Developments in Home Health and the Evolution of the Skilled Nursing Competitor/Ally

Home health, which provides post-acute medical services directly in a patient’s home, increasingly plays two interesting roles in the post-acute industry: as skilled nursing competitor and potential ally. And as the Centers for Medicare and Medicaid (CMS) pushes for care coordination and value-based purchasing, skilled nursing providers increasingly are forming relationships with home health agencies.

As prospective competitors, home health agencies are seen as providing post-acute care at lower costs than long-term acute care hospitals or skilled nursing properties. As a result, hospitals and risk-bearing payors are incentivized to refer patients needing post-acute care directly to home health agencies, bypassing skilled nursing. When home health is viewed as a prospective ally, if the skilled nursing property is the risk-bearer in a bundled payment program, it, too, has an incentive to discharge patients to the lower-cost home health agency.

With more bundled payment programs likely coming down the pike, skilled nursing operators will be well-served to have a thorough understanding of the home health industry, including its challenges and opportunities.

Home Health Is Still Evolving

An important note is that home care differs from home health; home care is non-medical services provided in the home, such as assistance with home maintenance and meal preparation, as well as companionship. Home care and home health often work in conjunction to support seniors following an acute medical episode; some home care services overlap with home help services, such as some assistance with activities of daily living (ADLs). The lines between home care and home health are blurring, as evident in the state of New York. At the end of June, the state’s legislature voted to allow home care aides to take on more medicalized tasks under the supervision of a nurse. While this move does not immediately qualify home care for Medicare and Medicaid reimbursement for services usually reserved for home health, we may see in the future that home care agencies encroach on the home health market, especially if they are able to capture the attention of government payor sources.

While the differences between home care and home health may be becoming more ambiguous, a project piloted by the Alliance for Home Health Quality and Innovation aims to shape home health and skilled nursing. The coalition’s project, which includes research from Avalere, predicts that through data analytics and technology incorporation, home health agencies will soon begin to provide higher acuity care and other medical services. Primary care, long-term care, and even urgent care may be provided in the home in the near future, according to the organization. Current regulatory barriers exist to achieving this vision immediately, as Medicare has strict rules for what and how services can be reimbursed.

Another innovation in home health is a model designed to replace long-term care insurance. The Philadelphia Inquirer reported in-depth on this new concept, which operates like a CCRC except care is provided in the home. Participants pay an entry fee and monthly fees to reserve their future use of home health services. After the initial fee is paid, as soon as a participant needs home health services, the agency provides those services, regardless of the enrollee’s address. Home health services in this model include low-acuity and high-acuity care, as well as transportation, meals, and other services. Entry fees range from $10,000 to $50,000 in this “continuing care at home” program, with monthly fees ranging from $150 to $500. Like a long-term care insurance plan, participants can adjust their coverage and copay amounts when they join.

An Important Month for the Home Health Industry

In June, home health experienced two major developments from the regulatory perspective. First, a Health and Human Services Office of the Inspector General (HHS OIG) report found that 5% of home health agencies show signs of fraud. According to the report, over 500 home health agencies and 4,500 physicians demonstrated Medicare claims behavior that could be fraudulent.

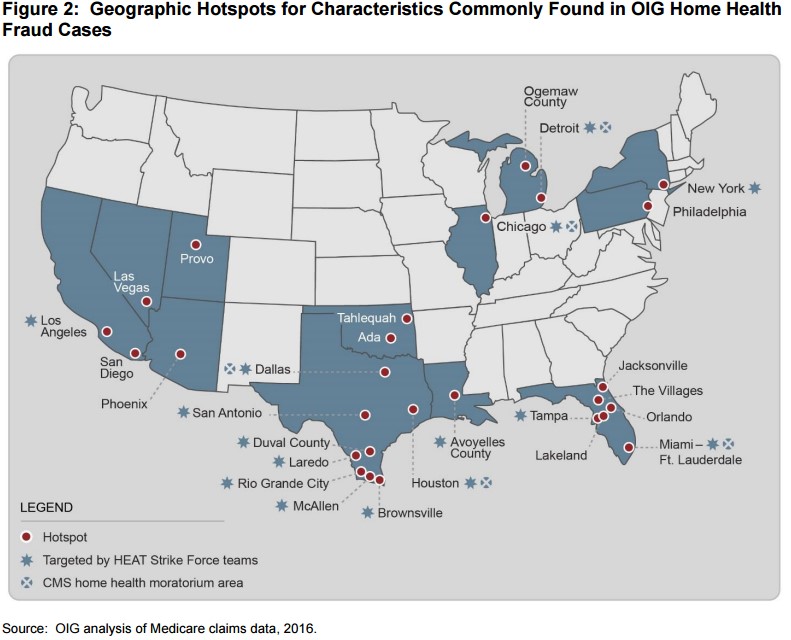

In CY 2015, Medicare paid $18.4 billion to home health agencies, and the HHS OIG estimates that $10 billion will have been spent in improper payments through the 2015 fiscal year. Criminal investigations into home health agencies amounted to just under $1 billion between 2011 and 2015. In light of these findings, the OIG issued a second report announcing its intent to “crack down” on home health Medicare claims reimbursements. The OIG identified geographic “hotspots” for fraudulent home health claims activity, many of which are already under advanced scrutiny because they are targets for ongoing HEAT Strike Force investigations or have been identified by CMS as having enough fraudulent activity to warrant a moratorium on licensing for new home health agencies.

Not only will home health agencies now face tougher scrutiny over their Medicare claims, they also are subject to a 1% reduction in Medicare reimbursements for 2017, as CMS announced last month. CMS must make cuts to home health agencies because of requirements in the Affordable Care Act to lower Medicare spending. Modern Healthcare reported that margins for home health agencies averaged 17.2%. In the proposed rate cut, CMS also proposed a value-based purchasing model for home health agencies in select states. The model would impose reductions and bonuses based on quality metrics for home health.

Also in June, the Supreme Court declined to review a challenge to the Department of Labor’s decision to redefine “domestic service employment” and “companionship services.” The move makes home care employees eligible for overtime pay, when previously they had been excluded. The Supreme Court’s denial of a review of the challenge means the Department of Labor’s change will remain as intended, making these workers eligible for overtime pay.The Supreme Court decision does not apply directly to home health, but because home care and home health work closely together, the decision still may have implications for the home health industry. Just as in the skilled nursing world, home health faces significant labor challenges. Wages are low, turnover is high, and now home care labor has the potential to become more expensive.

An Eye on the Future

As home health continues to evolve and more attention is paid to it, the role of regulations will likely be key in shaping the direction of that evolution. We’ll be keeping an eye on these trends to ensure that both providers of care and capital have the latest information needed to stay on top of this evolving industry. Considering the degree of overlap home health and skilled nursing display, knowing about the home health industry will be vital to making decisions in this dynamic space.