December’s Job Gains Are Strong At 292,000

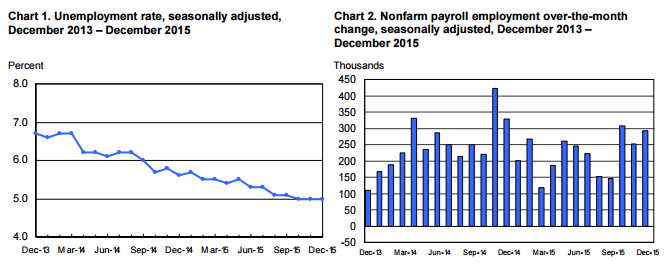

For December, the Labor Department reported that non-farm employment increased by a strong 292,000 positions, while the prior two months were upwardly revised by 50,000 jobs. Record warm weather in the month may have had an impact on the impressive December increase since construction jobs remained at unseasonably high levels.

For all of 2015, the economy added an average of 221,000 jobs per month. That is a slowdown from the 260,000 jobs generated per month in 2014, but ranks as the second strongest year since 1999. For the entire year, jobs increased by 2.7 million, compared with 3.1 million in 2014. Looking ahead, Moody’s Analytics is projecting average monthly gains closer to 200,000 than 300,000 in the first quarter. Nevertheless, this is well above the rate required to keep pace with growth in the working age population which is closer to 100,000.

The jobless rate remained relatively low at 5.0%. The wider measure of unemployment, the U-6 measure, was 9.9%, down from 11.2% a year ago. Moody’s Analytics estimates that this latter measure needs to fall to 9% for the economy to be considered at a “full employment” level. Meanwhile, in a separate report issued earlier this week, jobless claims fell to their lowest level in 42 years.

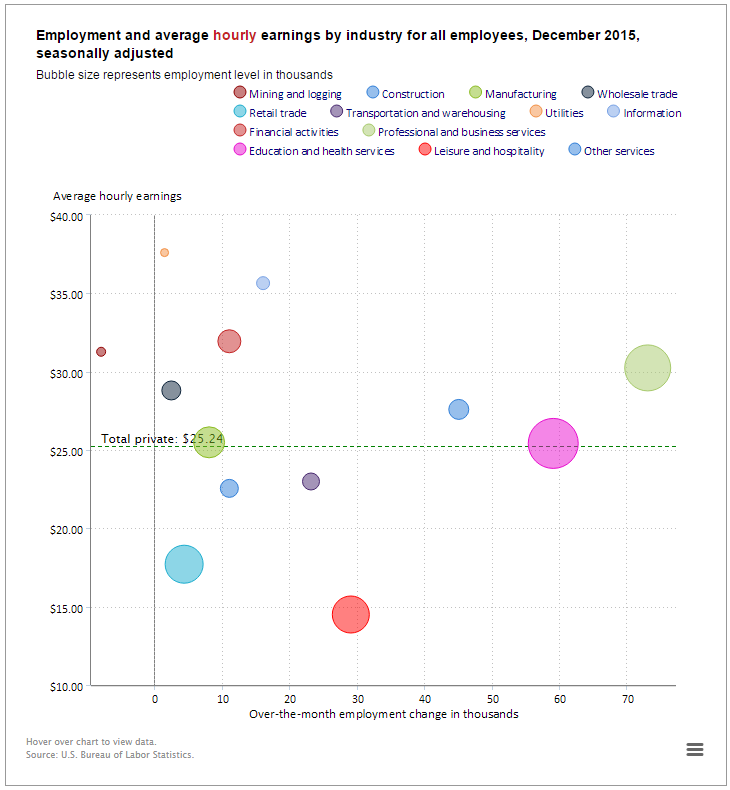

Average hourly earnings were up 2.5% from year-earlier levels, although wage growth remains generally weak.

Despite the strong jobs report, the 10-year U.S. Treasury yield closed at 2.11% on Friday. This is below the 2.3% yield reached on December 16th when the Federal Reserve nudged rates higher and reflects the events of the week associated with the turmoil in China’s stock market and the continued drop in oil prices to less than $33 per barrel. Most analysts are now anticipating that further rate hikes by the Federal Reserve will occur sometime after the first few months of the year as the Fed waits for further evidence of inflation. Commodity prices and wages will need to gain traction for that to occur.