U.S. Economy Generated 227,000 Jobs in January 2017

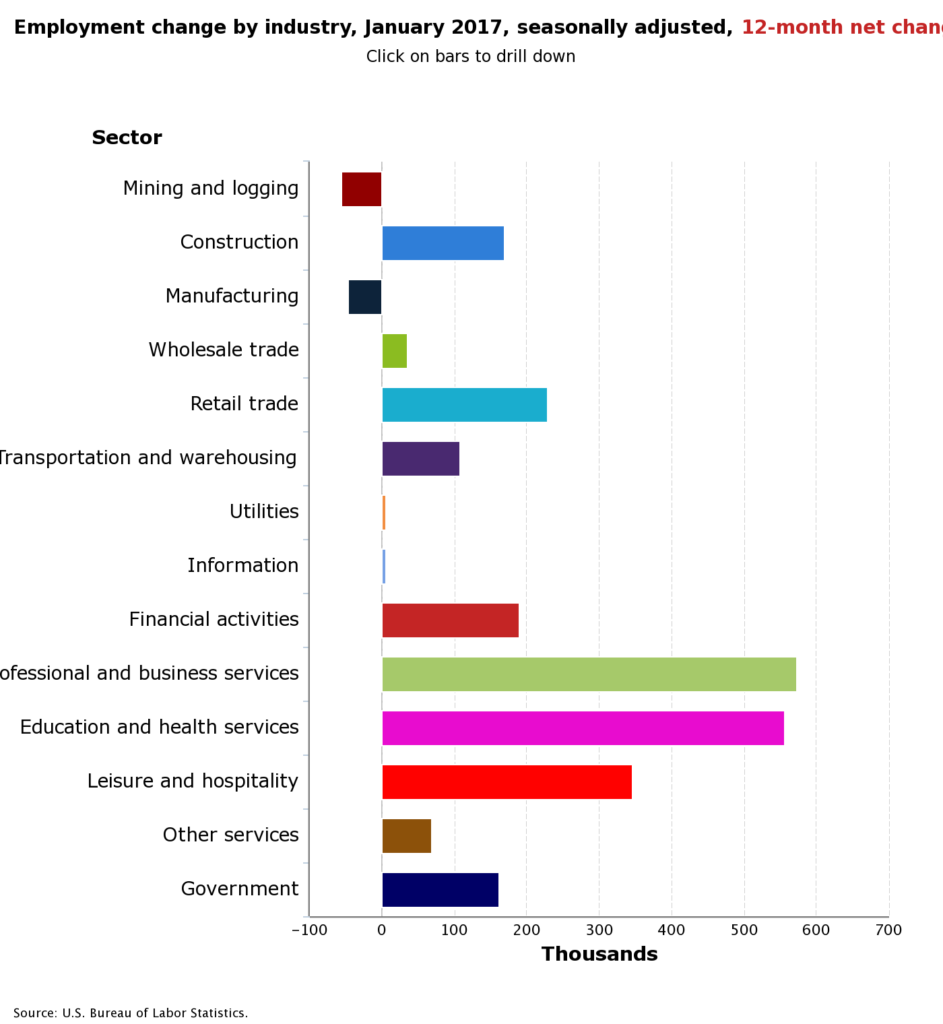

In the first major release of employment conditions under the Trump Administration, the Labor Department reported on Friday that nonfarm payrolls increased by 227,000 positions in January, above the consensus 175,000 estimate. The change in total nonfarm payroll employment for November was revised down from 204,000 to 164,000, and the change for December was revised up from 156,000 to 157,000. With these revisions, employment gains in November and December combined were 39,000 lower than previously reported. Monthly revisions result from additional reports received from businesses since the last published estimates and from the recalculation of seasonal factors.

Employment in healthcare rose by 18,000 in January. Over the past 12 months, the sector has added 374,000 jobs.

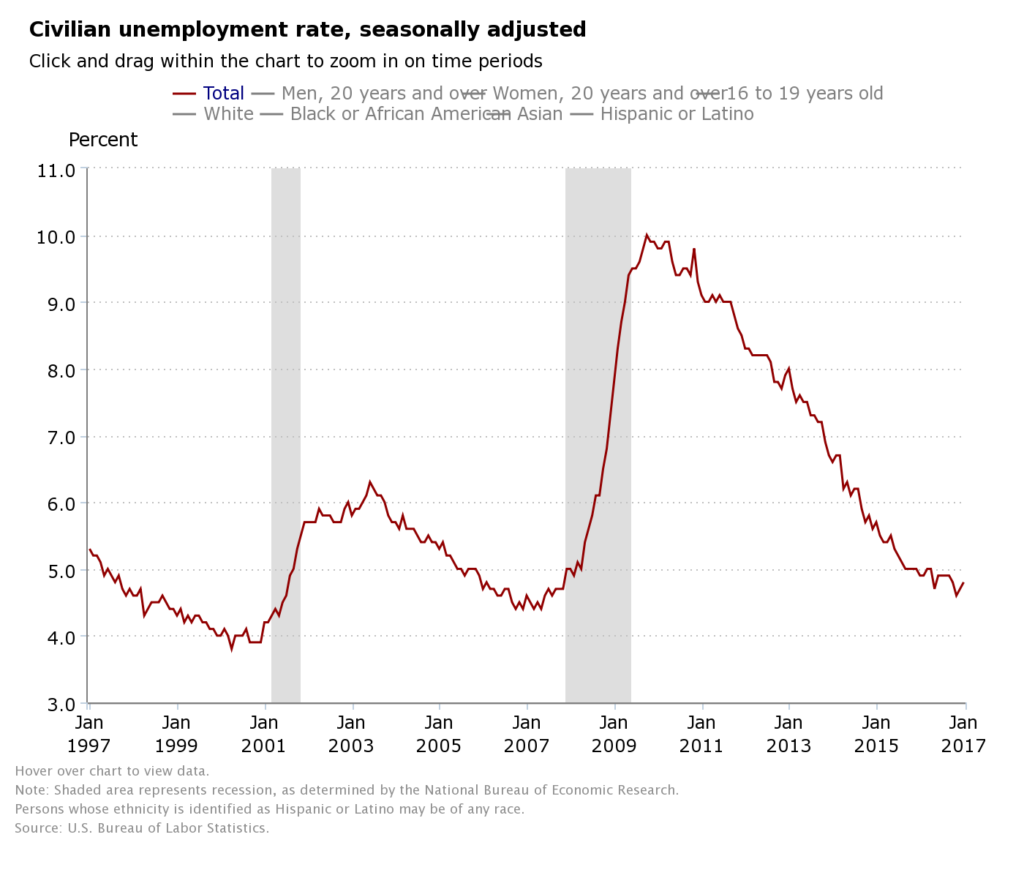

The unemployment rate rose 10 basis points to 4.8% in January. The unemployment rate is derived from a separate survey than the payroll employment number cited above. The number of long-term unemployed (i.e., those unemployed for more than 6 months) totaled 1.9 million and accounted for roughly 24.4% of those unemployed. Over the year, the number of long-term unemployed has declined by 244,000.

A broader measure of unemployment, the U-6 unemployment rate (which includes those who are working part-time but would prefer full-time jobs and those who have given up searching), rose to 9.4% in January from 9.2% in December.

Average hourly earnings for all employees on private nonfarm payrolls increased by three cents to $26 in January. Over the year, average hourly earnings have risen by 2.5%, down from 2.8% in December (revised lower from 2.9%). Increases in minimum wage rates in many states and tightening labor markets may start to put further pressure on this measure of earnings.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work, rose 0.2 percentage points to 62.9% in January. It is very low by historic standards and in part reflects the effects of retiring baby boomers.

The January jobs report paints a picture of a reasonably strong labor market and lends support for further rate increases by the Federal Reserve. Nevertheless, the Fed is not likely to act immediately due to uncertainty over changes to fiscal policy under the Trump Administration. The next FOMC meeting will take place March 14–15.