Seniors Housing Annual Total Investment Returns Equal 12.79% in Q1 2018

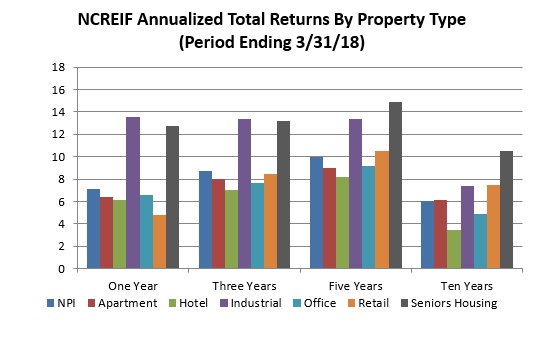

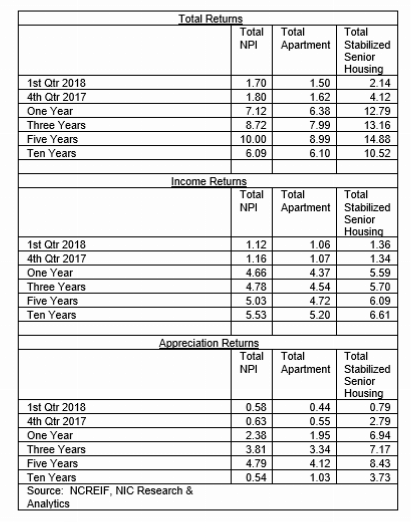

First-quarter investment return data for the NCREIF-reported seniors housing properties equaled 2.14%, composed of a 0.79% capital return and a 1.36% income return. The annual total return through the first quarter of 2018 was 12.79%, overshadowing the NCREIF Property Index (NPI) result of 7.12% and the apartment result of 6.38%. However, at 13.53% industrial total returns outpaced seniors housing.

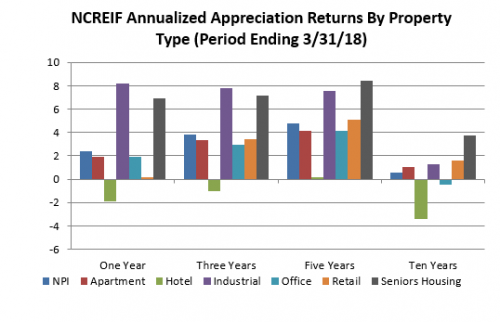

Despite the relatively strong showing, the total annual return for seniors housing has been trending down since mid-2014 when it peaked at 20.37%. This pattern can also be seen in the broader NPI index and is due to the appreciation return which tends to slow at this point in the real estate cycle.

Looking more closely at the components of total returns, appreciation returns for seniors housing exceeded all major property types on a 10-year basis. Hotel and office both experienced negative capital returns over this period, while seniors housing had a 3.73% capital return. More recently, the capital return was 6.94% on a one-year basis, dwarfing all other property types except for industrial, which has benefited from e-commerce which has increased demand for last-mile warehouse space.

With the exception of the hotel sector, seniors housing income returns have also exceeded the NPI as well as the other main property types on both a one-year and a ten-year basis.

These performance measurements reflect the returns of 104 seniors housing properties, valued at $5.3 billion in the first quarter. This is the first quarter that the market value of the NCREIF universe of seniors housing has exceeded $5 billion.