Jobs Increase by 164,000 in April 2018

The Labor Department reported that there were 164,000 jobs created in the U.S. economy in April, below the consensus expectation of 193,000. This followed a downwardly revised gain of 324,000 jobs in February (originally reported as 326,000) and an upwardly revised gain of 135,000 in March (originally reported as 103,000). The two-month revision was a positive 30,000 new jobs.

The April increase in employment marked the 91st consecutive month of positive job gains for the U.S. economy, the longest period of steady job growth on record by the BLS. Through the first three months of the year, job gains have averaged 208,000, stronger than the monthly pace of 182,000 in 2017.

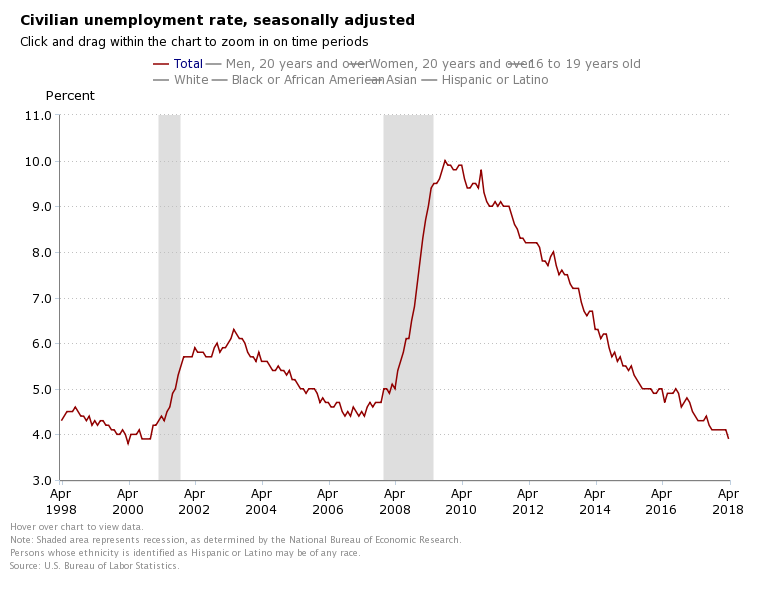

The unemployment rate fell to 3.9% in April from 4.1% in March, its lowest level in 18 years. This is well below the rate of what is generally believed to be the “natural rate of unemployment” of 4.5% and continues to suggest that there will be growing upward pressure on wage rates. The jobless rate is calculated from a different survey than the survey used to calculate the number of new jobs (the household versus the establishment survey, respectively).

Average hourly earnings for all employees on private nonfarm payrolls rose in April by four cents to $26.84. Over the past 12 months, average hourly earnings have increased by 67 cents, or 2.6%.

The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.3 million and accounted for 20.0% of the unemployed. A broader measure of unemployment, which includes those who are working part time but would prefer full-time jobs and those that they have given up searching—the U-6 unemployment rate—fell to 7.8% in April from 8.0% in March and was down from 9.2% as recently as December 2016. April’s rate was the lowest level in 17 years.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work fell by 0.1 percentage point to 62.8% but was up from 62.4% in 2015. Nevertheless, this remains quite low by historic standards, at least partially reflecting the effects of retiring baby boomers.

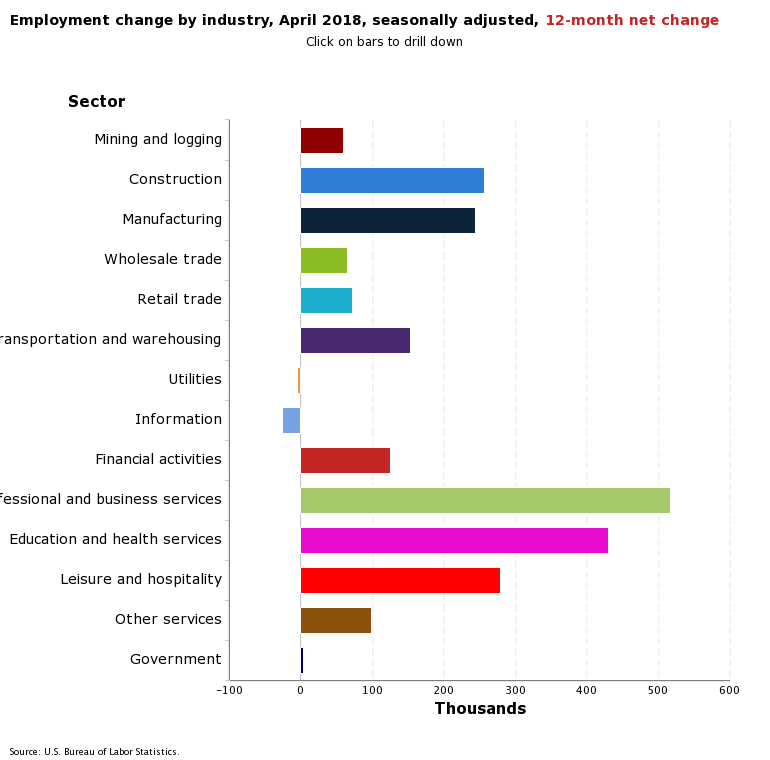

Health care added 24,000 jobs in April and 305,000 over the past year.

The April jobs report will provide further support for increases in interest rates through 2018 by the Federal Reserve. Already, the Fed increased the fed funds rate 25 basis points at its March 20/21st FOMC meeting. The Fed has raised rates by a quarter percentage point six times since late 2015, and most recently to a range between 1.50% and 1.75%, after keeping them near zero for seven years. Hence, it is likely that there will be another 25-basis point increase announced by the Fed at its June FOMC meeting.