Focused on transformational change and increased collaboration, the annual event brought together more than 1,700 seniors housing and care executives – and a growing number of healthcare players – in San Diego, February 20-22.

The conference theme, “Investing in Seniors Housing & Healthcare Collaboration,” addressed the reality that the sector faces a period of change in which partnerships with a…

Read Post ›

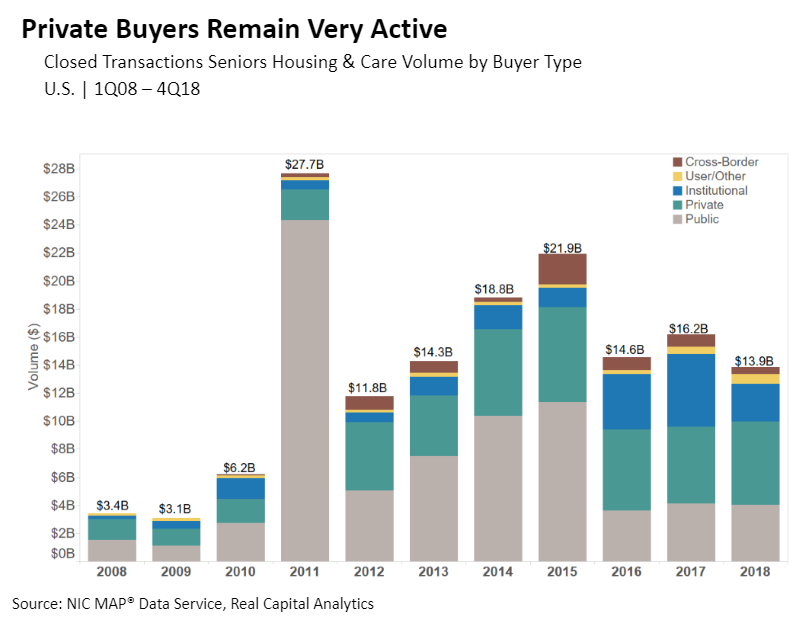

Private Buyers Remain Very Active

There may have been some challenges in the seniors housing and care markets in 2018 but it is safe to say that liquidity did not seem to be one of those challenges based on the latest sales transactions data. Indeed, not only was there strong dollar volume registered in terms of closed sales transactions, but…

Read Post ›

Focused on the theme, “Investing in Seniors Housing & Healthcare Collaboration, the 2019 NIC Spring Conference kicked off on Wednesday afternoon. The Conference drew more than 1,500 attendees, including investors, seniors housing and care operators, and healthcare providers.

A reception was held for first time attendees. “Our company has six projects coming out of the ground,” said first time attendee…

Read Post ›

Former Speaker of the U.S. House of Representatives Paul Ryan will offer insight on what to expect from the new Congress and the impact on America’s seniors

Paul Ryan, the 54th Speaker of the United States House of Representatives (2015-2019), will address the 2019 Spring Conference of the National Investment Center for Seniors Housing & Care (NIC) on Feb. 21…

Read Post ›

Last week’s post on NIC’s data group introduced some of the teams and processes involved in collecting the most accurate and reliable data available on America’s seniors housing and care properties. This second half of the story delves into processing and reporting on the data.

A team of three full-time analysts is responsible for processing the data from the Quality…

Read Post ›