Seniors Housing Net Absorption Outpaces Inventory 4Q15

The average occupancy rate for seniors housing properties in the fourth quarter of 2015 was 90.1%, as net absorption of units outpaced the additions to inventory. This represented an increase of 20 basis points from the prior quarter, and was 20 basis points shy of its cyclical peak of 90.3% that was reached in the fourth quarter of 2014.

Since its cyclical low point of 86.9% in the first quarter of 2010, occupancy has risen by 330 basis points. Since that time, there have been nearly 50,000 seniors housing units that have come online, a 10% increase in inventory. Demand, as measured by net absorption or the change in occupied stock, increased by nearly 60,000 units over this same time period—hence the increase in occupancy.

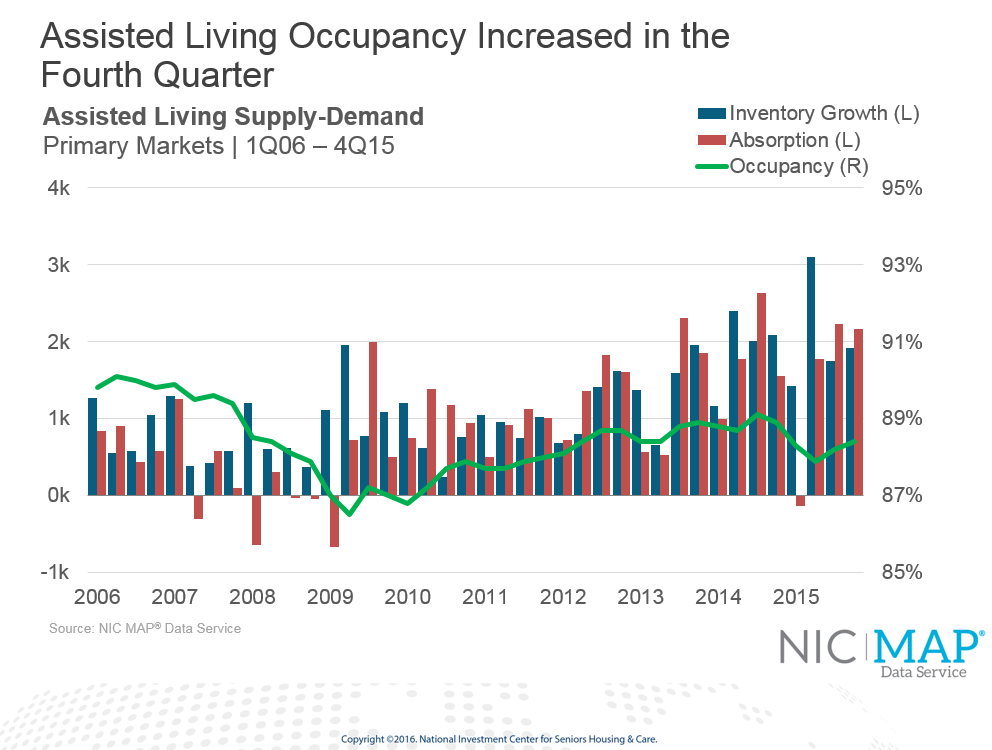

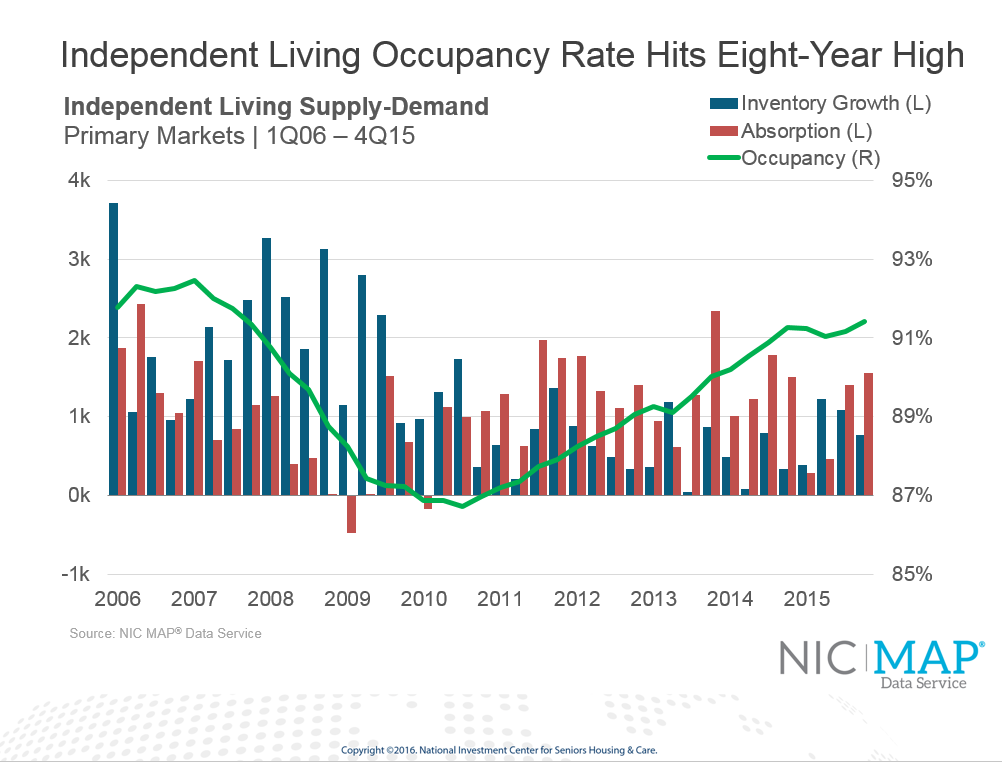

The majority of new units coming online since early 2010 have occurred in assisted living properties (two-thirds of the overall seniors housing inventory growth or roughly 31,000 units). Construction of independent living properties has been less, but is starting to ramp up. In the fourth quarter, construction as a share of inventory for independent living climbed to 3.8%, up from 2.9% a year earlier and the most since early 2009. By comparison, construction as a share of inventory for assisted living is significantly higher at 7.9% in the fourth quarter, an all-time high and up from 6.5% in the fourth quarter of 2014.

The occupancy rate for independent living properties continued to be higher than that for assisted living during the fourth quarter of 2015—at 91.4% and 88.4%, respectively. Compared with the prior quarter, the occupancy rates for both independent living and assisted living increased by 20 basis points. Occupancy for independent living was still 10 basis points above year-ago levels, compared with assisted living, which was down 50 basis points from the fourth quarter of 2014. Despite the gradually growing pipeline in independent living, occupancy in the fourth quarter was at its highest level since 2007, while rent growth reached its strongest pace since 2009.

The occupancy rate for independent living has been higher than that of assisted living since 2012 when it was nearly the same. Since then, the gap has been widening toward 300 basis points as the effects of strong construction activity in assisted living have affected occupancy levels. On an absolute basis, there have been more units of assisted living absorbed on a net basis than independent living over this same period (24,000 versus 20,000 for the Top 31 Markets). The difference in occupancy performance reflects the difference in the size of each of the property type sectors (229,000 units of assisted living versus 293,000 units of independent living) and the greater amount of new supply that has been delivered for assisted living.

Looking ahead, the expectation is that a reasonably strong national economy that is growing on par with the past year’s growth (2% to 2.5% GDP growth), favorable consumer confidence, and an improving housing market (both price appreciation and the pace of new and existing home sales) will support demand for seniors housing. Demographics will also influence demand, with more than 5 million Americans aged 82 to 86 (the typical age of a resident) available as potential new residents. These favorable demand drivers are expected to allow absorption to keep pace largely with new construction activity and keep occupancy rates near today’s levels. There remains a risk, however, that supply could get ahead of demand fundamentals, particularly for assisted living where nearly 9,500 units are anticipated to be delivered over the course of 2016. As a result of these broad national pressures, operators and investors in seniors housing should be particularly mindful of their own supply and demand particulars in their local market areas since local area market conditions vary considerably.