Q1 2017 Transactions Update: Portfolio Deals Drive Volume Gains

Q1 2017 Transactions Update: Portfolio Deals Drive Volume Gains

This blog is a follow-up to the preliminary transactions data from last month’s post. Here is the latest data as of Q1 2017.

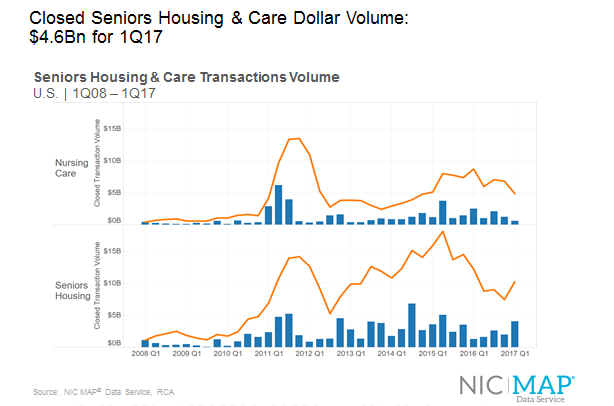

Transaction Dollar Volume Increases

Transactions volume for seniors housing and care registered $4.6 billion in Q1 2017. Seniors housing had a strong quarter, accounting for $4.1 billion of the total, but nursing care tallied volume of only $500 million. The total volume was up 45% from the previous quarter’s $3.2 billion, and up 22% from Q1 2016 when volume totaled $3.8 billion.

The first quarter of the year is usually one of the weakest quarters in volume due to the usual rush to close deals at the end of the year, leaving the pipeline a bit empty heading into the new year. However, this year’s first quarter had one of the strongest starts of the last five years. Much of the strength was due to a few large deals, including one valued at more than $1 billion. The rolling four-quarter total for seniors housing volume stands at $15.1 billion, up about 5.9% from the prior quarter.

Comparing nursing care and seniors housing volume, we see that nursing care volume was down a significant 54% from the prior quarter’s volume of $1.2 billion. Seniors housing was up more than 100% from $2.0 billion to $4.1 billion. Compared to Q1 2016, nursing care volume was down 77% and seniors housing was up 218%. The rolling four-quarter volume in nursing care decreased from $6.8 billion to $4.9 billion, and seniors housing increased from $7.5 billion to $10.2 billion.

A significant part of the pick-up in seniors housing volume in the first quarter was due to the sale of assets by the public REITs to institutional buyers. There were a few large portfolio deals (mentioned in last month’s blog post) in the first quarter which helped to drive the increase in volume.

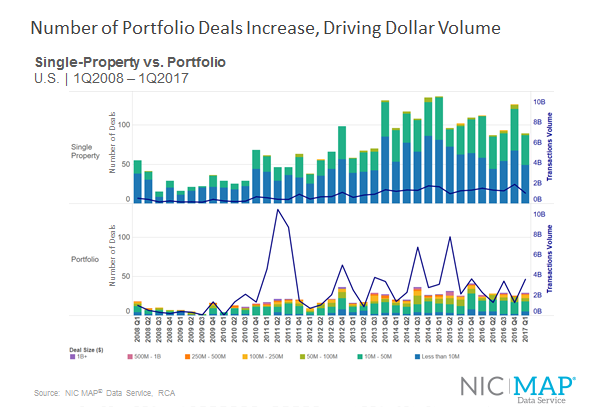

Deal Size

Over the past several quarters, there have been very few transactions of more than $1 billion, or deals in the $500 million to $1 billion range. These big deals can move the dollar volume needle significantly. Not only did we see portfolio deals increase overall in the first quarter, from 25 to 29 closed deals to be exact, but we also saw large portfolio transactions close in the quarter. Last quarter, zero deals closed valued at $500 million and up, and this past quarter we had two such deals close which drove the robust transaction dollar amounts.

When it comes to the overall count of transactions closed, the single property deals still dominate with 89 closed, for a total of 118 deals including portfolios. In comparison, we had 151 total deals close in Q4 2016. So, even though the number of transactions was down quarter-over-quarter, volume was up significantly because the large portfolio deals made up for the lower deal count. However, keep in mind that even with deal count down, this was the 14th consecutive quarter with at least 115 deals closing, which tells us that the brokers are still staying quite busy. The dominate deal size continues to be the single property transactions of less than $10 million, and those between $10 million and $50 million, which is why the deal counts are keeping up a healthy pace.

Compared to Q1 2016, closed deal count was down from 138, a number that includes 26 portfolios and 112 single property deals.

For more details of the latest transactions data please look for the next NIC Insider, coming in June.