is that monetary policy is becoming less accommodative, short-term interest rates are on the rise, and the cost of capital is increasing. For businesses dependent upon short-term debt and investment capital, it is likely that today’s borrowing environment may be preferred to tomorrow’s.

NCREIF investment returns strong, but slowing. First quarter investment return data for the NCREIF-reported seniors housing properties equaled 3.62%, composed of a 2.25% capital return and a 1.37% income return . The annual total return through the first quarter of 2017 was 12.05%, far above the broad-based NCREIF Property Index (NPI) return of 7.27% and the apartment return of 6.73%. However, industrial total returns slightly outpaced seniors housing returns at 12.18%.

Despite the relatively strong showing, the total annual return for seniors housing has been slowly trending down since mid-2014, when it peaked at 20.37%. The annual appreciation return has also been slowing and, at 5.91%, was its lowest for any trailing four-quarter period since mid-2014, while the 5.87% income return was below its long-term average of 6.78%. The slowdown in annual income and capital returns has also been evident within the broader all-property index (NPI), which includes returns data on office, industrial, multi-family, retail and hotel properties.

The data suggests and NCREIF writes in its analysis that “the appreciation cycle for institutional real estate has entered a new phase such that total returns are more dependent upon their income component…Healthy, yet stabilizing property fundamentals and the shift toward income-driven performance imply that commercial real estate expansion has matured.” This also appears to be the case for seniors housing, indicating that income returns will comprise a larger component of the overall return. Earlier in the cycle, property values rose faster than NOI growth. Now both are decreasing—income gains are slowing as fundamentals have stabilized and outsized appreciation gains/cap rate compression is slowing due to the phase of the market cycle.

Despite the recent slowdown, total returns for seniors housing still exceeded both the NPI and apartments by more than 400 basis points on a 10-year basis. The difference with hotel properties was even greater at 675 basis points (11.13% versus 4.38%), while the difference with retail was the smallest to the positive of the other five main property types at 297 basis points (11.13% versus 8.16%).

As always, I welcome your feedback, thoughts, and comments.

Seniors Housing Inventory Growth and Absorption Climb to Record High Annual Rates

Five Takeaways from NIC MAP’s Second-Quarter Seniors Housing Data Release

NIC MAP® Data Service clients attended a webinar earlier this month on the key seniors housing data trends during the second quarter of 2017. Five key takeaways emerged:

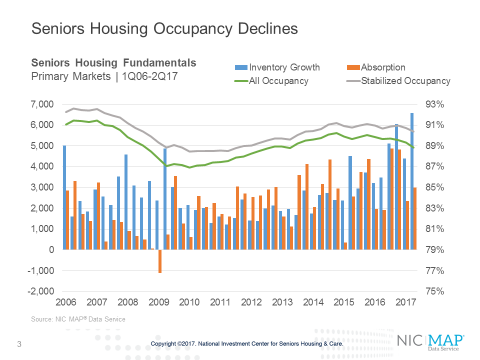

Seniors housing occupancy fell 50 basis points to 88.8%

The all occupancy rate for seniors housing, which includes properties still in lease up, was 88.8% in the second quarter, down 50 basis points from the first quarter. This placed occupancy 190 basis points above its cyclical low of 86.9% during the first quarter of 2010 and 140 basis points below its most recent high of 90.2% in the fourth quarter of 2014.

The quarterly decrease in occupancy stemmed from an increase in inventory of nearly 6,600 units, which outpaced a change in net absorption of 3,000 units. As the chart shows, the increase in inventory was the most in a single quarter since NIC began reporting the data in 2006.

It is notable that the difference between total occupancy and stabilized occupancy was 160 basis points, the widest differential since mid-2009. The size of this gap reflects the large number of properties recently opened and still in lease up.

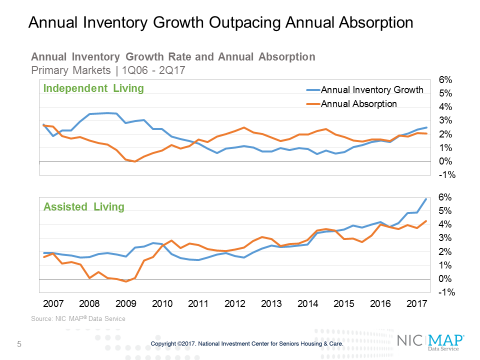

Assisted Living occupancy fell to its lowest level since 2009

Inventory growth has been ramping up for a much longer period for assisted living than for independent living and as of the second quarter, annual inventory growth reached 5.9% – its highest level since NIC began reporting the data in 2006. This has put significant downward pressure on assisted living occupancy which stood at 86.5% in the second quarter. Annual absorption also accelerated in the second quarter to a pace of 4.3%. That put annual absorption also at its highest rate since NIC began reporting the data.

Seven Markets Saw Gains in Inventory of More than 10%

During the past year, there have been nearly 35,000 units added to the stock of seniors housing inventory among the Primary and Secondary markets. Roughly 30% of this growth occurred in seven metropolitan markets: Dallas, Chicago, Minneapolis, Atlanta, Houston, Miami, and Boston. Dallas and Minneapolis alone accounted for 12% of all new seniors housing inventory in the past 12 months.

Relative to each metropolitan market’s own inventory, there were seven markets that experienced gains in inventory of more than 10% over the course of the year. They included New Orleans, Salt Lake City, Albuquerque, Austin, Melbourne, Jacksonville and El Paso.

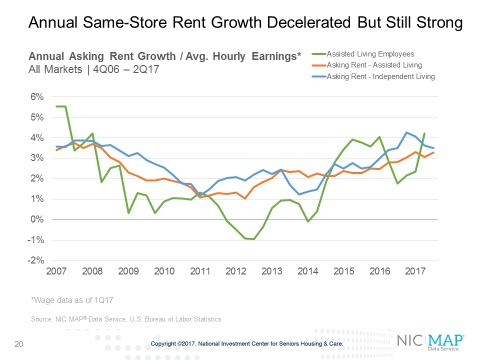

Same-Store Rent Growth Remains Strong

Same-store asking rent growth for seniors housing was generally strong in the second quarter, with year-over-year growth of 3.4%. This was down from 3.8% in the second half of last year, but was well above the 2.6% average pace experienced since late 2006.

Asking rent growth for assisted living was 3.3% for the second quarter, up 20 basis points from the first quarter. For independent living, rent growth declined to 3.5% from 3.6% in the first quarter and down from 4.2% in the third quarter of 2016, when rent growth reached its greatest pace since NIC began collecting this data.

There is wide variation in rent growth, however. Detroit, San Jose, St. Louis, Sacramento and Seattle all experienced rent growth in excess of 5% from year-earlier levels, compared to Miami, Dallas, San Antonio, Kansas City and Cleveland, which all experienced rent growth of less than 2%. Cleveland was up by only 0.6%.

Compared with the 3.3% year-over-year increase in assisted living rents, average hourly earnings were up 4.2% for assisted living employees as of Q1 2017, according to data tracked and monitored by the U.S. Bureau of Labor Statistics.

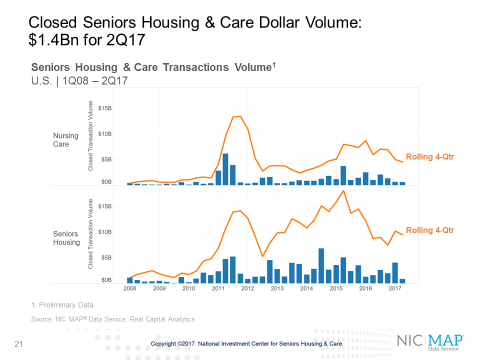

Closed Transaction Volume Slows in Second Quarter

Although some large deals have been announced over the past couple months, the deal volume that actually closed in the second quarter, based on preliminary figures, was relatively weak. In fact, the second quarter represented the lowest closed transaction volume since the first quarter of 2012. Transactions volume for seniors housing and care registered $1.4 billion, with $873 million in seniors housing and $573 million in nursing care. Volume in the second quarter of 2017 dropped 69% from first quarter total of $4.6 billion, and declined 45% from the second quarter of 2016, when volume totaled $2.6 billion.

The rolling four-quarter total of seniors housing and care volume registered $14.1 billion, but was still down 8% on a quarter-over-quarter basis and 5% on a year-over-year basis.

Get Ready: Global Aging Changes Everything Paul Irving Keynotes 2017 NIC Fall Conference

While global warming gets a lot of attention, a less noticed but equally impactful trend is that of global aging—the quickly advancing age of populations worldwide. In fact, a recent report shows that the world’s older population will jump from its current level of 617 million to 1.6 billion people by 2050, a 159 percent increase.

“Global aging will change everything” said Paul Irving, chairman of the Milken Institute Center for the Future of Aging, and author of a popular book on the impact of longevity. “It will literally change everything from health care, housing, transportation, consumer trends, the workplace and politics.”

A national thought leader on aging, Irving will present the opening keynote address on the opportunities and challenges posed by the emerging longevity economy at the 2017 NIC Fall Conference, taking place September 26-28 at Sheraton Grand Chicago.

NIC recently talked to Irving to give the conference attendees a preview of his remarks, setting the stage for the conference theme of navigating the present marketplace and anticipating the future.

Offering some context, Irving believes the country is at an inflection point that can lead to an older, sicker and less engaged population, or one that changes the culture around aging to maximize health, productivity and social connections. “We need to think about ways to disrupt the model that has been created,” said Irving. “We have under-recognized the market potential of older adults to drive business opportunities.”

Irving thinks the seniors housing and care industry is in a unique position to change the culture of aging. Building owners, operators and capital providers can be leaders on the issue of global aging.

Taking the lead

Irving shared his provocative thoughts below on the industry’s role in the emerging longevity economy. He plans to explore these in more detail at NIC’s Fall Conference.

- The industry has a remarkable asset in its relationships with residents and families. But bridges need to be built to the next generation to make senior living communities a compelling choice. Services could be offered to those outside the community, something like a country club with different membership levels depending on the services provided. “Why do customers have to be residents?” asked Irving

- Policy is still important. The U.S. has aged more slowly than many nations because of its generally more open immigration policies. But discussions on the issue of aging are at a more advanced level in other countries, said Irving. “We need a lot more conversation here about aging and caregiving as a challenge,” he added.

- How can the industry increase a resident’s “health span”—the period where a resident has a sense of purpose and continues to build relationships? People’s physical lives have been extended, but more work needs to be done to extend the length of time that they remain healthy enough to stay engaged. “A longer life is a wonderful notion,” said Irving. “But for most of us, the dream is to live a healthy life with a short period of decline.”

- Some of the most interesting housing models are intergenerational communities that mix younger and older people. Research has shown that those with a positive image of aging, which can be enhanced by multi- generational communities, live 7.5 years longer than those who have a poor perception of aging.

- Could pricing be structured as risk sharing? Operators want to keep their census up and a longer stay could be encouraged by offering discounts for losing weight, or exercising. “Are there opportunities for shared stakes?” asked Irving. “Insurance companies are looking at that, operators should too.”

- Providers could partner with technology companies that offer services such as home care or concierge-type help. “Look for alliances,” said Irving.

Consider forming affiliations with academic institutions to recruit creative thinkers.

The greatest threat to the industry? “Complacency,” said Irving. The industry is in relatively good shape. Returns are good. Occupancy is still relatively high. The value of facilities continues to climb and cap rates are low.

“This is not an industry that is broken,” he said. But, Irving warned, new ways of meeting the needs of families and residents could easily disrupt the current landscape. “Look at how rapidly Amazon has derailed the retail industry, or how Uber has upended the taxi business,” he said. “Change can come in shocking and unexpected ways.”

Irving challenges the industry to look inward and reframe its thinking about aging. Even the word “senior” has a negative connotation that perhaps should be retired and replaced with less biased terms such as older adults or older people.

“What you call things matters,” said Irving, adding that the industry needs to think about the customer and how the customer is changing in order to capture a larger audience. He asked: “How do we give people something special?”

2017 Spring Investment Forum Recap Series 3

The Value-Based Care Revolution

A big change in the health care delivery and payments system is well underway which is already impacting seniors housing and care operators and investors.

The details of this major policy shift from a fee-for-service to a value-based payments system were outlined for attendees at the 2017 NIC Spring Investment Forum. A panel of experts discussed effective strategies to manage the transition during a session titled, “The Value-Based Care Revolution.”

After the Spring Forum, questions have arisen about the future of new policies because many were enacted under the Affordable Care Act (ACA). An effort has been underway in Congress to repeal and replace the law. But that effort has failed so far, offering further evidence that payment reform is likely to move ahead. Also, payment reform has generally enjoyed broad bi-partisan support as a way to reduce costs.

At the Spring Forum, panel moderator Lynne S. Katzmann, founder and president of Juniper Communities, provided context noting that the federal government is pushing to reduce the cost of health care while improving outcomes. “If we think about holding health care costs in check, who do we look at?” asked Katzmann. “We look at those who spend the most.”

That population is comprised of frail seniors, the residents of senior living and care communities, said Katzmann. Many have multiple chronic conditions, functional limitations and often suffer from depression and cognitive issues.

New strategies are being tested to deliver care to frail seniors, said Katzmann. “A winning strategy will rely on creating, providing and demonstrating clear value for the money, rather than just doing more,” she noted.

Katzmann introduced two experts who help navigate health care system changes for hospitals, accountable care organizations (ACOs), and managed care organizations (MCOs). They provided insights into how the changes are impacting the seniors housing and care industry.

Brian Fuller, vice president, value-based care, naviHealth, spoke about the post-acute care market. He emphasized that the Centers for Medicare & Medicaid Services (CMS) is not wavering on its plan to increase value-based payments, despite the election of a new administration in Washington, D.C.

About half of CMS payments are now value-based, and Fuller expects the shift to accelerate. “You will see this soon,” he said.

Fuller asked the audience: “What is your organization’s status regarding making the transition from providing care on a fee-for-service basis to providing value-based care?” He noted that most post-acute providers are just at the start of that process. And, though the changes will impact skilled nursing first, the role of assisted living to reduce costs is likely to emerge as a future solution.

Meanwhile, insurers, ACOs and health systems have recognized the vital importance of post-acute care which accounts for 43 percent of all hospital discharges at a cost of $60 billion a year.

Fuller provided several examples of how new payment models are impacting post-acute care providers.

Under the Bundled Payments for Care Improvement (BCPI) initiative, which links payments to an episode of care, about half of all expenses in a 90-day episode take place outside the hospital. Hospitals responsible for the entire episode are very concerned about post-acute care, said Fuller. “Hospitals want to curb spending,” he said.

However, he noted that hospitals aren’t good at managing patients after discharge, which opens an opportunity for post-acute care providers. Hospitals are seeking high quality skilled nursing facilities as referral partners.

Looking at the ACO model, Fuller noted that a study of successful ACOs showed that savings could be generated by focusing on post-acute care. Skilled nursing can provide value as a preferred partner for ACOs, he said.

Risk management

Erik Johnson, vice president at Optum, discussed population management and risk sharing models. He defines population health management as the identification of at-risk elders and the introduction of support systems to keep them in their communities.

Johnson foresees an integrated care model or “portfolio approach” to risk management that includes home health, skilled nursing, rehab facilities and perhaps even assisted living. “It’s more than a discharge nurse’s name in a rolodex,” said Johnson. “Success involves tracking data and being willing to collaborate on the identified set of high-risk patients.”

The panelists agreed that the shift to value-based care will not be reversed. Johnson pointed to The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA)—bipartisan federal legislation that establishes new ways to pay physicians for caring for Medicare beneficiaries based on quality metrics. “This will drive the formation of more alternative payment models,” he said.

Fuller noted that the thinking around real estate is changing. Five years ago, hospitals were building large facilities but are now focused on smaller centers. He believes the shift will have an impact on post-acute and seniors housing providers, and could affect the operations and designs of communities.

Regarding the roll out of value-based care, Fuller said individual markets vary widely. Some markets are farther along in the transformation than others. “You have to know your market,” said Fuller.

As risk-sharing models become more widespread, Fuller warned providers to be careful, especially during a time when post-acute care facilities are under pressures to improve their census.

He urged providers to “get in the game,” and focus on care coordination. “Risk is not the end game, it’s care coordination,” he said.