April 2015

Download the Full Insider: April 2015 Issue

NIC 2015 Forum Overview

Amid a landscape of shifting demographics, health care reform and new technologies, the NIC 2015 Forum brought together more than 1,200 industry professionals to discover emerging opportunities.

Designed especially for small and mid-size owners and operators, the Forum was held March 31-April 2 in San Diego. Sessions focused on best practices, industry trends, and peer-to-peer exchanges.

With robust attendance by a wide variety of industry stakeholders, NIC conferences have earned a reputation as efficient settings where participants can network and also make deals. And this year’s Forum included a new concept to facilitate transactions called “Capital Connections.” More than 35 capital providers made short “pitches” to capital seekers during three concurrent sessions which were held over two days.

Key note addresses by national leaders at the Forum provided insights into pivotal trends. Kathleen Sebelius, former secretary of the U.S. Department of Health and Human Services, spoke on the massive change in how health care providers will be reimbursed from fee-for-service to fee-for-value based on outcomes. Technology expert Katy Fike previewed the future of senior living as avatars and wearables change the ways services are delivered. And Dr. Bruce Chernof, a national health care and long-term care leader, spoke of the increasing importance of person-centered care and quality of life and the opportunities that the shift in health care payments and service delivery creates for senior care providers.

In closing comments, NIC CEO Bob Kramer noted that quality measures must be tied to transparency for consumers, payors, operators and investors. “It represents a huge opportunity,” he said.

Attendees have complimentary access to the session audio recordings synchronized with the session PowerPoints from all the breakout and general sessions. Click on Schedule and the session titles to download the MP4 files.

Thoughts from NIC’s Chief Economist

Jobs, the Economy and Seniors Housing Demand

Even though the economy slowed during the first quarter, the outlook for the rest of the year remains generally sanguine. The first-quarter slowdown stemmed from a few factors. First, let’s consider the strong dollar. The trade-weighted U.S. dollar has appreciated 15% against foreign currencies since last summer, including a 20% singular gain against the euro, which has made American-made goods more expensive for foreign buyers. As a result, exports have fallen and U.S. manufacturing output has weakened.

Second, housing activity continues to be relatively weak. Housing starts came in at a 926,000-unit annualized rate in March, compared with an historical average of more than 1.5 million per year before the Great Recession. Trepidation on the part of both potential first-time buyers and former homeowners appear to be the dampers in the market at the moment. Third, unseasonably cold weather in the Northeast and hot weather in the West took a toll on activity, as did a longshoreman strike at the Ports of Los Angeles and Long Beach. In addition, the sharp drop in oil prices has hurt energy-related investment and jobs. Moody’s Analytics estimates that these three factors shaved 1.5 percentage points from underlying growth of 3% in the first quarter, resulting in the projected gain of only 1.5% in real GDP, with employment gains slowing at the same time, averaging 200,000 per month, down from 300,000 at the end of 2014.

Looking ahead, the economy is expected to pick up its pace, helped in part by the positive effect of lower oil prices on consumer spending. American households will spend close to $150 billion less on gasoline this year compared with last, or a savings of more than $1,000 for the typical American household, according to Moody’s estimates. Another factor expected to bolster growth is a gradual recovery in the housing market, helped by low interest rates and pent-up demand. For the year, real GDP is pegged to come in around 3%, up from 2.4% in 2014. An expanding economy, along with the growing confidence of residents and their adult children, is expected to support further demand for seniors housing for the rest of 2015.

Interest Rates, Cap Rates, Risk Premiums and Real Estate Values

It’s likely that the Fed’s zero interest rate policy (ZIRP), in place since 2008, will end sometime later this year and interest rates will gradually edge higher. It’s important to pay attention to the execution and communication of this policy change. An unexpected, quick, or significant bump in interest rates could cause a sharp market reaction and produce sudden volatility in rates. On the other hand, slow, steady, and deliberate rate hikes will be more manageable for the market to absorb.

If rates do increase by year-end, there will likely be upward pressure on capitalization rates. And, if net operating income growth cannot offset this pressure, values may decline. All else equal, a 50-basis point increase in cap rates from 6.0% to 6.5%, for example, requires an 8% increase in net operating income (NOI) in order for the property values to remain unchanged.

That said, a significant risk premium exists for seniors housing investments, despite strong historical and projected performance. Given solid operating and investment performance of seniors housing properties in recent years—especially the resiliency demonstrated during the Great Recession—as well as the potential portfolio diversification attributes that the sector can provide to investors, one could argue that seniors housing’s spread over the risk-free rate should be narrower or compress with time.

If such narrowing spreads occur from today’s 500-basis point differential, seniors housing cap rates may not experience the same magnitude of upward pressure that the expected rising interest rates could impose on other commercial property types. Indeed, with its compelling investment thesis, it’s reasonable to argue that cap rates for seniors housing may prove to be sticky and not follow rising interest rates in lock-step.

Competitive Lending Landscape

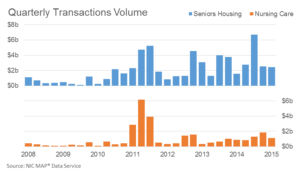

Today’s low interest rates have surely contributed to a robust sales environment, with property sales transaction volumes rising to $19.4 billion for seniors housing and care properties in the first quarter on a rolling four-quarter basis—the strongest pace since early 2012. More than 122 deals penciled out in the first quarter, the seventh consecutive quarter where more than 100 deals occurred. Moreover, over the past four quarters, 556 deals closed on a rolling four-quarter basis, which ties with the third quarter of 2014 for the most number of deals closed, the strongest volume since NIC has been tracking the data dating back to 2008.

The low interest-rate environment has also led to a proliferation of lenders and a very competitive lending environment. Both large and small commercial banks, the Agencies, HUD, life companies, and a number of other nonbank lenders, including CMBS lenders, are active in the market.

Does Scale Matter?

Data from NIC and Real Capital Analytics (RCA) indicate that pricing differs if a property is sold as a stand-alone asset or as one property sold within a larger portfolio. The portfolio premium, which could be as much as 20%, is attributable to several factors. One of them is the potential cost advantages associated with the size of a portfolio and an operator’s ability to more easily achieve best practices and economies of scale.

Going forward, scale has the potential to become even more important in an evolving and progressively more cost-conscious health care policy environment. Value will be created by those businesses that can best align themselves in the accountable-care (ACOs) and managed-care (MCOs) environment, where costs can be optimized between the post-acute care and acute-care worlds of hospitals, skilled nursing facilities, and seniors housing properties (memory care, assisted-living and independent-living care properties). Those operators that can effectively and efficiently integrate systems and big data that measure outcomes and reduce costs should benefit. On the other hand, those operators who do not have the means and understanding of the changing environment are likely to be less successful and become potential take-over targets.

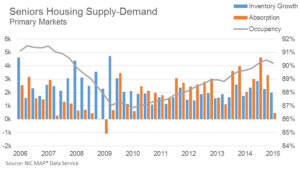

Weather, the Flu and First Quarter Absorption Patterns

First quarter occupancy data was disappointing and showed a dip of 60 basis points for majority assisted living properties; majority independent living properties showed no change in occupancy and remained at 91.2%. However, absorption rates were very weak for both property types. The relatively weak absorption rates were a surprise, especially juxtaposed to generally favorable economic trends in the past year. They were also a stark contrast to recent trends where absorption has been very strong. As recently as the third quarter, absorption had hit a record high. The numbers were also a surprise because supply generally has been of greater concern than demand.

Often, first quarter occupancy rates slip back due to the effects of weather and the flu season. During particularly strong flu seasons such as this year’s, more residents are likely to be hospitalized, vacating their beds in seniors housing properties. This year, 6% of all hospital visits (a relatively high number) were related to flu-like symptoms toward the end of December, according to the Center for Disease Control. This may have inflated move-out rates and affected the overall absorption rates for both majority assisted living and majority independent living properties. Moreover, according to the National Climatic Data Center, the Northeast suffered its coldest winter ever this year, while at the same time, the West Coast saw record high average temperatures. This too, may have affected both move-in and move-out patterns.

Second-quarter numbers will shed some light on whether or not the first quarter numbers were outliers or if they signal a different pattern of demand going forward.

As always, I welcome your thoughts, comments and feedback.

Beth

Seniors Housing Occupancy Falls on Unexpectedly Weak Demand

Transient Effects or Weakening Fundamentals?

Seniors housing occupancy started 2015 with one of its few hiccups since the recovery began in 2010. During the first quarter of 2015, occupancy in seniors housing was 90.2%, down 20 basis points from the fourth quarter. It was the first decline since the second quarter of 2013 and only the third quarterly decline during the current recovery.

While overbuilding concerns have been the forefront of discussions, weak demand was behind this quarter’s occupancy decline. During the first quarter, absorption came in at an annualized rate of just 0.4% – it had been averaging 2.2% since the first quarter of 2010. In fact, absorption during the first quarter was the weakest since the first quarter of 2009 – the deepest part of the recession.

While the first quarter is usually the weakest, the surprisingly weak demand is a bit difficult to explain. One theory revolves around the severity of the flu season. According to CMS data, the 2015 flu season was among the strongest on record. The only other occupancy declines during the recovery also coincided with exceptionally strong flu seasons.

Another compounding factor may have been the extreme weather. A large portion of the country experienced a miserable winter, which could have negatively affected demand. On the economic front, data generally came in below expectations, with growth slowing a bit during the first quarter. First quarter GDP is expected to be a little soft, mainly the result of transient factors, such as the winter and the west coast port closures. The sector has some sensitivities to the economy, so this may have played a minor role.

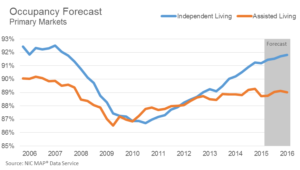

An additional potential issue could be that occupancy is beginning to bump against previous peak levels. Although probably an early conversation for independent living, there is evidence that assisted living occupancy is back to its peak levels before the recession. While occupancy for all assisted living properties fell during the first quarter, stabilized occupancy in the fourth quarter reached 91.1%, tying it for the highest reading in the market cycle. Can occupancy continue to rise in assisted living, especially given the amount of supply expected to be delivered in the next 12 months? NIC’s forecasts occupancy rising 30 basis points during the next four quarters, but that would still be down 30 basis points from the fourth quarter of 2014. As resident turnover rates have certainly increased since 2006 with residents in general now frailer and entry ages higher, structural occupancy now would be expected to be lower than it was pre-recession.

Of course, all of these explanations are only suppositions at this point. The second quarter reading will be critically important to determine if the first quarter performance was indeed just an aberration or a real weakening of fundamentals.

Transactions Market Remained Active to Begin 2015

More than $3.5 billion in Closed Volume and Strong Pricing Continues

The market for seniors housing and care properties was strong during 2014 and that strength carried into the first quarter of 2015. During the first quarter of 2015, transactions volume totaled more than $3.5 billion for seniors housing and care properties, up 45% from 2014. The quarter’s volume was driven by Ventas’s $1.2 billion acquisition of American Realty Capital Healthcare Trust, New Senior Investment Group with a $435 million acquisition from Hawthorn Retirement Group, and Healthcare REIT with a $360 million acquisition from Intercontinental Real Estate Corp. Those three (3) deals accounted for 45% of the quarter’s overall volume.

Pricing remained strong, and for seniors housing near record levels. On a rolling four-quarter basis, the seniors housing price per unit averaged $191,000, up more than 20% from a year ago. Pricing was even 8% above that of 2011 – a year which saw the most volume on record. While nursing care pricing hasn’t surpassed its peak levels, it too has been strengthening, reaching $89,000 per bed as of the first quarter, up 23% from a year ago.

As aggressive pricing has continued, there has been increased chatter of peak pricing. This has been highlighted by other outlets and the topic of several conversations during the recent NIC 2015 Capital & Business Strategies Forum. The prolonged period of low interest rates has played a role in spurring record pricing and general asset inflation. Interest rates continue to remain historically low– the 10-year Treasury yield was 1.9% as of April 17.

How high will pricing go? No one really knows – but the peak will only be known once softening begins. Rising interest rates on the short end of the yield curve is all but guaranteed sometime this year, but longer term yields may not react immediately, which most assets are priced against. Cap rates on seniors housing and care properties may not necessarily increase, however, as there is the argument for compression due to the amount of capital scheduled to enter into the sector. There are certainly a lot of dynamics, and it will be interesting to watch how the data unfolds as the capital environment is set to change.