Closed Volume in Third Quarter at $5 Billion, Institutional Buyers Represent Growing Share

Updated third quarter data shows seniors housing and care transactions volume in the third quarter of 2017 registered $5.0 billion. That includes $1.5 billion in seniors housing and $3.5 billion in nursing care. The total volume was up 129% from the prior quarter’s $2.2B and up 6% from the third quarter of 2016 when volume totaled $4.7 billion.

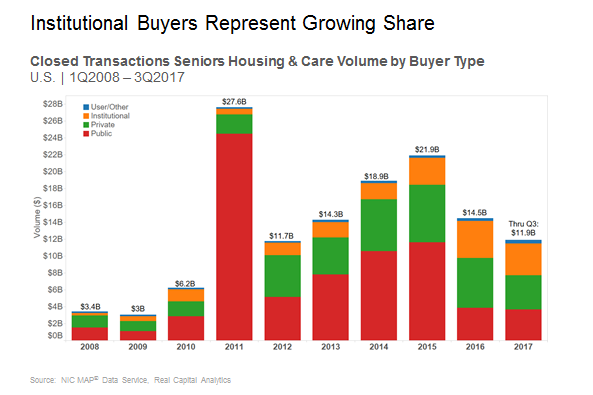

This blog will analyze the buyer types that represent the bulk of the transaction volume. Before we do that, the definitions of the buyer types are as follows: The public type consists of any company that is publicly-traded in the equity markets. The private type is any company that is not publicly traded—for example, a private REIT or single owner or partnership. The institutional type usually consists of the equity funds that manage pension money or other types of institutional money.

Since the end of 2015, the public buyers, especially publicly traded REITs, have been relatively quiet in terms of dollar volume. However, that has changed as the public buyer volume increased significantly in the third quarter of 2017. It increased 733% (this is not a typo!) from last quarter’s volume. Last quarter, closed volume from the public buyer type was only $345 million, but this quarter was a different story as it registered $2.9 billion in closed transactions. One would have to go back more than two years to see a quarter that had higher volume for the public companies, which was in the second quarter of 2015 when $5.6 billion of volume closed. Not only did the third quarter produce a large increase over the past quarter, but volume was up significantly from a year ago when volume registered $1.4 billion in the third quarter of 2016. Now, to be fair, the main reason for this jump in volume was the large Sabra/Care Capital Properties deal that closed in the third quarter. This deal represented $2.1 billion of the $2.9 billion public volume and included 331 skilled nursing properties.

There were a couple other notable public REIT deals including the Omega transaction to purchase 15 skilled nursing properties from Kindred for approximately $200 million, and the Sabra purchase of a seniors housing and care portfolio for $430 million from North American Health Care with 24 properties, mostly located in California.

Not only was the public buyer more active in closing deals in the third quarter, but institutional deals increased significantly from the prior quarter. The institutional buyer volume increased 225% from $275 million in the prior quarter to $896 million in the third quarter. However, institutional volume was down 49% from last year’s third quarter. A large deal of note on the institutional side in the third quarter was closed by Kayne Anderson, the institutional alternative investment manager, which bought a $633 million portfolio from Sentio Healthcare Properties, which consisted of 32 seniors housing and care properties. This deal included some medical office building (MOB) properties which are not reflected in these volume numbers.

Worthier of note is the longer-term trend we have seen over the past three years: institutional buyers have grown their share of the seniors housing and care transaction market as the public buyers have been less aggressive. In 2015, institutional buyers represented 15% of total transaction volume which increased to 30% of volume in 2016. Institutional volume is now at 32% at the third quarter mark in 2017. In contrast, the public buyers represented 53% of the transaction volume in 2015 and now represent 31% as of this latest data set through the third quarter in 2017. The private buyers have been consistent, representing a steady volume of transactions with a 31% share in 2015 and 34% share as of the latest data.

Last but certainly not least, the private buyer—private REITs, owner operators, and private partnerships—has been consistently above $1 billion of closed transactions each quarter for the last four years. That is impressive deal flow. The private buyer volume dropped 23% in the third quarter from the prior quarter, but once again came in at $1 billion or more at $1.1 billion. When compared to the same quarter last year, the volume also dropped 23% from $1.5 billion.